WTI Crude Oil

The WTI Crude Oil market exploded to the upside during the trading session on Wednesday, leaving the $50 level behind it. At this point, it’s very likely that the pullback should offer buying opportunities, and that the $50 level now should act as support. Not only have we broken above horizontal resistance, we have also broken above a trendline during the overnight hours. That being the case, I think that the market will continue to reach towards the $55 level, and perhaps even further. The 50 day EMA is just above, and that could cause a little bit of technical resistance as well. However, the market suddenly has become very constructive as the greenback took a bashing due to the Federal Reserve minutes being a bit more dovish than anticipated. A weaker US dollar, and perhaps some continued movement by Saudi Arabia may push oil a bit higher.

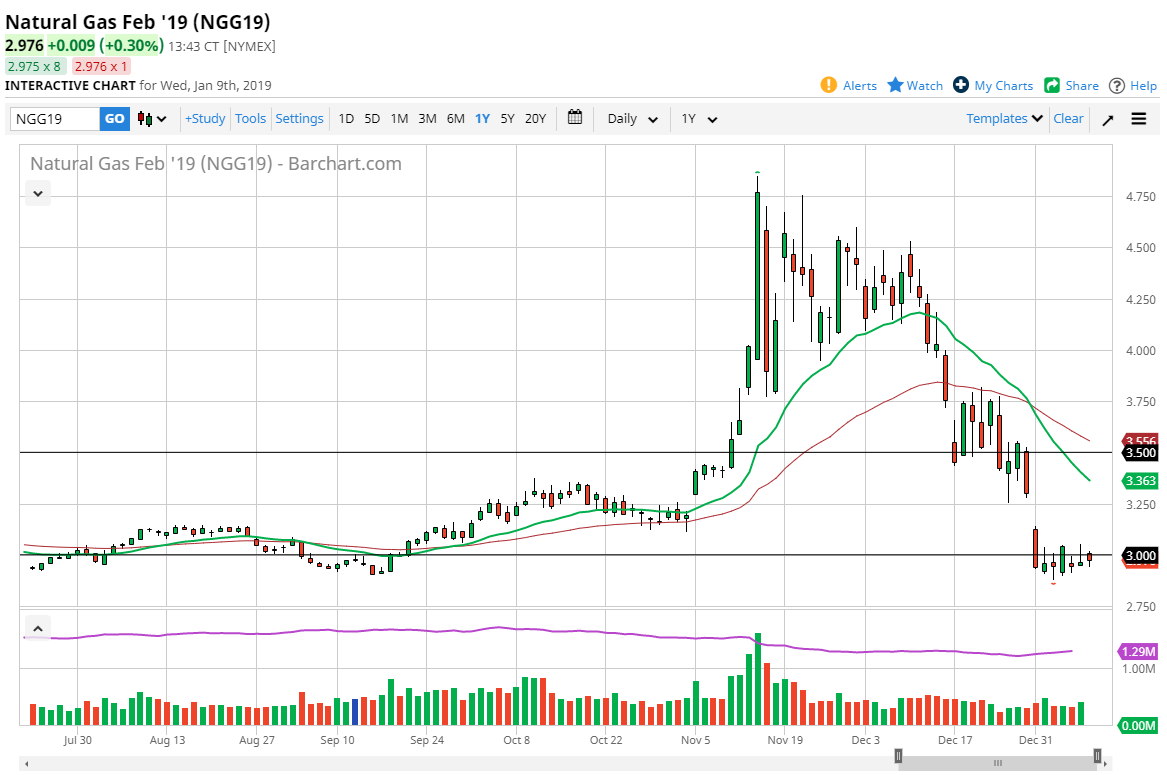

Natural Gas

Natural gas markets fell after initially gapping higher during the trading session, as we continue to bounce around the $3.00 level. This is a market that looks very likely to struggle to find a certain amount of clarity, but the one thing that I am aware of is that the gap above has been filled. If we can break above to the upside, perhaps reaching towards the $3.30 level, then I think the sellers will come back. I believe that is the momentum necessary to break down below the current area, which could open the door to the $2.50 level. Beyond that, the 20 day EMA is sitting around the top of the gap as well. At this point, it’s likely that the sellers will be attracted to that as well. Above there, I also see a lot of resistance at the $3.50 level. Wait for a rally, and then sell at the first signs of exhaustion.