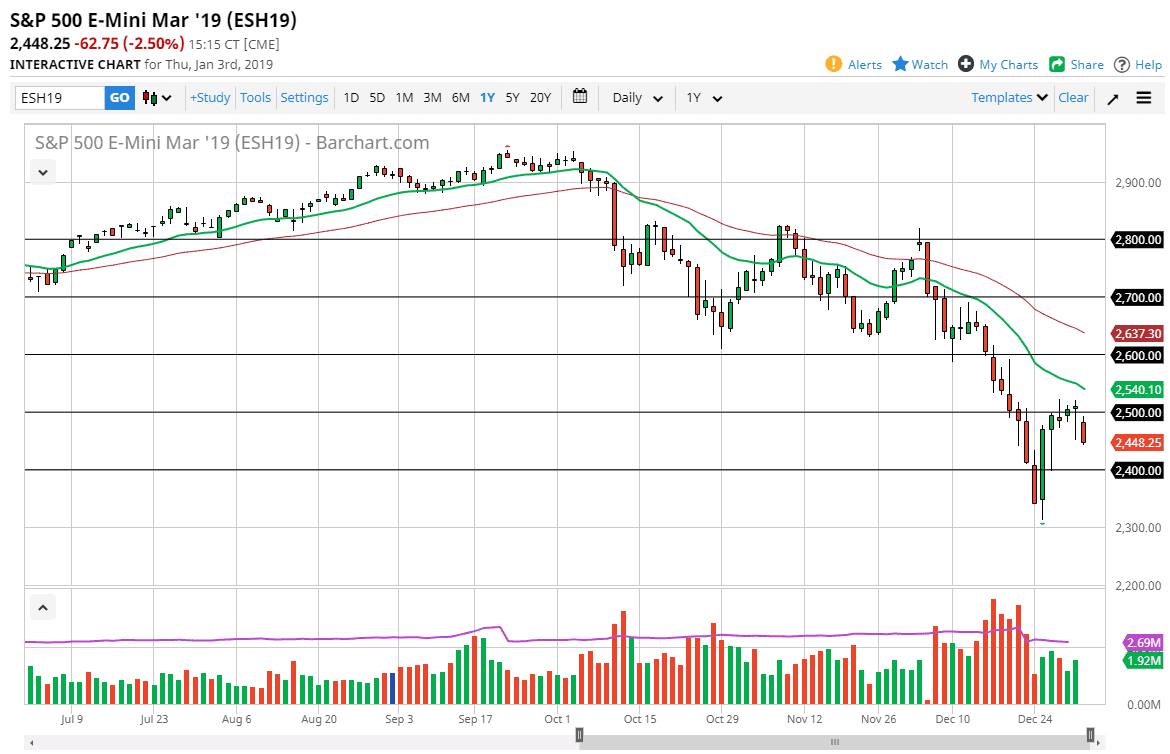

S&P 500

The S&P 500 gapped lower to kick off trading on Thursday, as we have seen a very negative reaction to Tim Cook of Apple suggesting that most of the iPhone disappointment in sales comes from a weaker than expected Chinese market. That had the market spooked, because China of course is supposed to be one of the biggest drivers of global growth. If that’s going to be the case, markets in general are going to be very skittish, and therefore I think it would make a lot of sense that we continue to see negativity. Rallies at this point will probably be sold into, but of course Jerome Powell speaks during the day and we also have the jobs figure, so I think the one thing you can count on for the Friday session is an extraordinarily volatile day. However, I think the negativity continues.

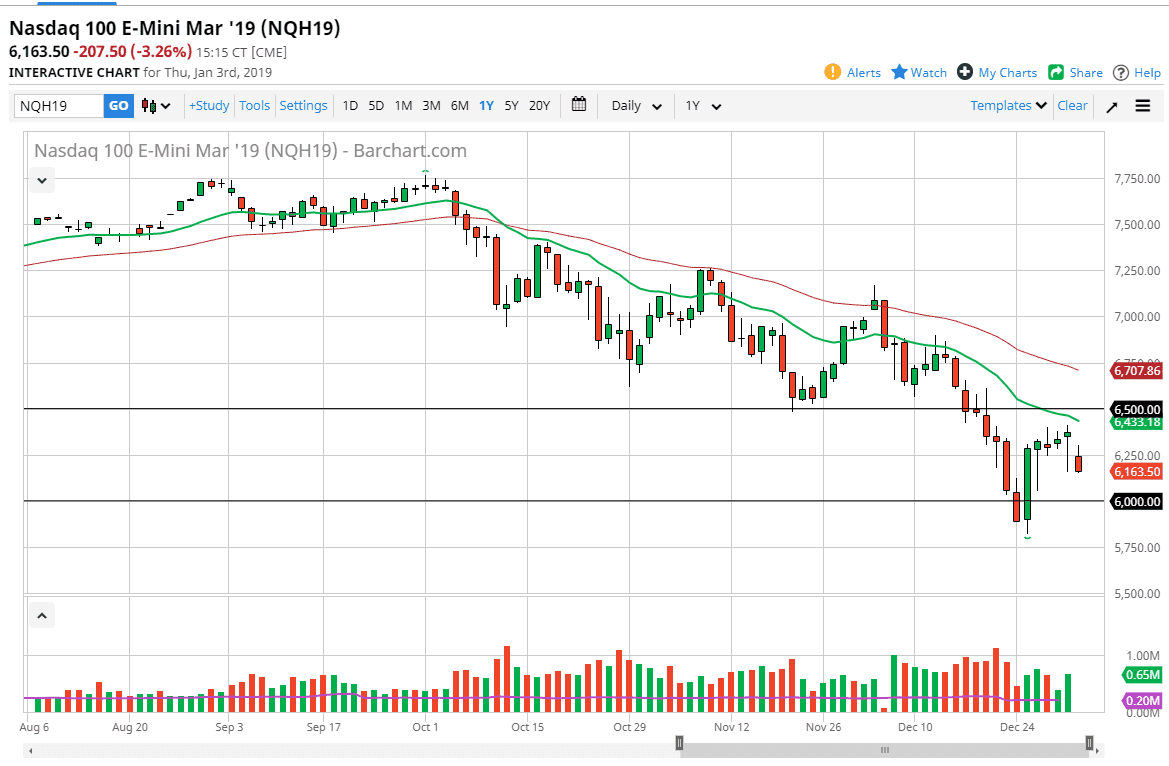

NASDAQ 100

The NASDAQ 100 gapped lower to kick off the session as well, for the same reason that the S&P 500 did, possibly even more so as it is technology driven. The fact that we have broken down below the 6250 handle sends this market looking towards the 6000 level. Ultimately, we are in a very strong downtrend, and the 20 day EMA just above should cause a bit of technical pressure. The 6500 level above was previous support, so it should now be resistance. I believe that we will continue to see sellers jump into this market, as we are fully entranced in a bear market overall. If we make a fresh, new low, then I think we could be unwinding down to the 5500 level, perhaps even the 5000 level. I think rallies will continue to be faded.