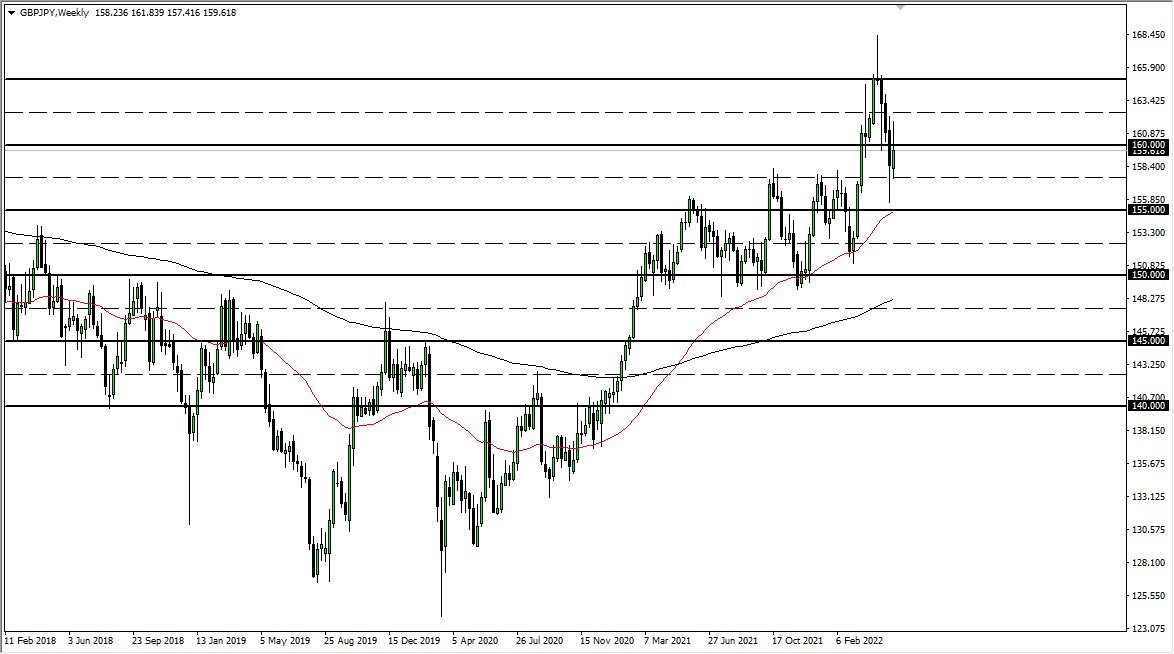

GBP/JPY

The British pound had a very good week, reaching much higher against most currencies. It was no different between the British pound and the Japanese yen, as we attacked the ¥145 level. I think there is significant resistance there though, and I suspect that initially we will get a bit of a pullback. That pullback would be an opportunity to buy value, as the British pound continues to enjoy a rebirth due to a delay of the Brexit. However, we are still stuck within the descending channel so I think the upside is somewhat limited in the short term.

