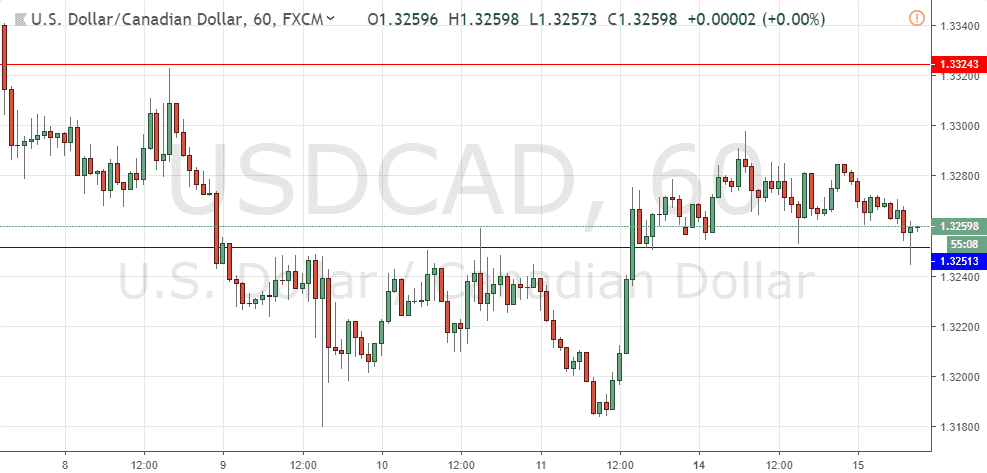

Yesterday’s signals were not triggered as the support level identified at 1.3251 was never quite reached during the specified time.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm New York time today only.

Long Trade

Go long after the next bullish price action rejection following the next touch of 1.3251.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short after the next bullish price action rejection following the next touch of 1.3324 or 1.3367.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

I wrote yesterday that I thought that 1.3274 would be today’s pivotal level, as if it held for several hours, the price was most likely to continue its rise. Having said that, I noted there was also support at the psychological level of 1.3250 which might complicate things. I was prepared to take a bearish bias if the price had broken firmly below 1.3250. This was a good call, as the break of 1.3274 did signify a further move down but only to the 1.3250 which at the time of writing is showing signs of acting as support.

The next major movement looks uncertain, the best I can say is that the psychological level at 1.3250 looks like being very pivotal today. After the USD data release later, I would follow any strong bounce off 1.3250 in either direction to determine the best direction to trade this pair, but I would want to see a short-term increase in volatility as this market here is getting quieter. There is nothing of high importance due today concerning the CAD. Regarding the USD, there will be a release of PPI data at 1:30pm London time.

There is nothing of high importance due today concerning the CAD. Regarding the USD, there will be a release of PPI data at 1:30pm London time.