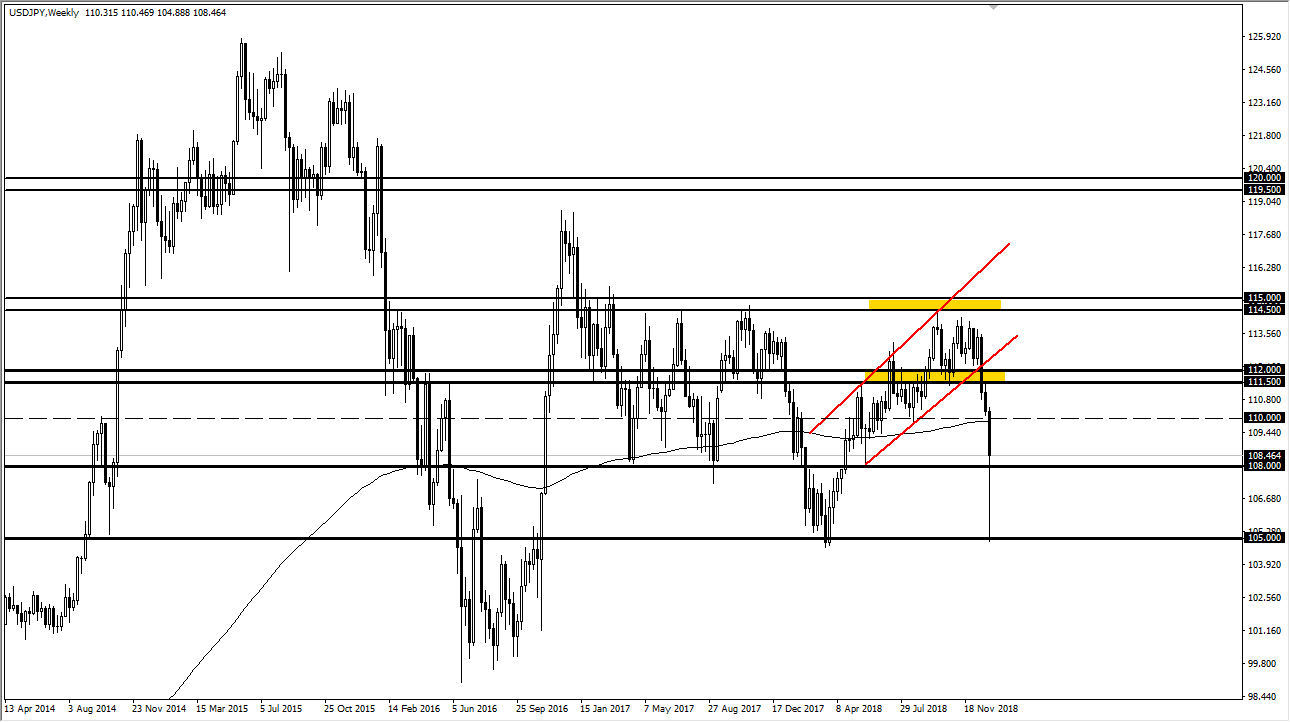

USD/JPY

The US dollar broke down during the bulk of the week, but a lot of that would have been done during the “flash crash” that we had seen in the currency markets between the American and Asian sessions in the middle of the week. We tested the ¥105 level, an area that has been supported, and because we got there so quickly, we turned around and rallied quite drastically. I think though, what we are looking at is an opportunity to sell rallies closer to the ¥110 level. Rallies are not to be trusted at this point.

