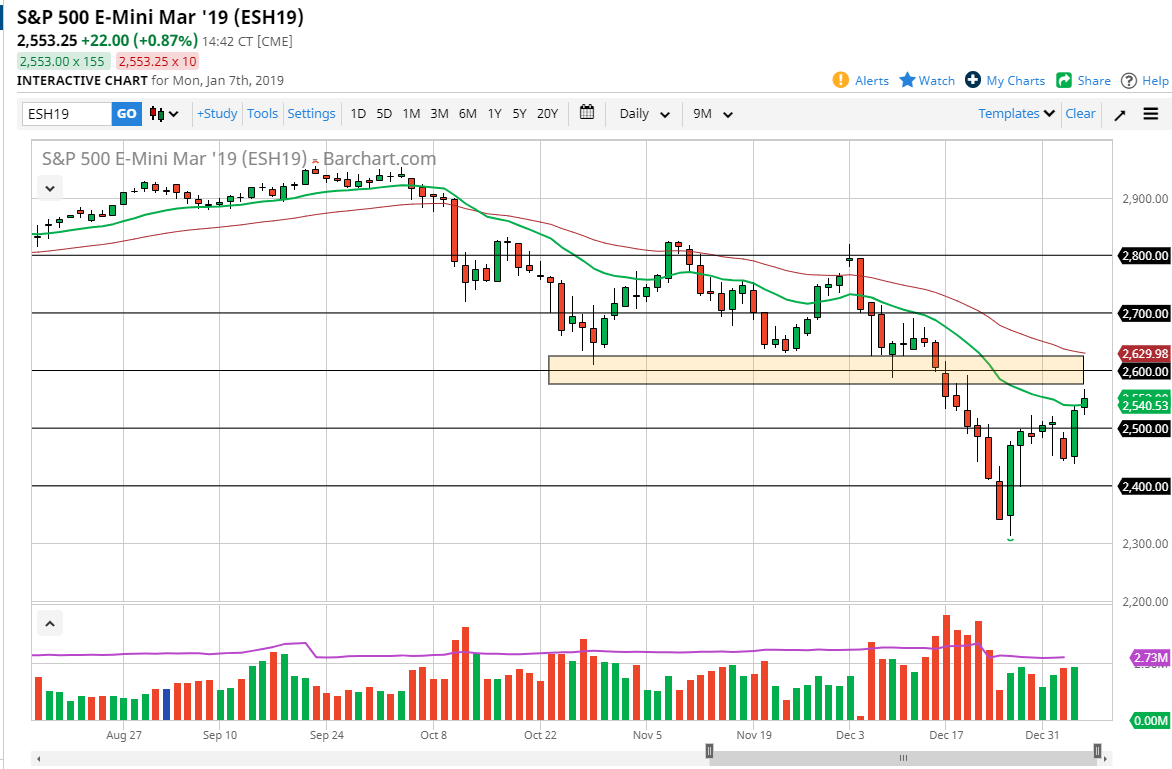

S&P 500

The S&P 500 rallied a bit during the trading session on Monday but gave back a bit of the gains towards the end of the day. We are approaching a major area of resistance from what I see in the form of the 2600 level, and the fact that the level had previously been so supportive previously tells me that there is a good chance that we will see sellers again in that area. I think that the first signs of exhaustion are going to bring in more sellers, perhaps reaching down to the 2500 level. I also believe that there is far too much out there that could scare the trader to keep a lot of money in this market. We are still in a downtrend, despite the recent rally. If we can break above the 50 day moving average, then perhaps we can pick up some momentum but until then I’m looking for opportunities to sell failed rallies.

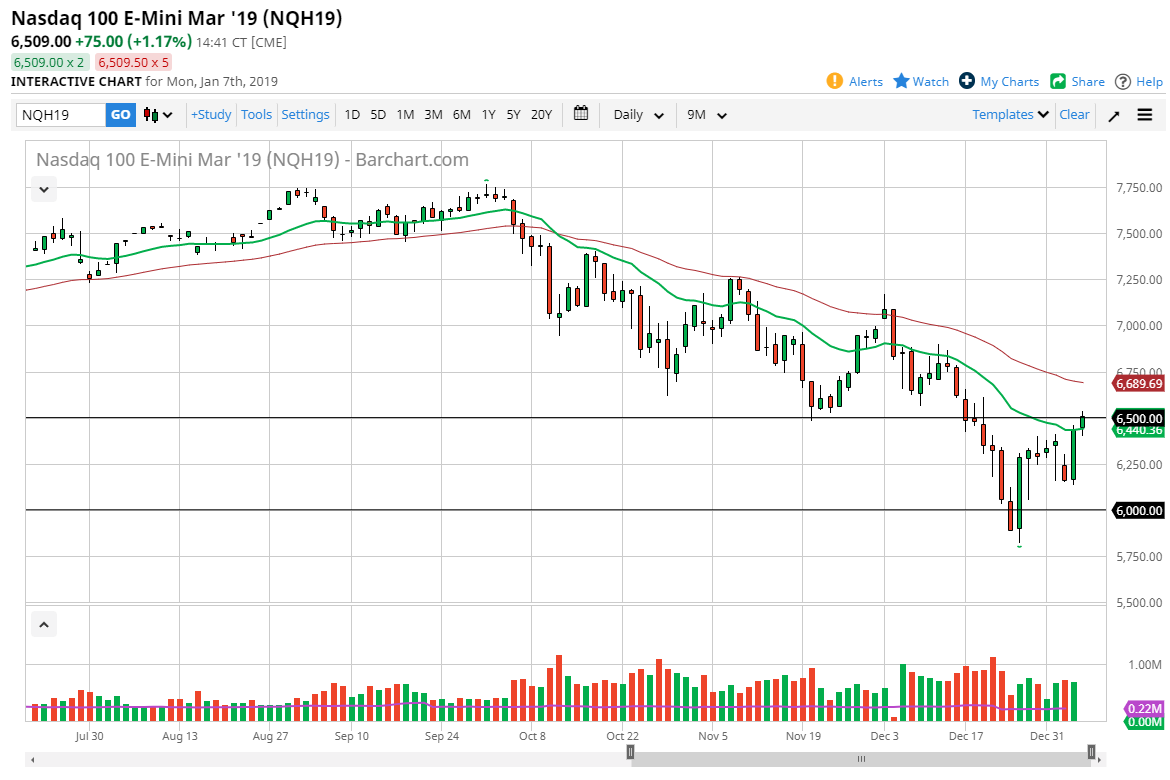

NASDAQ 100

The NASDAQ 100 found itself reaching above the 6500 level late in the day on Monday, with perhaps a bit of an eye towards the US/China trade negotiations going on. If those don’t pan out well, it’s likely that we will rollover and continue to go lower. I think at that point, the market would probably go reaching towards the 6000 level underneath, or at the very least the 6250 level. Rallies at this point will probably target the 50 day EMA initially, but it should be stated that the level has offered a significant amount of resistance lately, so I think I would be a bit cautious about trying to hang on to a breakout for more than that initial move.