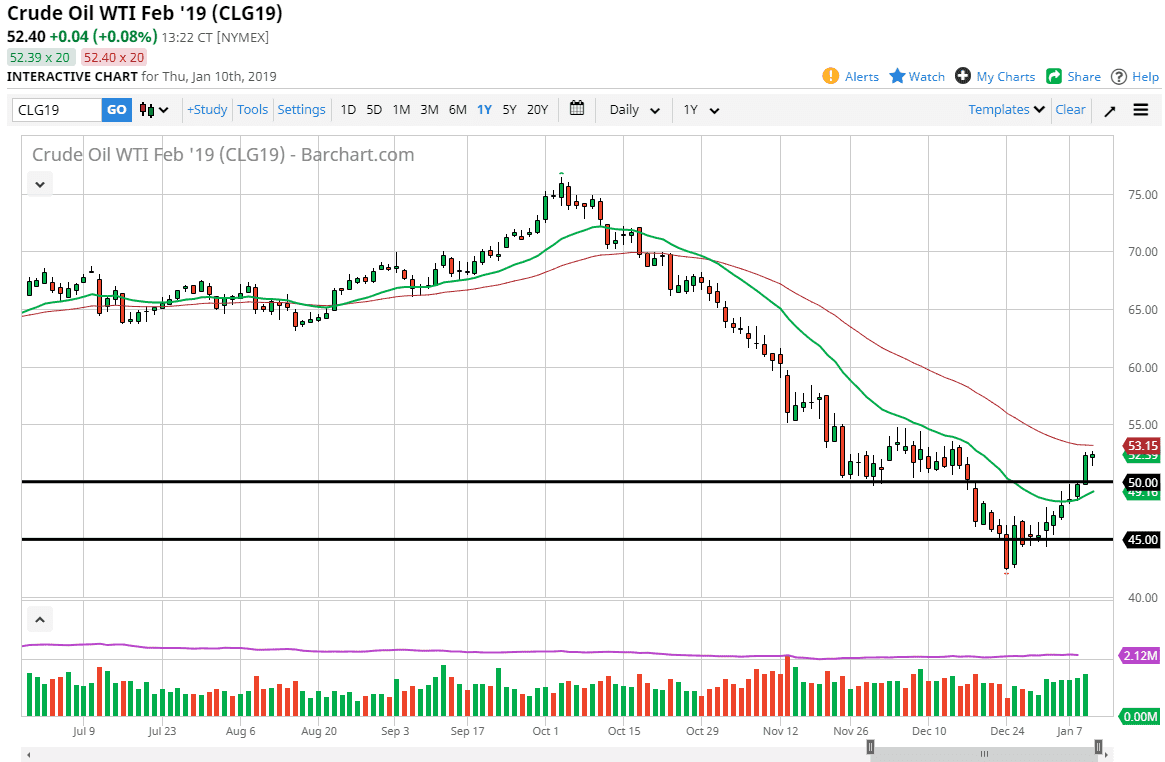

WTI Crude Oil

The WTI Crude Oil market pulled back a little bit during the trading session on Thursday, turning around to show signs of support. The 50 day EMA above should be resistance, and I think if we can break above that level, the market should then go to the $55 level next, perhaps even the $60 level beyond that. At this point though, I think we are running out of momentum after the major break out and I think the $50 level underneath should be supported now that we are through it. Beyond that, the 20 day EMA sits just below there so I think it’s only a matter time before the buyers come back. If the US dollar continues to soften, that could give us a little bit of a boost in the crude oil market as well.

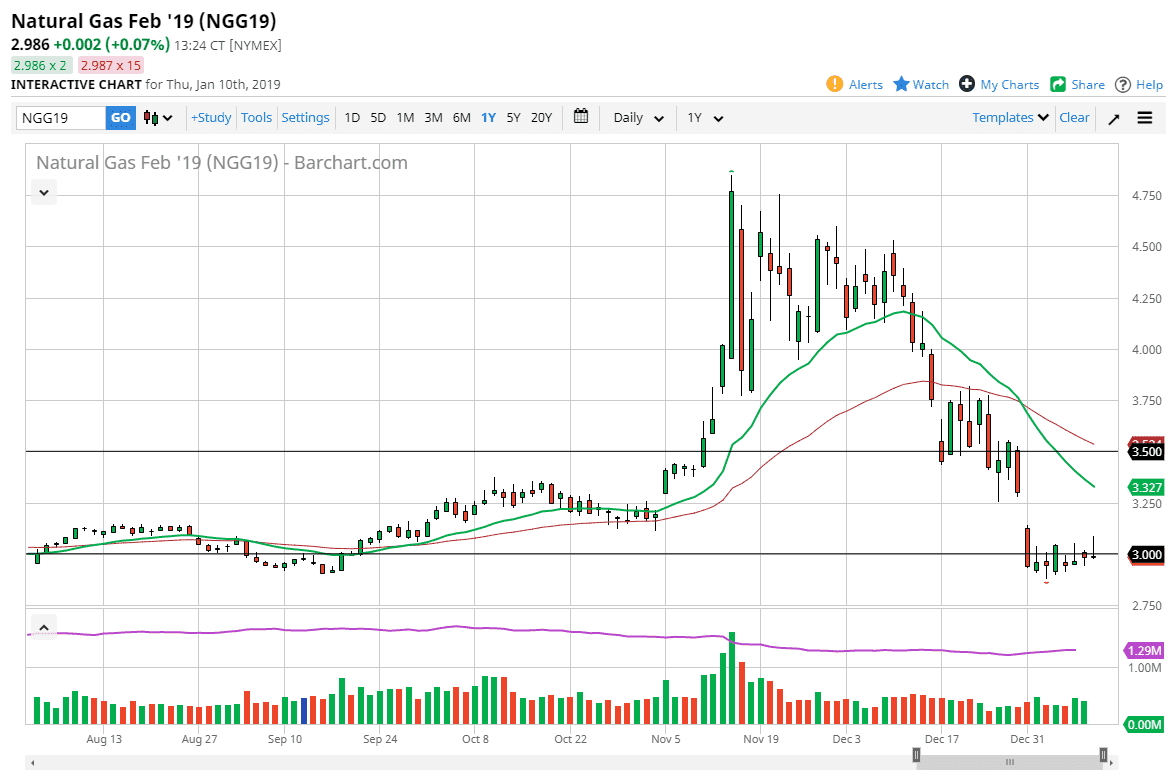

Natural Gas

Natural gas markets initially tried to rally during the trading session on Thursday, breaking above the $3.00 level again but then rolled over. This is a very negative looking candle that has formed, but I think ultimately we are looking at a scenario which we have gotten far ahead of ourselves to the downside so it would not surprise me at all to see a bounce from here. In fact, that’s what I’m hoping to see and I would love to see the gap above get filled. That would drive this market towards the $3.30 level where I am more than willing to start selling again. I think that from that level all the way to the $3.50 level is massive resistance. I’m looking for signs of exhaustion to sell at those higher levels. If we break down from here, we will probably go down to the $2.75 level, perhaps the $2.50 level after that. However, I feel much more comfortable shorting after rallies.