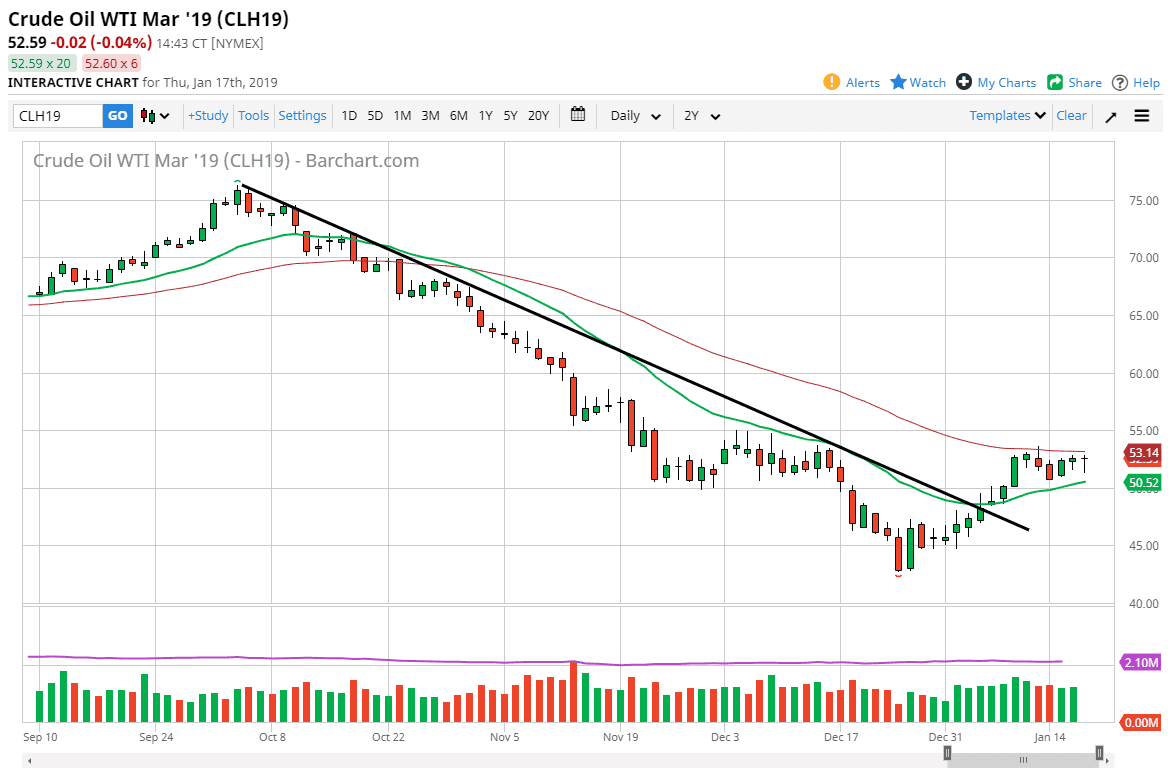

WTI Crude Oil

The WTI Crude Oil markets spent most of the day falling on Thursday after initially opening somewhat flat. However, we found enough support underneath the turn things around and form a bit of a hammer. We are currently trapped between two major moving averages, so I think at this point the best thing to do is to simply let the market break out before you put money to work. If we can get a clean and significant daily break above the 50 day EMA pictured in red just above, then you have a nice buying opportunity. At that point I would anticipate that the market will reach towards the $55 level, and then possibly the $57.50 level. Ultimately, if we get a significant break down below the 20 day EMA, pictured in green on the chart, then I think the market could go back to the $47.50 level to look for support. I do think that recent price action favors the buyers though.

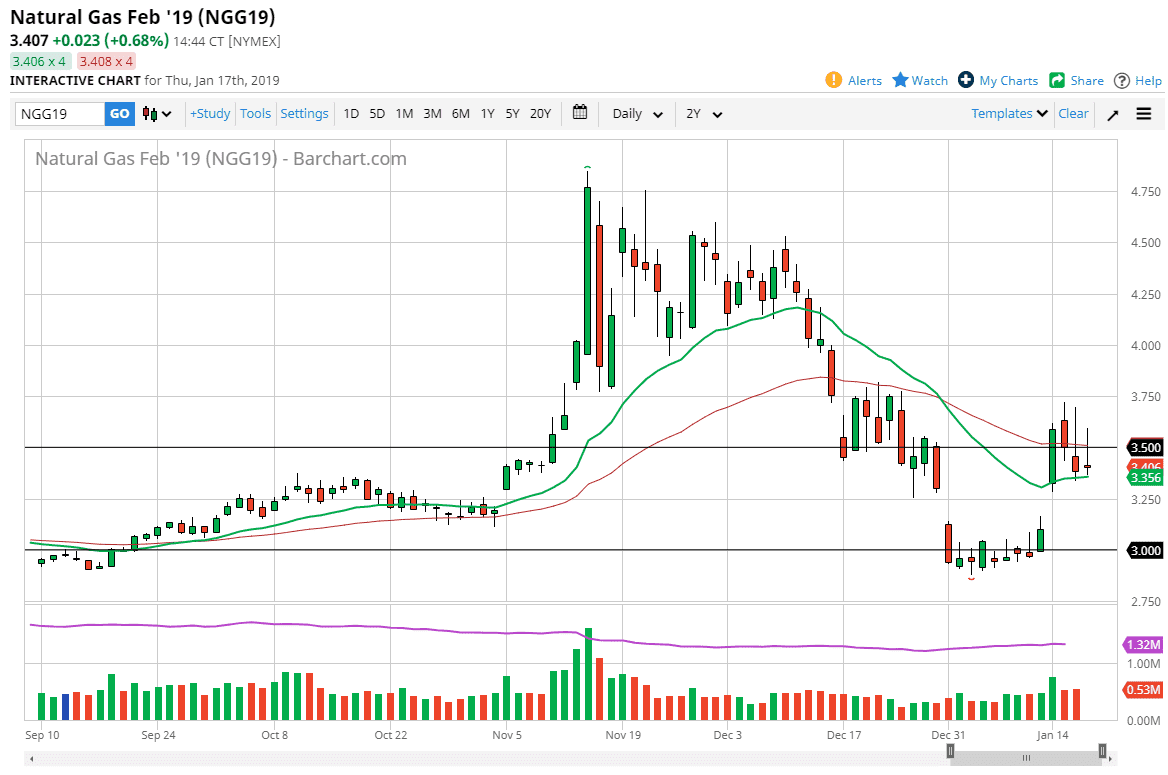

Natural Gas

Natural gas markets initially tried to rally during the day but gave back all of the gains to form a nasty looking candle stick again. The $3.50 level is offering significant resistance, and we are sitting just above the 20 day EMA. Because of this, I think we will then go down to the gap and reach towards the $3.10 level. I think there is significant support at the $3.00 level as well, so I think that the buyers will probably try to make a stand in that area. I still believe at this point; any time we rally you have to think about selling on signs of exhaustion as the oversupply of natural gas will continue to be a major issue.