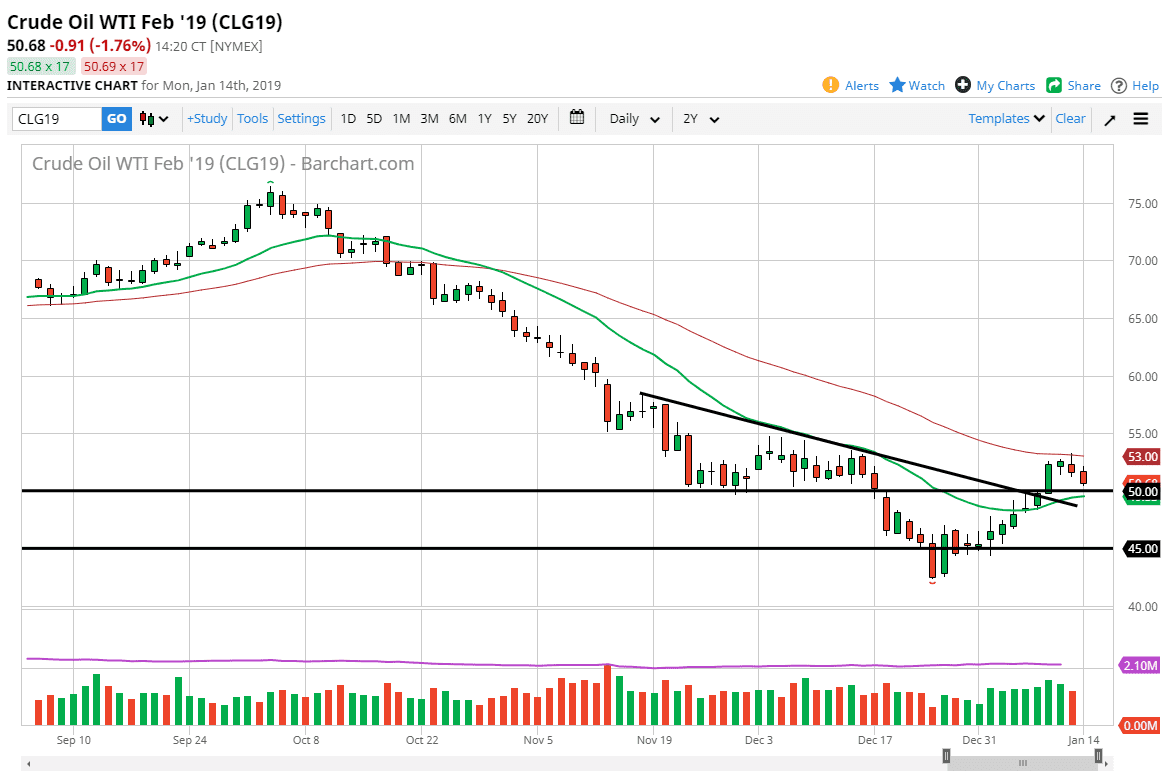

WTI Crude Oil

The WTI Crude Oil market tried to rally to kick off the session on Monday, but then turned around to show signs of exhaustion as we felt towards the $50 handle. We are currently stuck between a couple of major moving averages, in the form of the green 20 day EMA, and the red 50 day EMA. I think it’s probably fair to say that the $50 level will offer a bit of support, just as the previous downtrend line that was broken will be. I think it’s only a matter time before buyers will come back in, but I look at it this way: if we break above the 50 day EMA, then I think the buying pressure will pick up and we should continue to go much higher. However, if we break down below the 20 day EMA, then we could break down towards the previous downtrend line to find more support. In general, I think that the market will turn higher but there is obviously a lot of choppiness ahead.

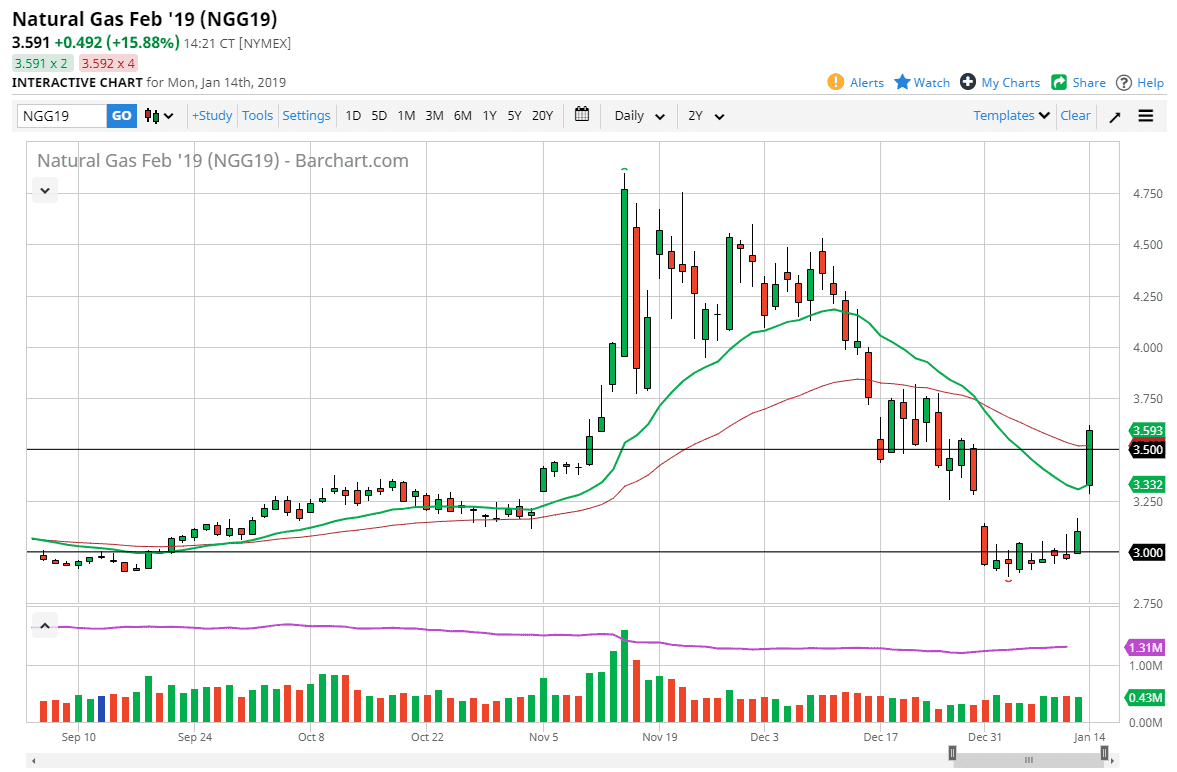

Natural Gas

Natural gas markets gapped higher to kick off the week and sliced through the $3.50 level quite stringently. We have clear the 50 day EMA, which under normal circumstances would be a very bullish sign. However, I recognize that this is in reaction to the cold snap in the United States and will more likely than not end up being sold off at the first signs of warmer temperatures. I suspect somewhere closer to the $3.75 level we will see sellers come back in, and I believe that an exhaustive daily candle is an invitation to start selling. We have a gap underneath that need to get filled, and I think it’s only a matter time before that happens.