AUD/USD

The US dollar has gone back and forth during the course of the week, as we continue to see a lot of resistance at the 0.7250 level. If we can break above that level, then I think the Australian dollar can continue to go higher. However, I suspect that in the short term we will probably get a small pullback. I would anticipate somewhere near the 0.71 level and most certainly at the 0.70 level we will find buyers willing to step into this market plays. I think at this point people are betting on the US/China trade situation getting better rather soon, which of course the Australian dollar will be a major beneficiary.

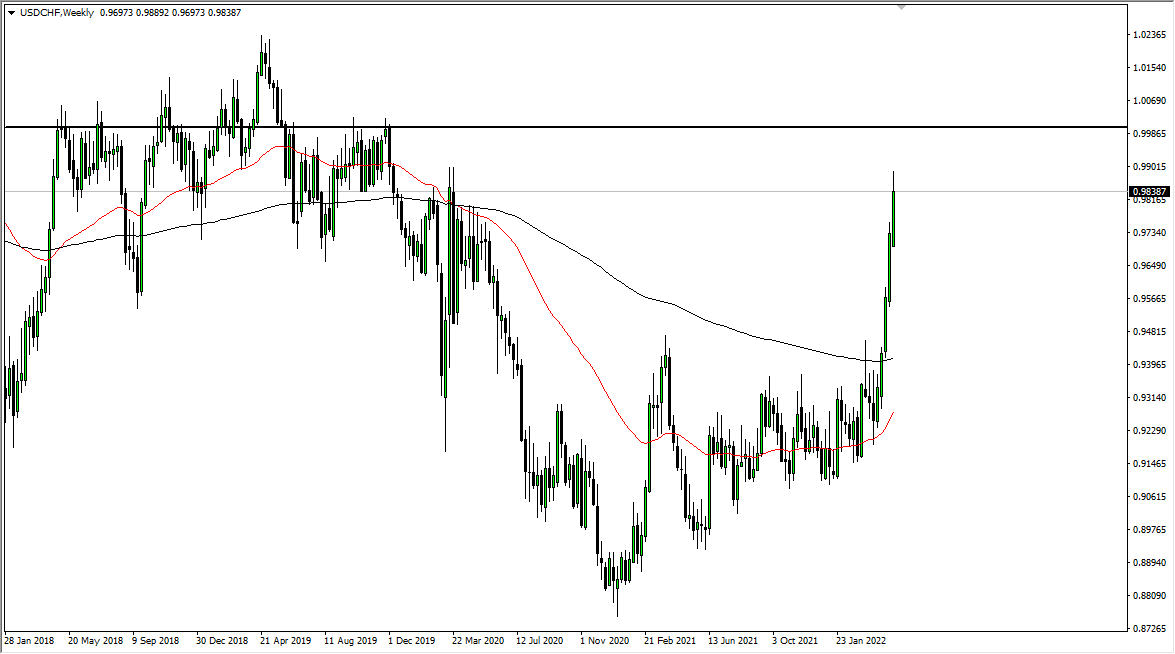

USD/CHF

The US dollar continues to rally against the Swiss franc during the week, but we are getting a bit extended and I do think that the parity level will continue to offer resistance. With that being the case, I think that we may get short-term follow-through, but I would fully anticipate that the sellers come back into the market and push this pair back towards the 0.9850 level. If we do break above the parity level on a daily close, then we could go to the 1.01 handle after that.

USD/CAD

The US dollar has stabilized a bit against the Canadian dollar near the 1.3250 handle. I think at this point, if we can break the 1.33 level, then the US dollar will continue to gain against the Canadian dollar. Pay attention to oil it always has its influence, so if oil rises it could put downward pressure on this market.

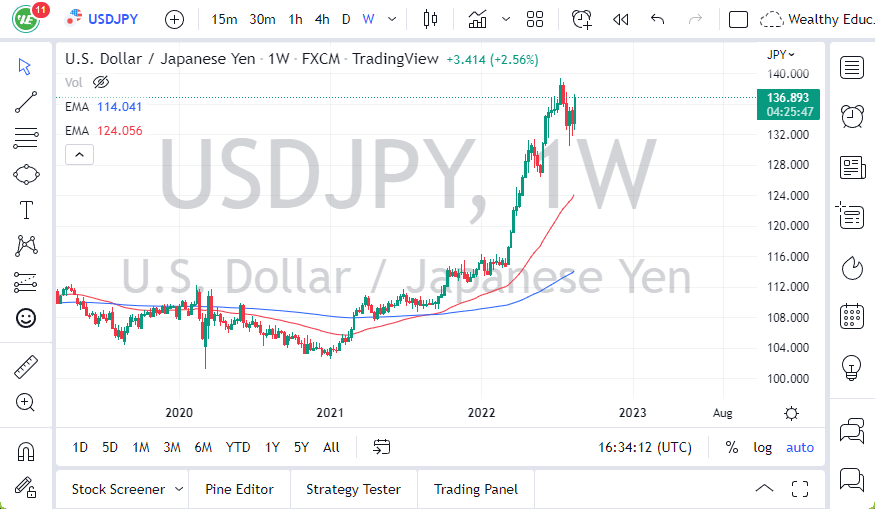

USD/JPY

The US dollar rallied significantly against the Japanese yen during the week but I think that the ¥110 level is where we are going to see a lot of resistance come back into the marketplace. We have the 61.8% Fibonacci retracement level above offering resistance as well, so I think it’s only a matter time before the sellers come in and push this market down. We may have a little bit more positivity ahead of us, but at that point I would expect the market to turn around and fall of the downtrend.