WTI Crude Oil

The WTI Crude Oil market continues to be very noisy, finishing slightly lower but in a relatively neutral candle stick. We are currently trading between the 20 EMA pictured in green, and the 50 EMA pictured in red. This will have a lot of conflicting traders going back and forth, and I think that the volatility will still be a major issue. If we can break above the $55 level, this market could really take off. However, if we break down below the 20 day EMA, the market probably reaches towards the $50 level, and then down towards the $47.50 level. We have recently broke through a downtrend line though, and as a result it looks likely that we will continue to find buyers try to build this market up and reverse the nasty downtrend that we had seen recently. It was an oversold market, so it makes sense that we are trying to form a bit of a base.

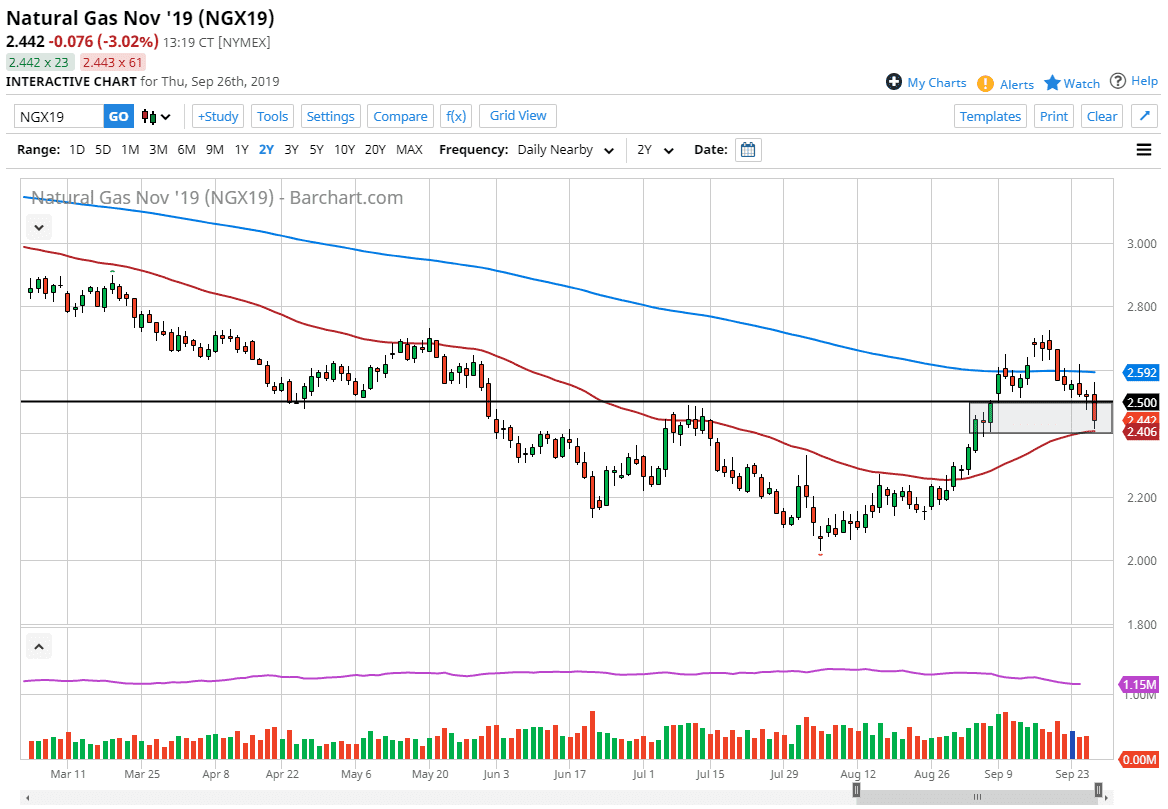

Natural Gas

Natural gas markets went back and forth during the trading session on Wednesday, as the three dollars level attracts a lot of attention. We did try to rally at one point but then rolled over a bit. This is a very unlikely rally though, so having said that it’s likely that we will continue to fade rallies, as the 20 day EMA will cause resistance, just as the $3.25 level above. I think that there is a significant amount of support underneath, so if we were to break down below the $2.75 level, the market probably then goes down to the $2.50 level, which is massive support. I do think that we could possibly get a bit of a “pop rally”, which could send this market as high as the $3.50 level, but I think signs of exhaustion there will be begging for short sellers to jump in and as we are leaving the seasonably strong time of year.