Gold prices ended Friday’s session down $9.09 an ounce as the dollar rose in the wake of U.S. non-farm payrolls data for December, which suggested the economy maintained strong momentum at the end of 2018. The Labor Department reported that the economy added 312000 jobs in December, beating consensus estimates of 179000, and average hourly wages jumped 0.4%. Gold drifted lower after prices fell below $1289, but found support in the $1279-$1277 area and trimmed losses following Fed Chairman Jerome Powell’s remarks. “Particularly with the muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves...We are always prepared to shift the stance of policy and to shift it significantly,” Powell said.

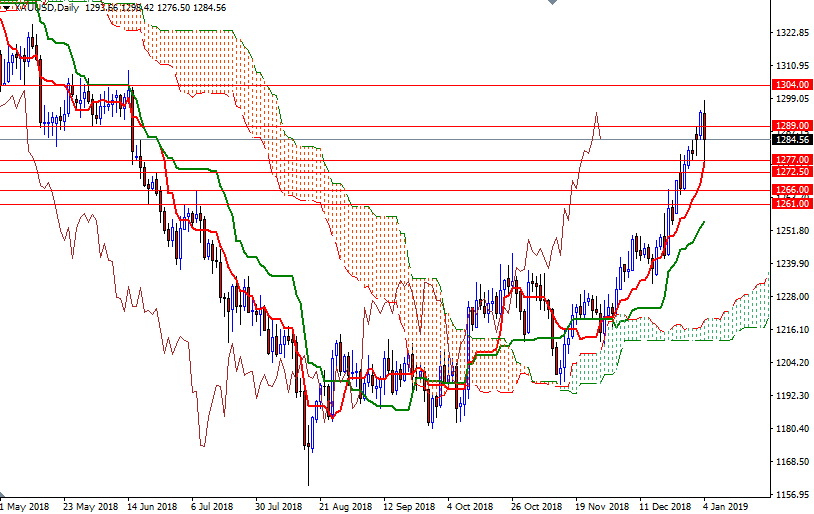

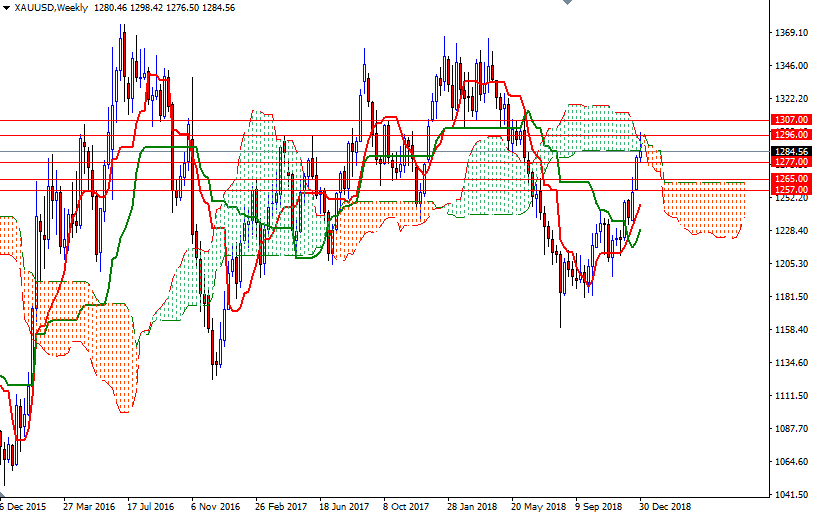

From a chart perspective, the bulls have the overall technical advantage. XAU/USD is above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on the weekly and the daily charts. In addition, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. I have been bullish on gold since mid-October (I still think that the precious metal will maintain its uptrend in 2019), but I wouldn’t rule out the possibility of a downswing before we see prices above the 1316/2 area.

As I pointed out last week, the bulls have to overcome a technical barrier at around the 1296 level to challenge 1300 and 1307/4. A daily close above 1307 could offer enough inspiration for bulls to send prices higher to 1316/2. A break through there brings in 1325. Once above 1325, the market will be targeting 1340. If the weekly cloud continues to act as resistance, keep an eye on the 1279/7 zone. The bears need to capture this strategic camp to test 1274 and 1272.50-1270. Breaking below 1270 on a daily basis implies that XAU/USD will visit 1266/5. If this support is broken, then the 1261/57 area will be the next port of call.