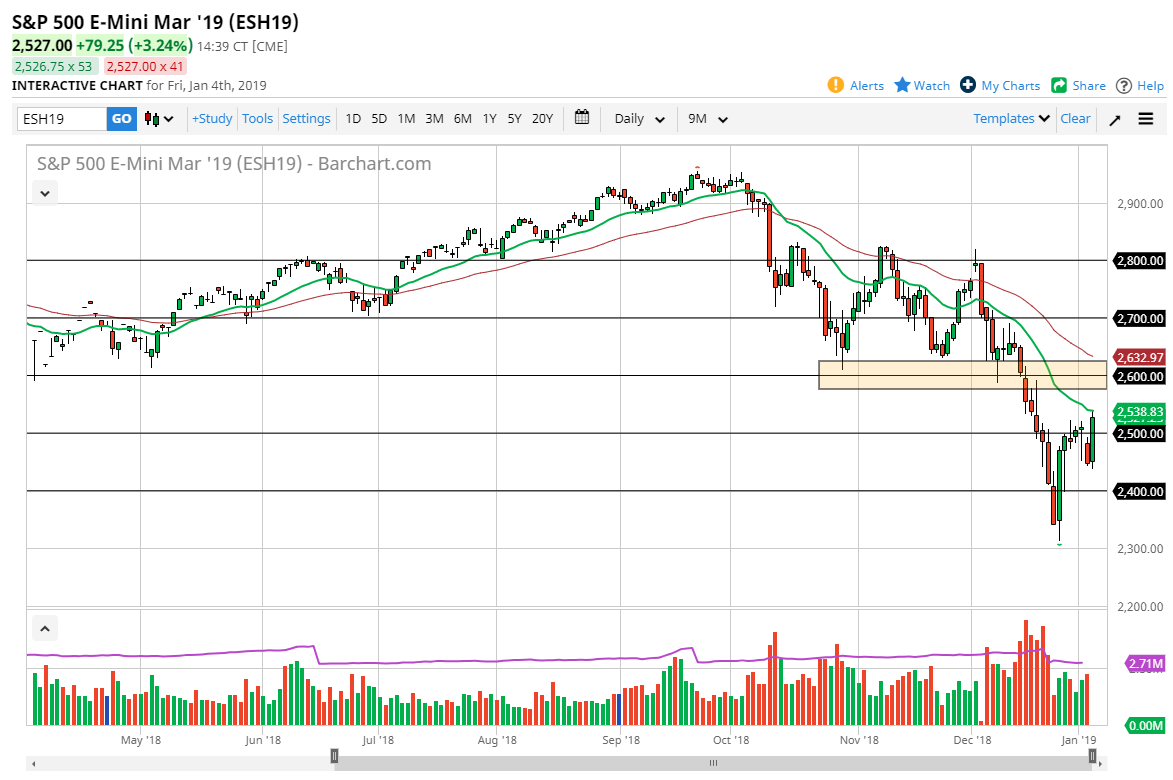

S&P 500

The S&P 500 has exploded to the upside after initially dipping slightly on Friday, with the “one-two punch” of a stronger jobs number than anticipated and the Chairman of the Federal Reserve, Jerome Powell, suggesting that perhaps the Federal Reserve was watching the markets, and therefore trader started to think about the “Fed put.” We have seen a 4% move to the upside, which of course is a very bullish sign, but we did pull back slightly from the 20 day EMA. However, even if we do break out to the upside I think we still have a lot of work to do to take out the negativity. The question is whether or not we can take out 2600 at this point, which we still have a way to go. I think the next couple of sessions will probably be bullish, but I’m looking to sell closer to the 2600 level.

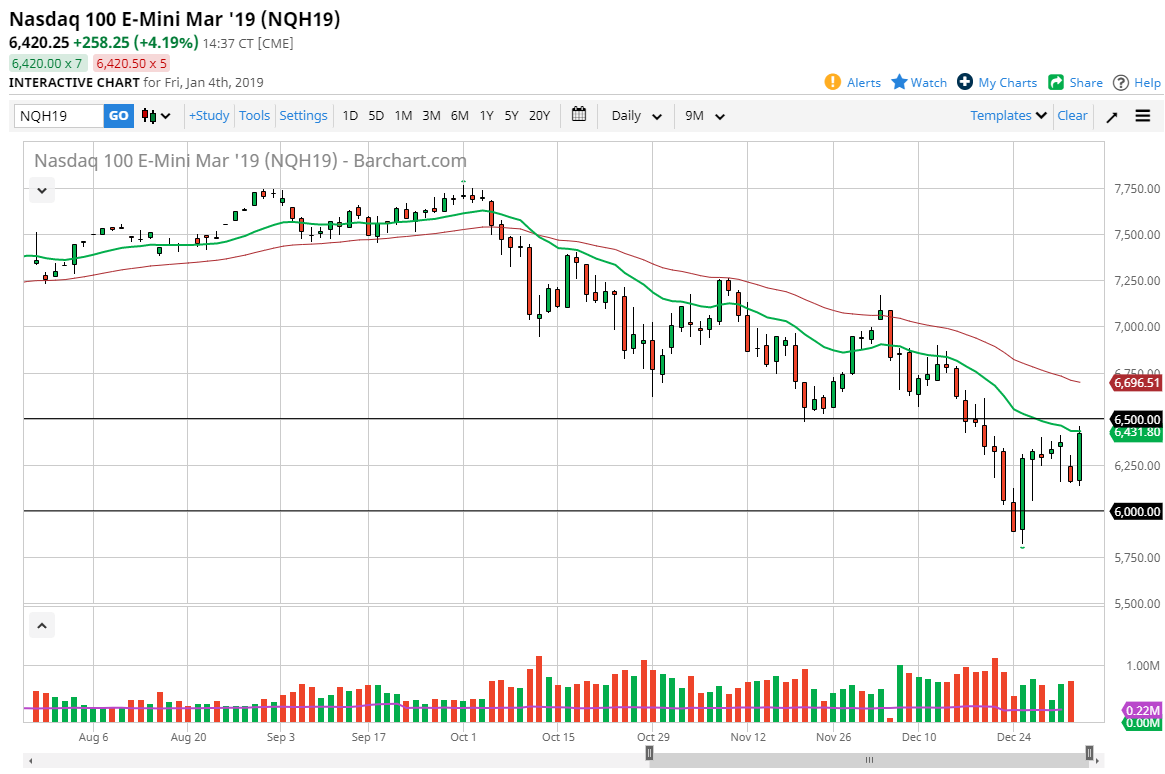

NASDAQ 100

The NASDAQ 100 broke higher as well, testing the 20 day EMA also. The 6500 level offers resistance, and of course the 50 day EMA is closer to the 6700 level. I think it’s only a matter of time before the sellers reenter this market, so I would look for some type of exhaustion. I question whether or not the volume was true after the Nonfarm Payroll Announcement and the statement. I think that a lot of traders are on the sidelines waiting to see what to make of this. If the Federal Reserve is suddenly worried about the markets, then is there something we should be worried about? I think that’s a conversation that’s going to be had over the weekend. If we can break above the 50 day EMA on a daily close, then I might be convinced to start buying. In the meantime, I’m willing to sit on the sidelines and wait for exhaustion to sell.