WTI Crude Oil

The WTI Crude Oil market rallied rather significantly during trading on Wednesday, touching the vital $55 level before pulling back. This is an area that has been difficult to break above lately, and I think it will continue to be. That being said, I do think that there is building upward pressure underneath, so buyers will probably return to this market after a pullback. At this point, we now have to worry about the inventory figures, and possibly even a surprise jobs figure on Friday. When I look at the longer-term charts though, I can make a strong case for an inverted head and shoulders. That has not kicked off yet, I have the neckline as $55 and I need to see a daily close above there to become bullish. Otherwise, I think that short-term back and forth trading will continue to be what we witness here.

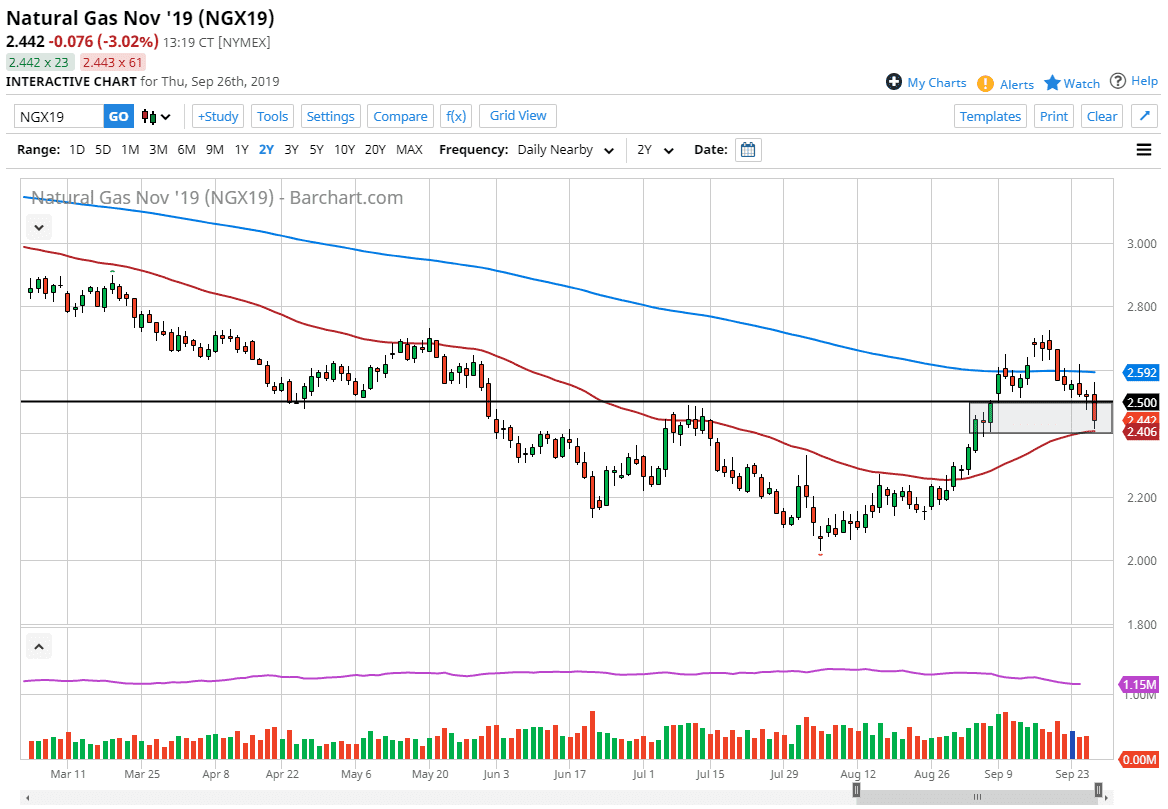

Natural Gas

Natural gas markets fell slightly during trading on Wednesday, as we continue to hover just above the $2.75 level, which I see as a major floor in the market right now. Ultimately, I do think that we get a bounce in the short term, but then will find sellers above that are willing to jump into this market and punish it for being so oversupplied. I am patiently waiting for a bounce that I can take advantage of. I am not interested in buying into that bounce, because it can turn around so quickly and what is an extraordinarily bearish market. The alternate scenario of course is that we break down below the $2.75 level, which of course would be very negative. At that point the market probably goes down to the $2.50 level next. I believe the “ceiling” in the market is probably close to the $3.25 level.