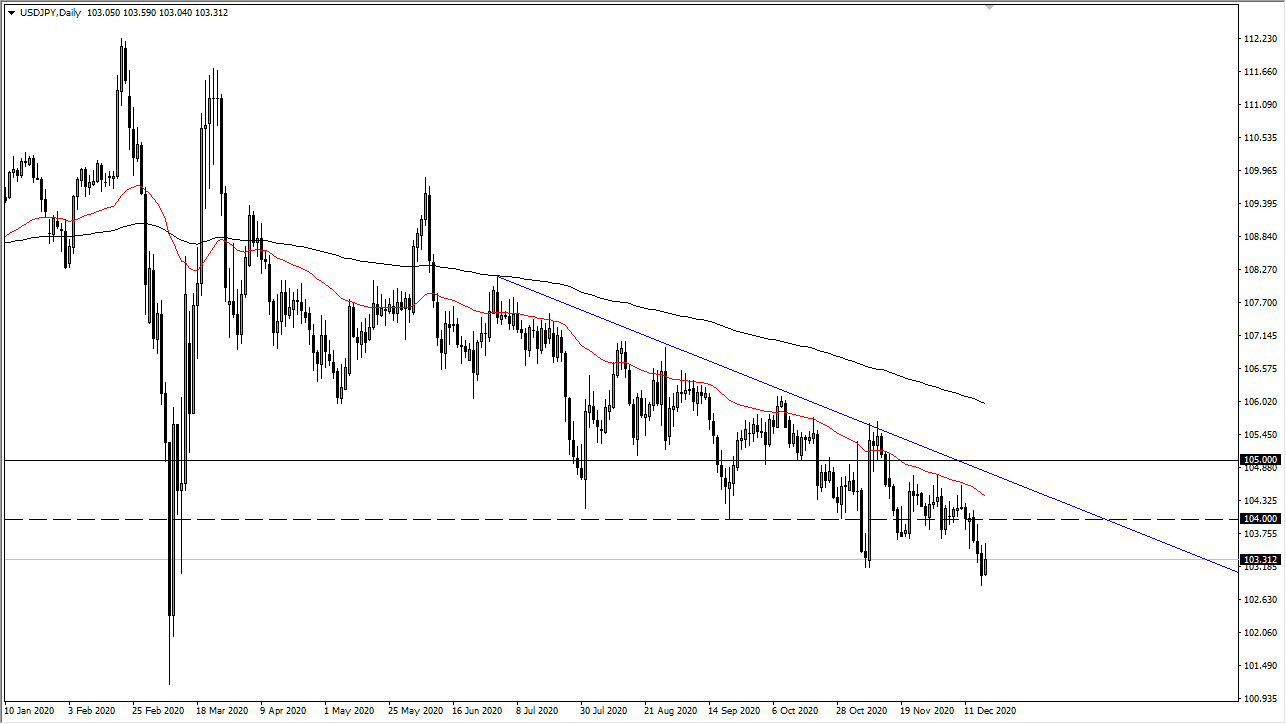

USD/JPY

The US dollar has rallied significantly during the trading session on Wednesday, testing the vital ¥110 level. We gave back gains from there though, and it looks to me like the sellers came back in force. Because of that, I think that we could see this market roll over significantly now that we had tested the major area, which is followed by the 61.8% Fibonacci retracement level, and the 50 day EMA. I think there are a couple of different reasons to think that we fall from here, not the least of which would be a relatively benign Federal Reserve. If that’s going to be the case, the dollar should continue to fall against most currencies as we had seen during quite a bit of the trading session in North America. Overall, I fade rallies as I have been saying, and that we will continue to go much lower.

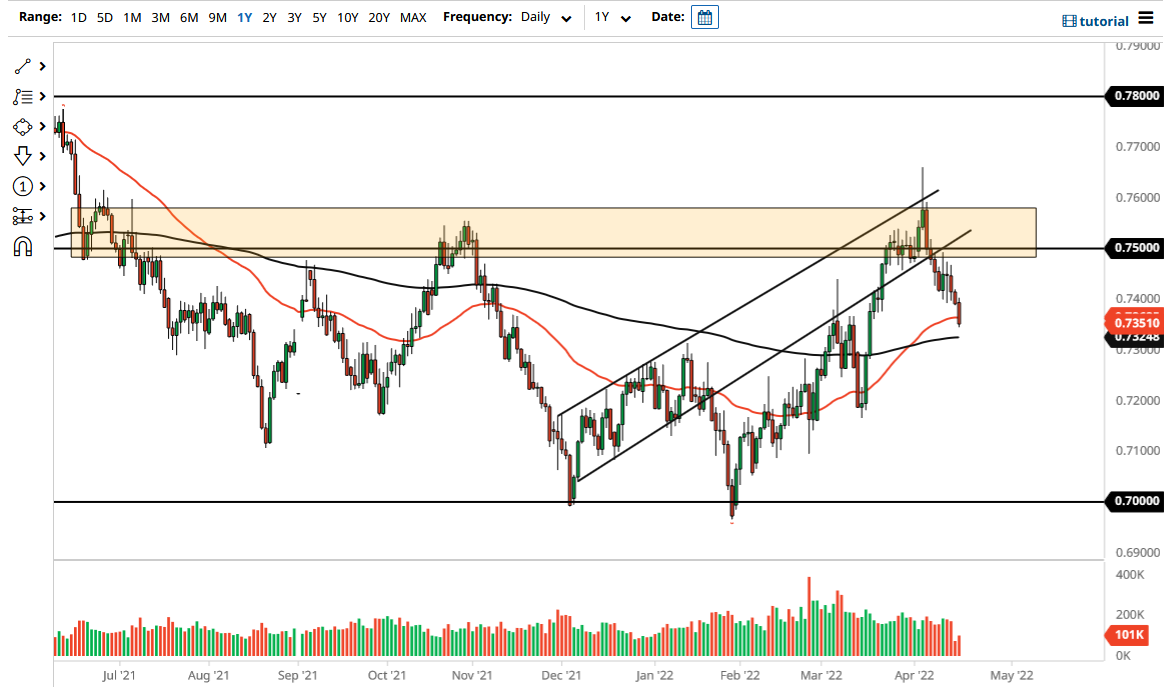

AUD/USD

The Australian dollar rallied slightly during the trading session on Wednesday but has struggled at the 50 day EMA. I think that the market probably will continue to show signs of weakness as the Australian dollar is so highly levered to the Chinese economy. I don’t think we’re going to break down drastically though, and quite frankly it would not surprise me at all to see this market struggle to make big moves in either direction. I believe that there is a massive support level that starts at the 0.70 level, so I’m going to let this market pull back a bit before thinking about buying. The 200 day EMA is just above the 0.7250 level, an area that I think will be a major barrier to breakthrough. If we can clear that area, then I think we could go higher. Otherwise, we continue to chop around and try to build a base underneath.