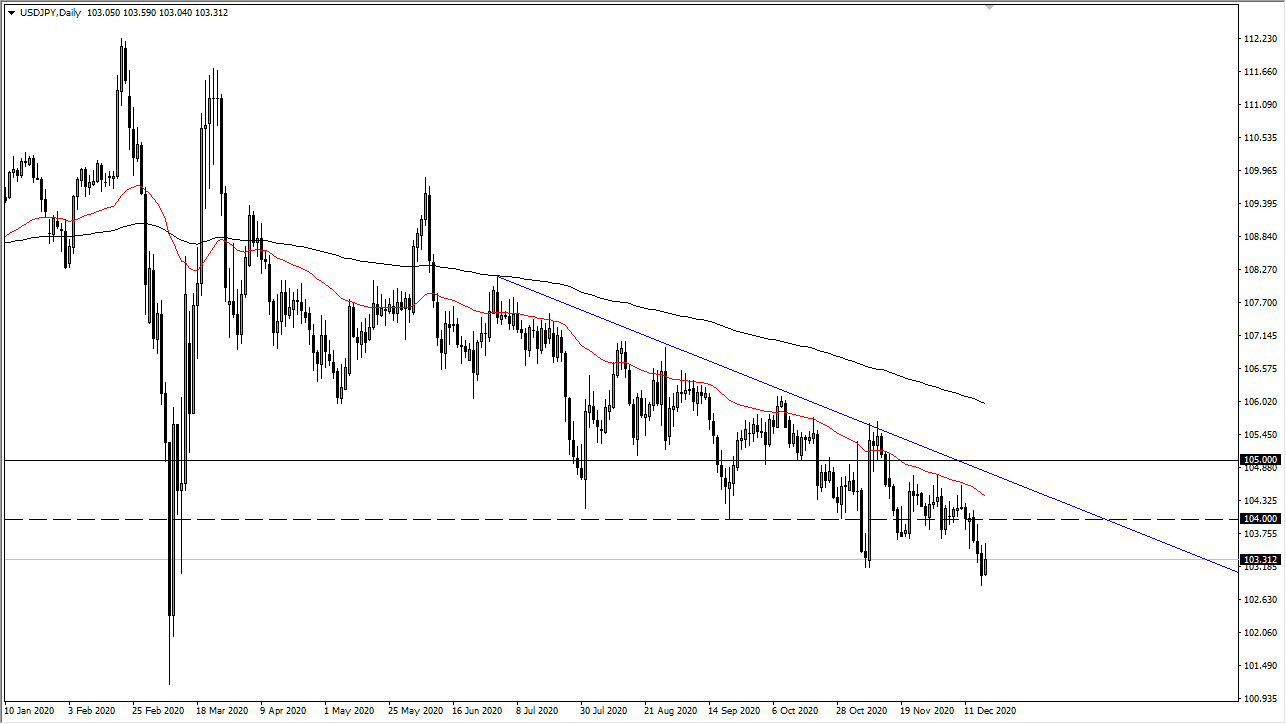

USD/JPY

The US dollar has been all over the place against the Japanese yen during the trading session on Wednesday, which you would expect during a Federal Reserve press conference. Ultimately, I think that the market will continue to be very noisy but I think that the US dollar will eventually fall, for a couple of different reasons. Additionally, you can make an argument about the Federal Reserve softening its stance, so therefore the US dollar should fall. That being the case, then we could go down to the ¥108 level. Ultimately, the markets look a little shaky in certain places, and if we get a bit of a “risk off” move, that’s parish for this pair as well. We have recently tested the 61.8% Fibonacci retracement level, which has offered significant resistance. I think we are still looking at a “sell on the rallies” type of situation.

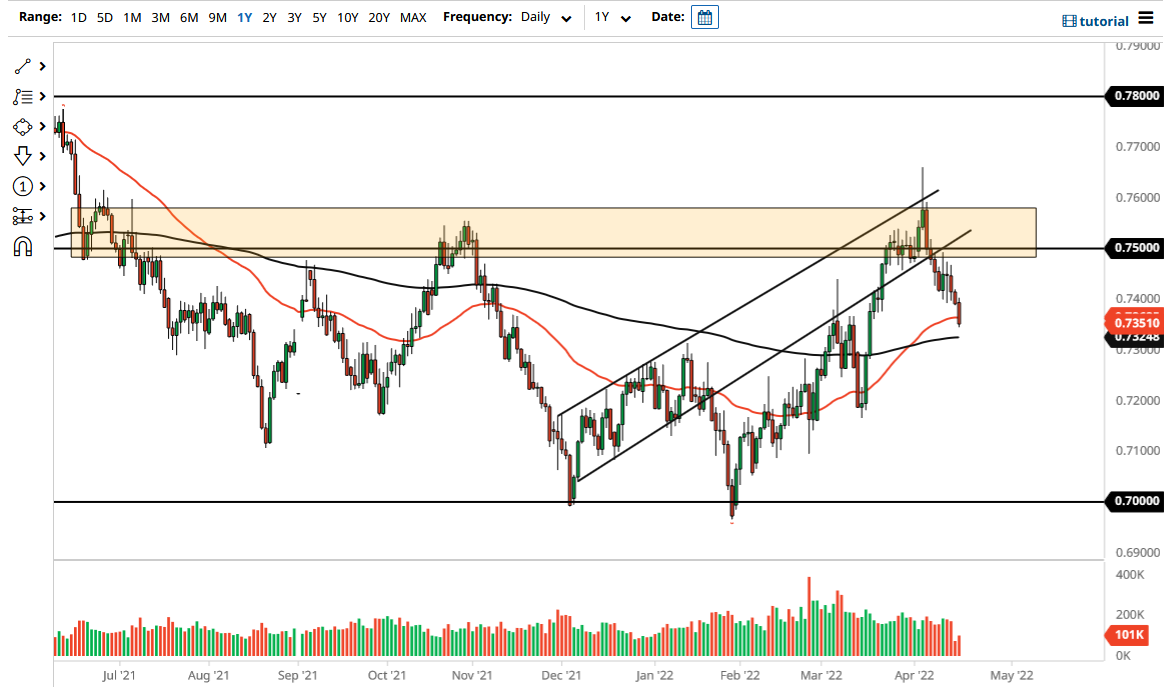

AUD/USD

Although the Australian dollar spikes during the trading session, it stopped right where you would expect it to you if you were bearish. We pierced the 200 day EMA but could not get above it. Beyond that, we have the Americans and the Chinese talking this week, and that is a major driver of what happens with the Aussie dollar. While the Federal Reserve didn’t explicitly say so, the tone of the attitude in the press conference certainly was a bit more cautious, especially when talking about global markets. That is horrific for the Australian dollar. I think that we are probably going to pull back from here, but I also believe that there is more than enough support underneath to keep the market afloat. In other words, even though we’ve had this surge higher I anticipate that we will probably get more of the same choppy action.