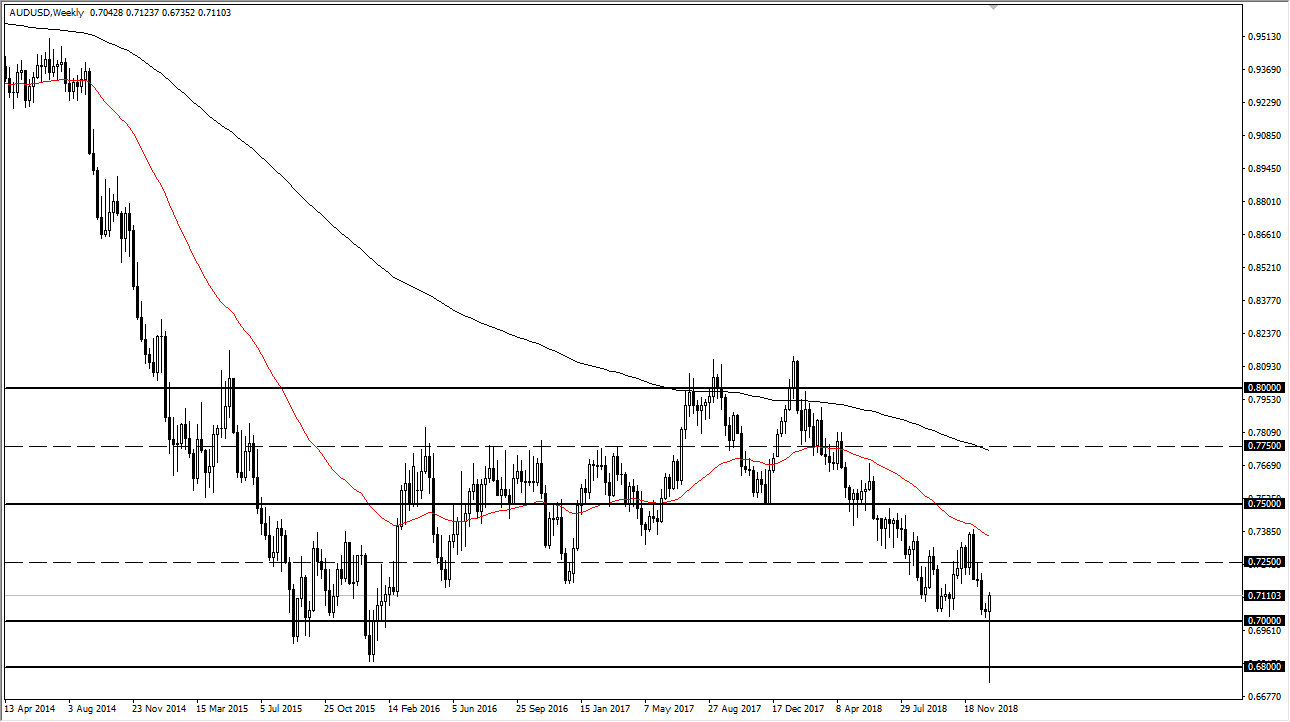

AUD/USD

The Australian dollar fell initially during the week, during that same “flash crash.” We peeked below the 0.68 level, and then turned around to break back above the 0.70 level. By breaking above that level, we did of forming a nice-looking hammer, but I think that the rally that could come from this is probably somewhat short term, and therefore I would be very interested in shorting this pair as we get closer to the 0.7250 level above. Pay attention to the US/Chinese relations, if we get some good news there that could also turn things around.

