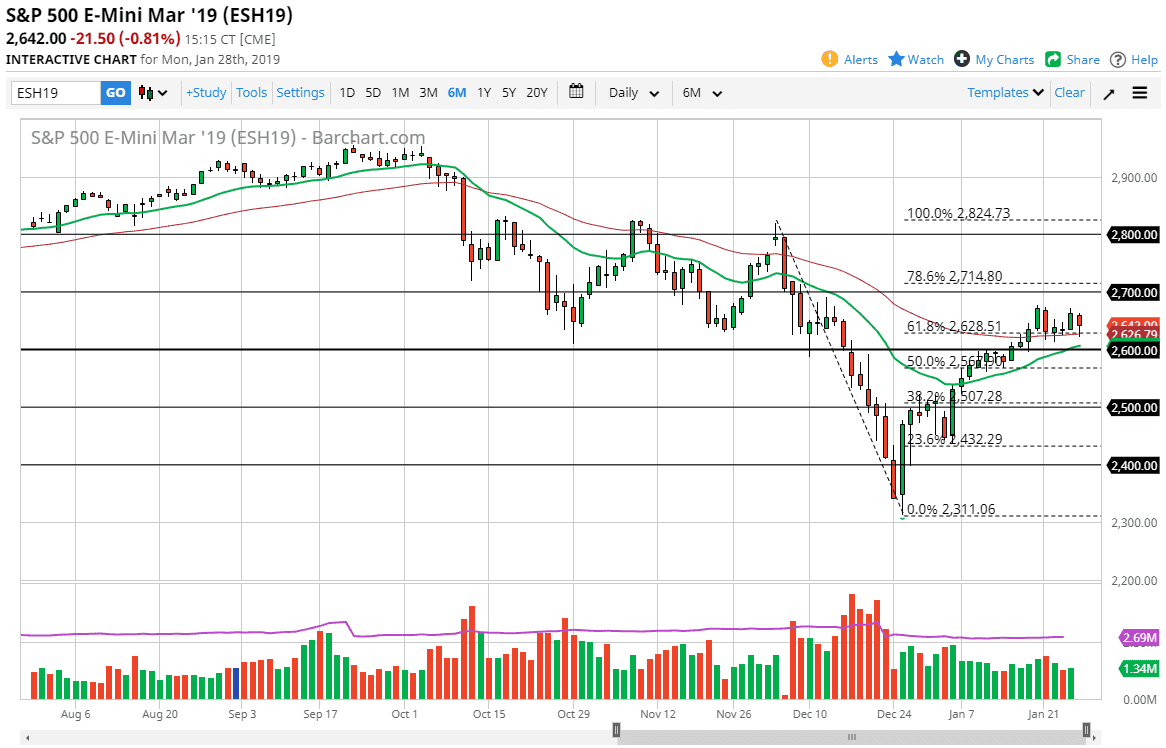

S&P 500

The S&P 500 pulled back a bit during the trading session on Monday, as we continue to see the 50 day EMA offer support. Currently, it looks as if we are going back and forth in a consolidation area that is 100 points, and therefore I think the 2600 level underneath is massive support, just as the 2700 level is massive resistance. In general, I think the market does have a lot of support underneath, but it’s very likely that the market will be paying attention to the FOMC statement on Wednesday, and then of course the jobs figure on Friday. Between now and then, I would not put too much money to work because you can’t put too much faith in any particular move. If we break out of this 100 point range though, then it should continue to move for bigger gains or losses. Until then, I suspect that this market is a choppy at best.

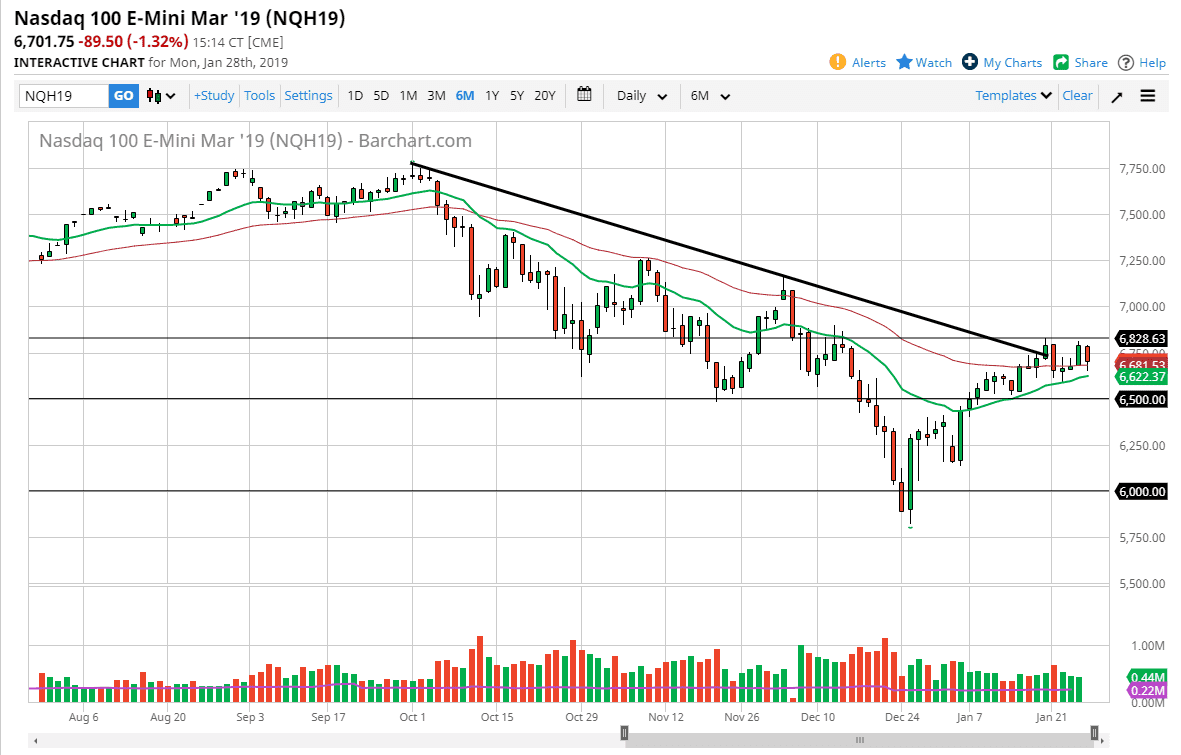

NASDAQ 100

The NASDAQ 100 continues to go sideways overall, as we have a lot of support underneath, but obviously there is a lot of resistance near the 6025 level as well. That being the case, I think that the market will continue to be very choppy and sideways but given enough time if we can break above the 6825 handle, then I think we can go towards the 7000 level, perhaps even higher than that. This is a market that is highly influenced by the US/China trade situation, so pay attention to headlines coming out of those talks. We also have jobs numbers coming out on Friday, which of course will have an influence as well. On a break above the 6825 level I’d be a buyer. Until then, it’s probably going to be very sideways and noisy.