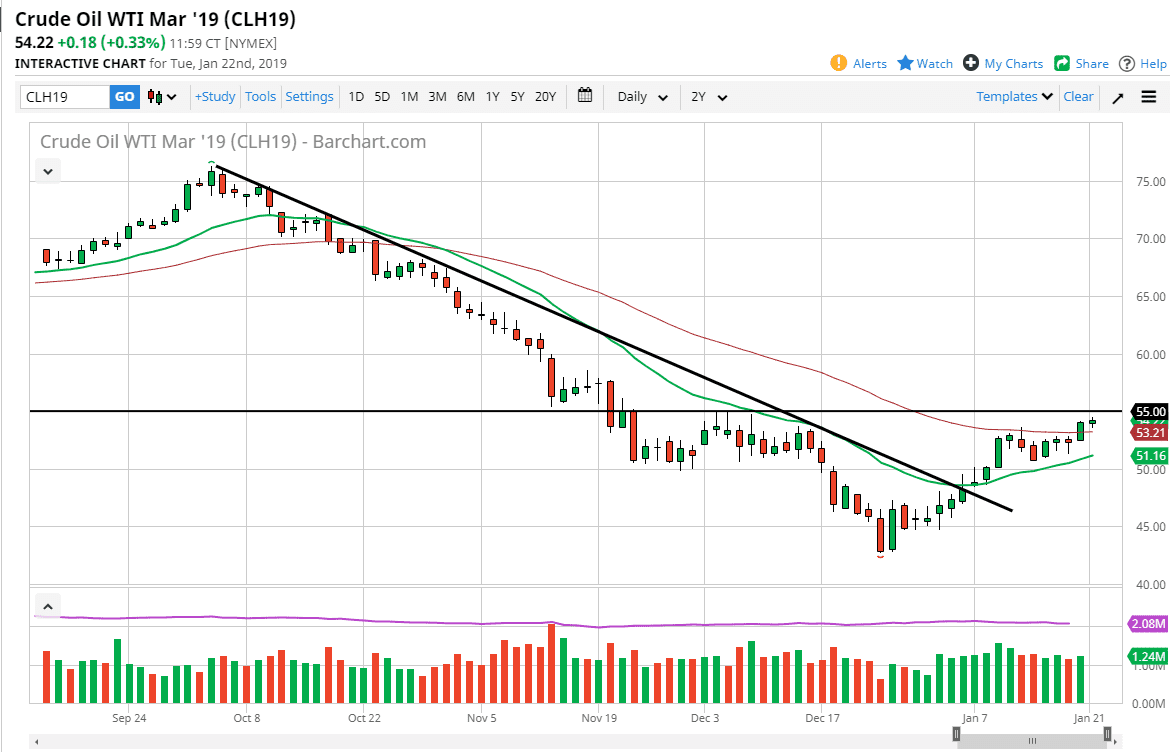

WTI Crude Oil

The WTI Crude Oil market rallied slightly during the trading session on Monday, hanging just below the $55 level. Overall, there is a lot of resistance there as you can see there have been shooting stars in this range previously. However, the Americans were away for Martin Luther King Junior holiday, which keeps volume a bit low. If we can break above the $55 level, that would be a very strong sign, and should send this market much higher. If we can break above the $55 level, I think we then grind towards the $57.50 level, and then perhaps the $60 level. Beyond that, it looks a lot like an inverted head and shoulders, which of course is a very positive sign. At this point, I think that the market will eventually break out considering we had smashed through a major downtrend line, the question is whether or not we can do it now, or if we have to pull back in order to build up the necessary momentum.

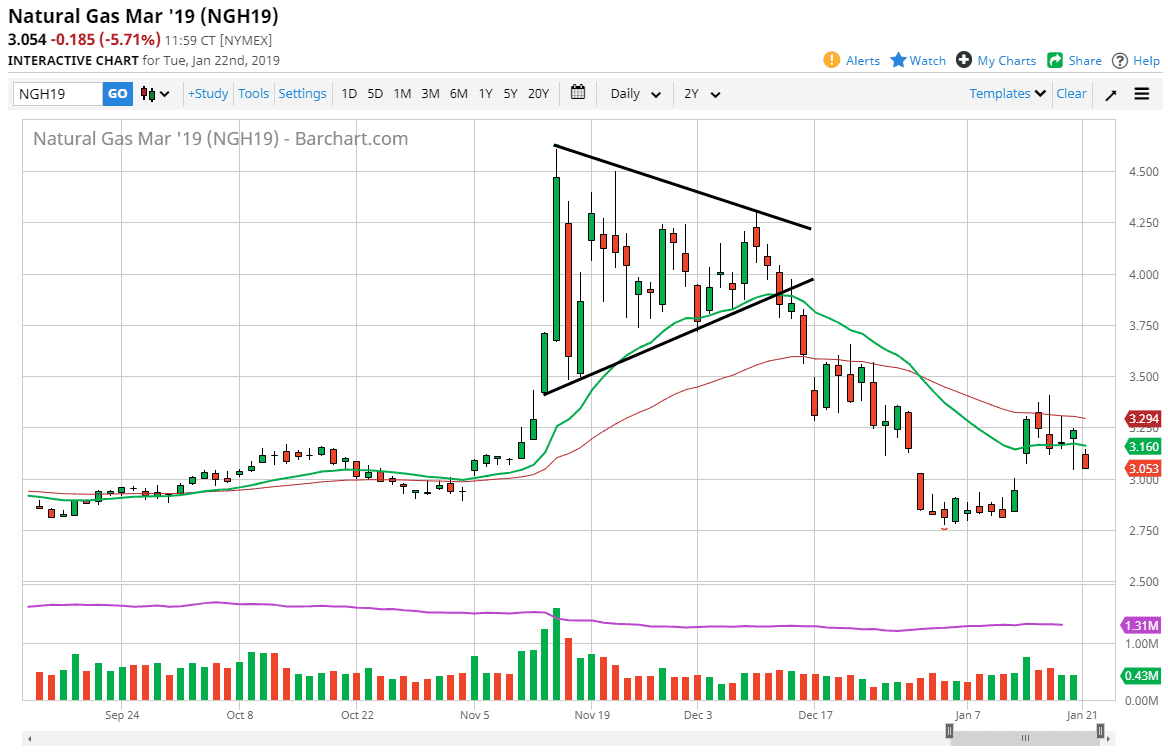

Natural Gas

Natural gas markets fell during the trading session, gapping lower and then simply falling towards the $3.05 level. At this point, the market looks as if it wants to fill the gap underneath, and I think that short-term rallies will continue to be sold as natural gas is oversupplied and of course we have seen a market that has been very battered as of late, so the rally should be a nice selling opportunity that we have had recently. The 20 day EMA is just above, so it should continue to cause pressure. I believe that the oversupply of natural gas will continue to be a major issue for this commodity.