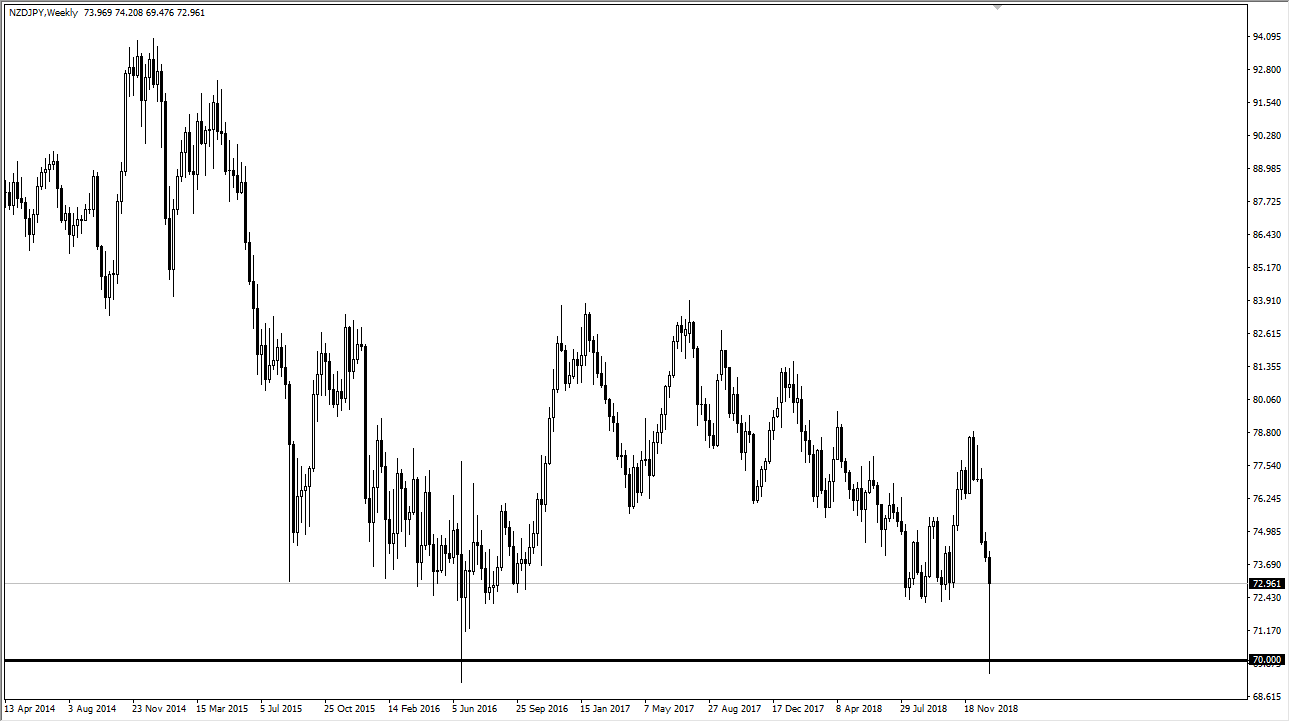

NZD/JPY

The New Zealand dollar also crashed against the Japanese yen, testing the ¥70 level, before turning around and bouncing to form a massive hammer. That hammer is forming at a relatively strong support level, so if we can break above the top of that hammer, we could go looking towards the ¥78 level. I think the market is overdone, so at this point it’s likely that if you are patient enough you should get a selling opportunity later in the week.

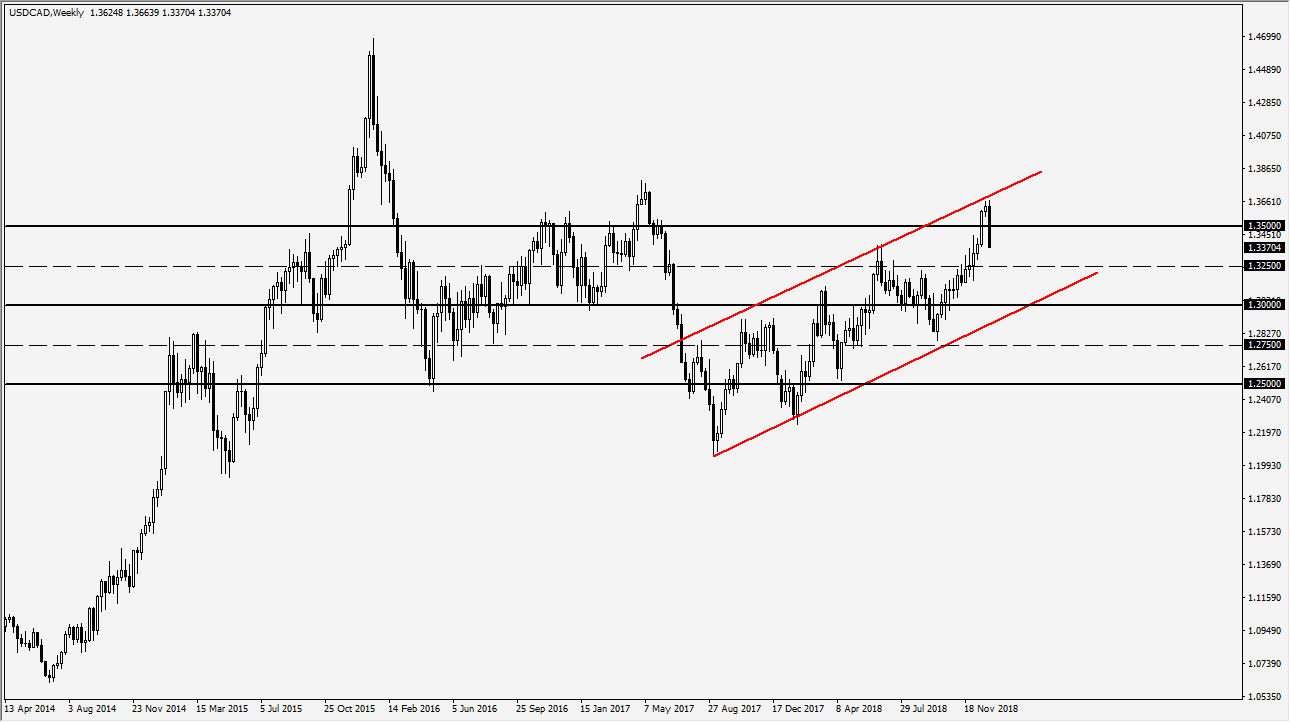

USD/CAD

The US dollar fell hard during the week, slicing through the 1.35 level, and even breaking through the 1.34 level. I think there is more support to be found at the 1.3250 level, so that’s probably where we reach down towards. We are in an uptrend channel, so the fact that we pulled back from the top of it shouldn’t be a surprise. I’m waiting to find some stability, perhaps towards the middle of the week, so that I can rejoin the uptrend.