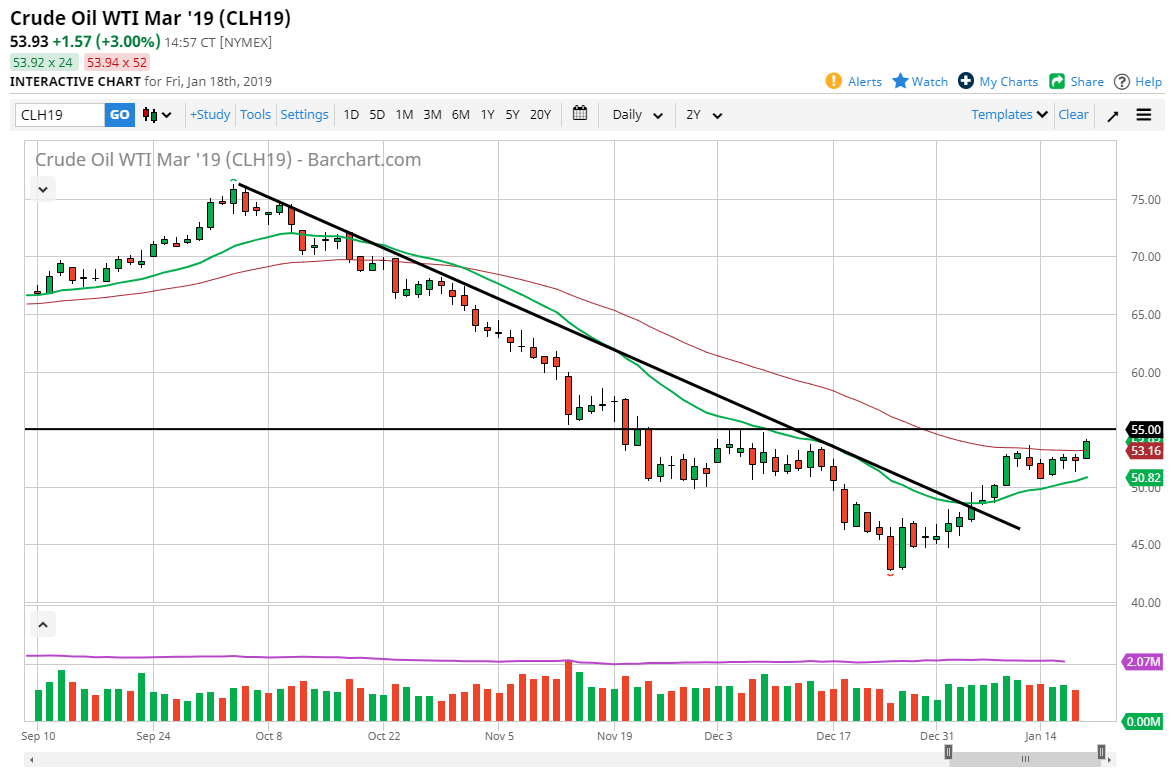

WTI Crude Oil

The WTI Crude Oil market broke higher during the trading session on Friday, slicing through the 50 day EMA which of course is a very bullish sign and could have Algo traders jump in. However, there is a lot of resistance in the form of the $55 level above so I think it’s going to take a certain amount of momentum to finally break above there. If you can clear that area, then you can really start moving towards the $57.50 level. At this point, I think that short-term pullbacks are going to continue to see buyers enter the market as we have decidedly broken higher. We have sliced through a major downtrend line, and now the major moving averages are starting to turn higher in the form of the green 20 day EMA and the red 50 day EMA.

Natural Gas

Natural gas markets have been all over the place as volatility continues to pick up. With the massive amount of swings in this market, it will continue to be very difficult to deal with, and you should keep in mind that there are a lot of concerns out there when it comes to an oversupply of the commodity. The natural gas markets will rally on weekly weather reports, especially in the northeastern part of the United States as it is the largest consumer of the commodity. I think at this point it’s very unlikely that the market will be able to go in one direction or the other for a longer-term move, but I also believe that rallies continues to be selling opportunities at the first signs of trouble. I am a seller of rallies that show signs of rolling over.