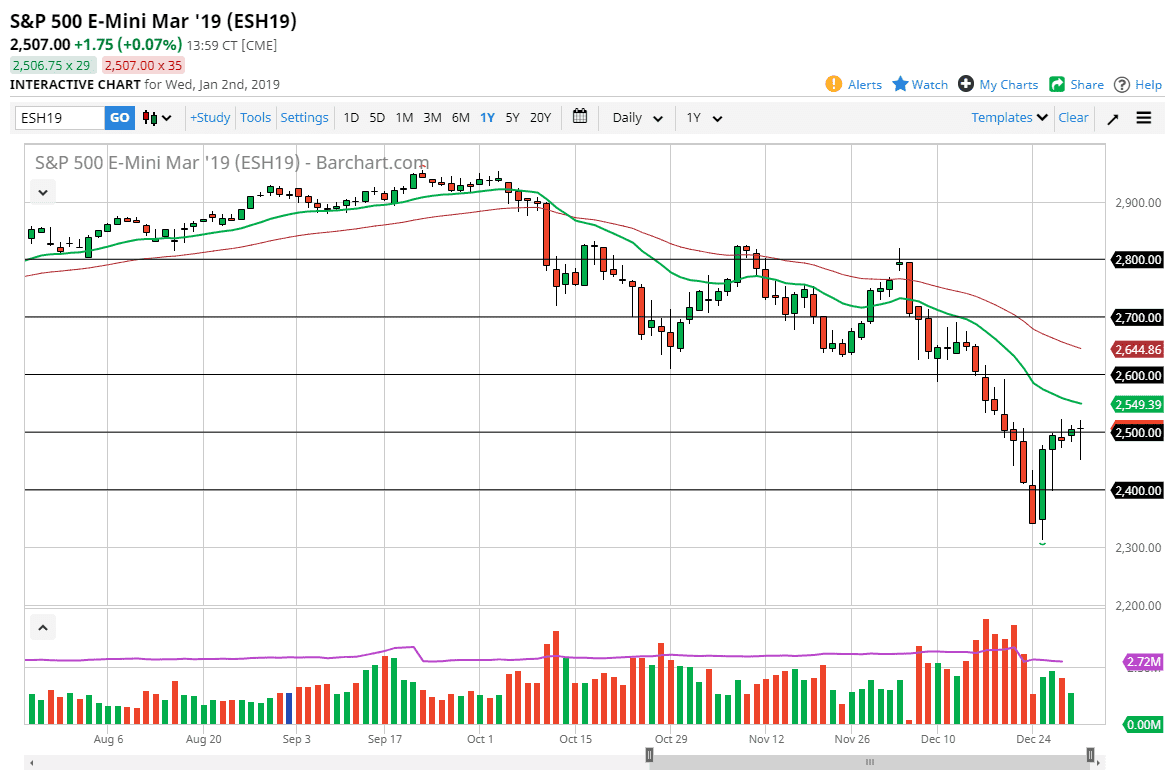

S&P 500

The S&P 500 initially pulled back during the trading session on Wednesday, but turned around to show signs of life, perhaps showing that we are ready to go higher in test the 200 day EMA. Beyond that, we could go as high as the 2600 level, because the resiliency shown during the day on Wednesday was rather decent. Ultimately though, the 2600 level will probably be tough to deal with because it had been so supportive in the past. At this point, I think that the market will eventually show signs of exhaustion that we can take advantage of. After all, the market has shown a lot of technical damage, and that of course is something that will be fresh in the mind of traders. Poor Chinese economic numbers certainly aren't helping either. I believe will get a short-term pop as fund managers start buying for the year, but ultimately we will run into a lot of trouble.

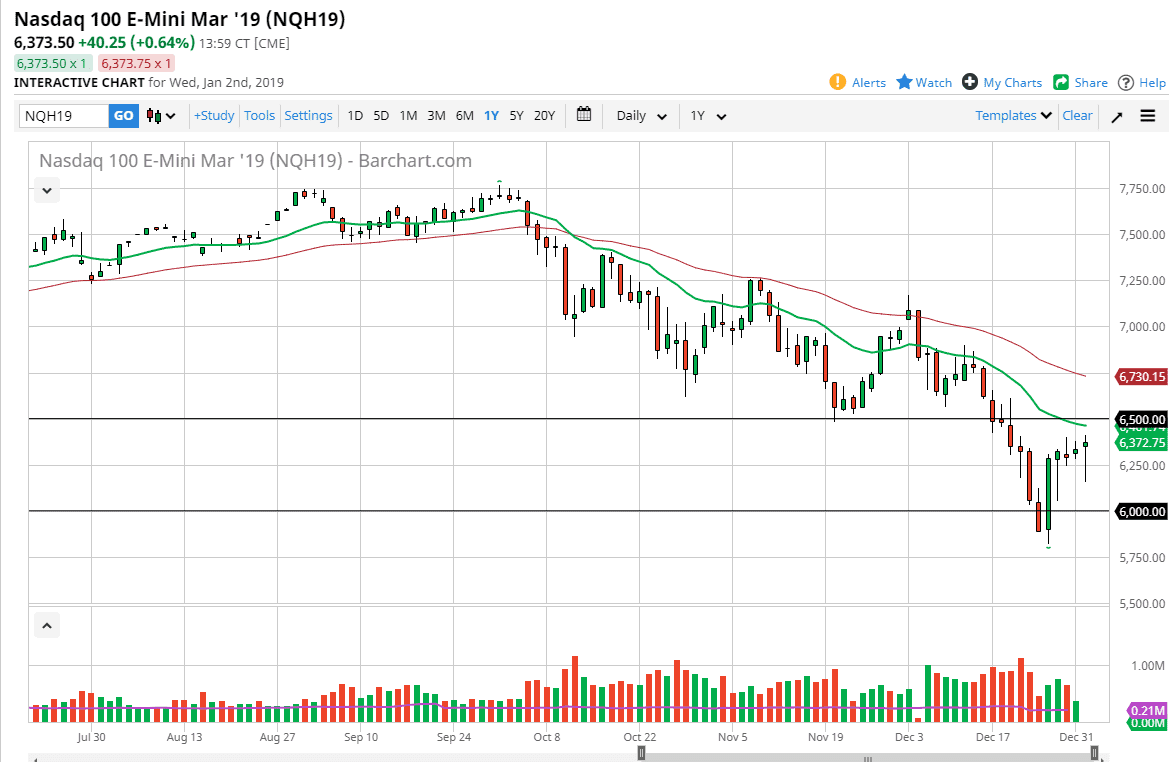

NASDAQ 100

The NASDAQ 100 initially fell as well, turned around of form a bit of a hammer. The 6500 level above is a previous support, so it should now be resistance. Beyond that, we have both the 20 and the 50 day EMA reaching downward, and I think that between those two levels should be an area where we could see exhaustion that we can take advantage of. I believe that if you are patient enough, you should see some type of exhaustive candle that you can take advantage of as the NASDAQ 100 will continue to suffer at the hands of the US/China trade war. Ultimately, the downtrend is still very much intact. Because of this, it is only a matter of time before a negative headline comes out that turn things around.