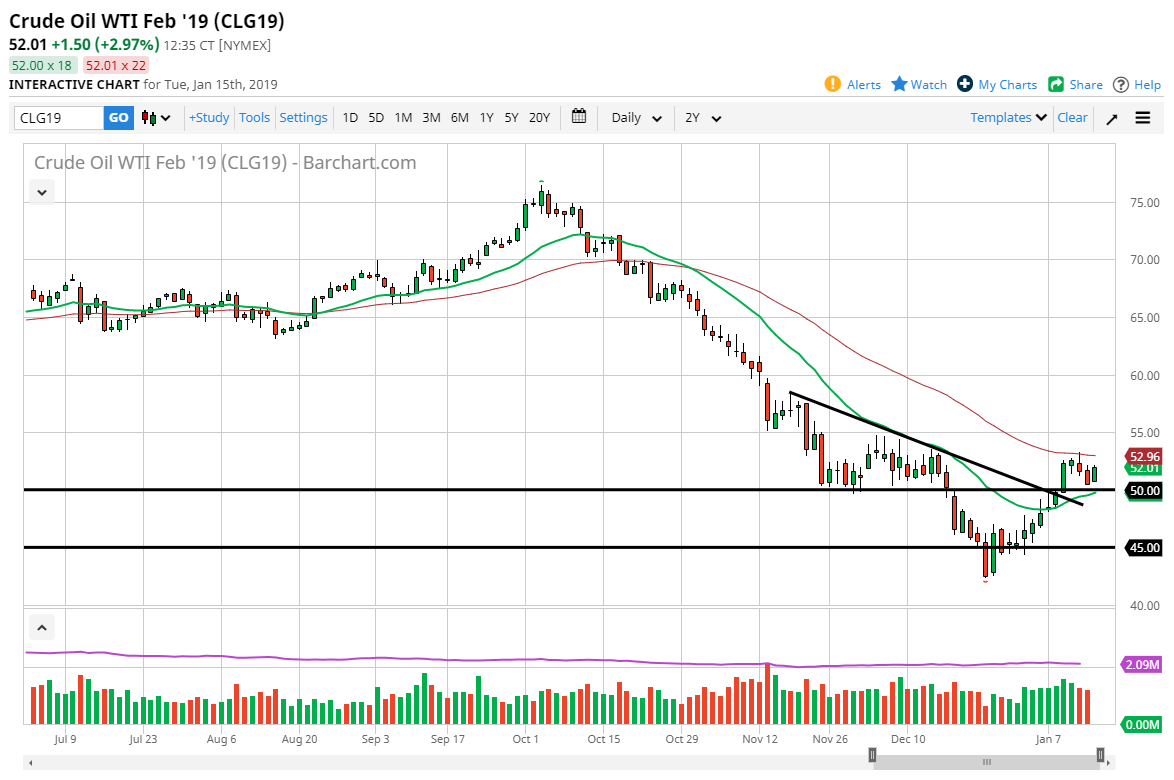

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Tuesday, as the $50 level continues to attract a lot of interest. However, there is a significant amount of resistance in the form of the 50 day EMA, pictured in red on the chart. I believe at this point it’s likely that we will continue to see a lot of volatility in the crude oil market, but it appears to me that the $50 level should offer quite a bit of bullish pressure. The fact that the 20 day EMA is starting to turn higher suggests that we could go higher as well. The if you give a little bit of artistic license, you can start to talk about a bullish flag that has formed as well. Overall, I believe that if we can break above the 50 day EMA, the market is likely to go towards the $55 handle, and then eventually the $57.50 level.

Natural Gas

Natural gas markets rallied a bit during the trading session initially on Tuesday but found enough resistance at the $3.75 level to turn things around and break towards the $3.50 level. If we can break down below that level, then it’s very likely that we could go down to fill the gap underneath. The oversupply of natural gas continues to be a major issue when it comes to this market, and the recent sharp rally of course has been due to the short-term cold snap that we have seen. At this point, I think that the market is more likely to fill that gap and reach towards the $3.00 level. I think it will take a bit of momentum building to get below the $3.00 level so look at this as an opportunity to start shorting from higher levels.