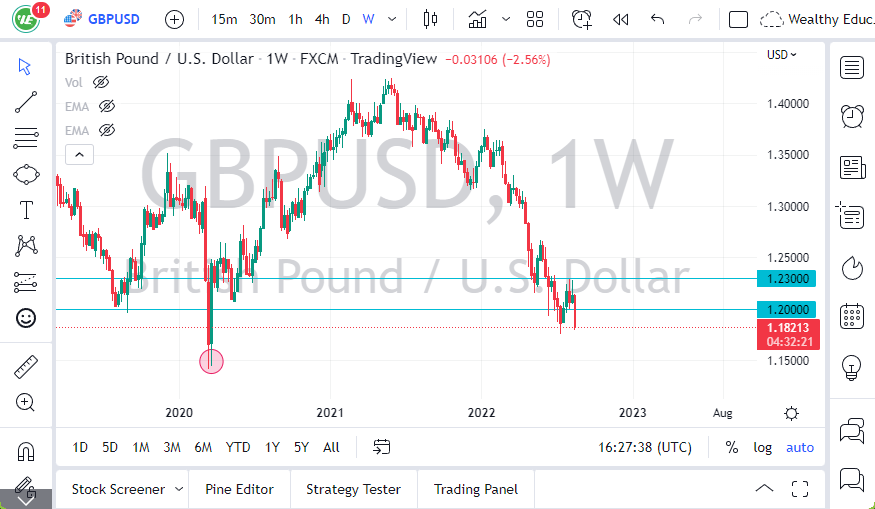

GBP/USD

The British pound exploded to the upside during the week, slicing through the 200 day EMA with force. Now that we are well above the 1.30 level, it looks as if the buyers are certainly in control. Ultimately, the market looks as if it will go looking towards the 1.33 handle, but I think we may get a short-term pullback as well, perhaps to build up a bit of value. If we can break above the 1.33 handle, then we should go to the 1.35 level after that..

EUR/USD

The Euro broke down significantly during the trading session on Thursday, in reaction to the ECB press conference that was a bit more dovish than anticipated. However, the Friday session has seen the market turned completely around to form a hammer. This tells me that the 1.13 level is massive support, and that the 61.8% Fibonacci retracement level underneath at the 1.12 level is still technically the bottom of the market. I think we will continue to grind higher, but that’s going to be the keyword here: grind..

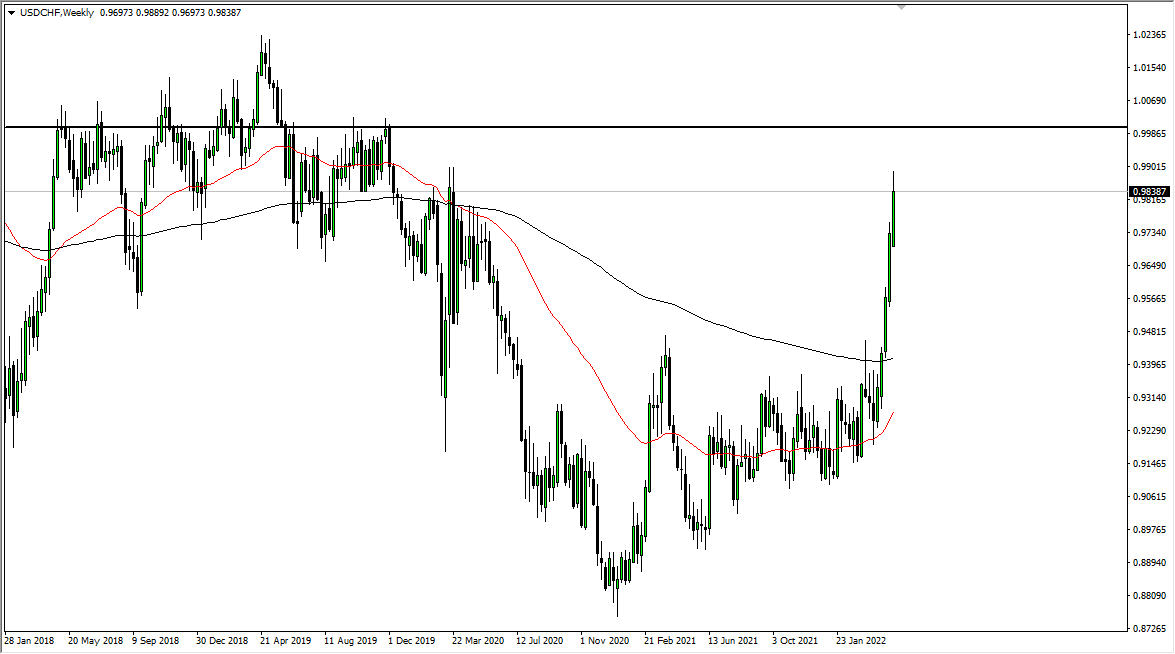

USD/CHF

The US dollar tried to rally initially against the Swiss franc this week but has ran into a buzz saw of resistance at the parity level. As we have turned around, we ended up forming a bit of a shooting star. Because of this, I think we are going to continue to fall from here, perhaps down to the 0.98 level in the short term. If we break above parity, that would obviously be very bullish.