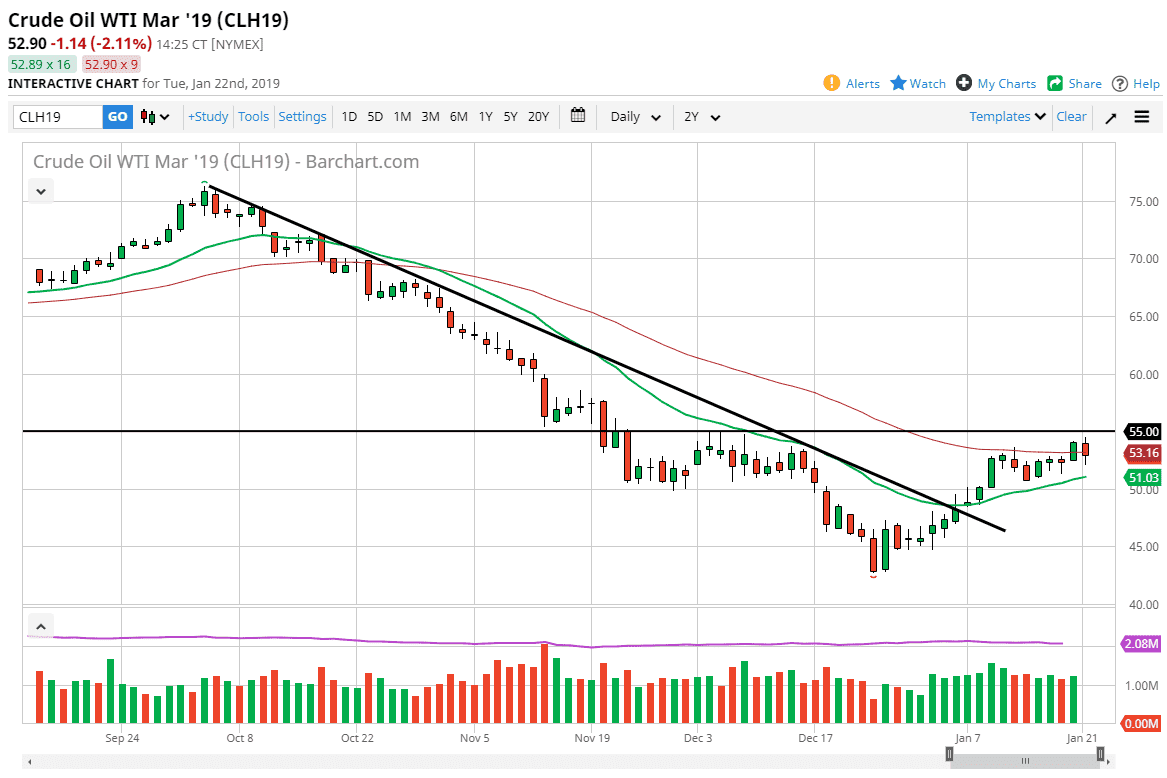

WTI Crude Oil

The WTI Crude Oil market pulled back during trading on Tuesday, reaching towards the 20 day EMA. However, later in the day we saw buyers come back into this market and it looks as if we are trying to find a bit of support so that we can turn around and break above the $55 level. I believe at this point it’s likely that we are going to break above there, but it may take some momentum building to do so. With that in mind I would anticipate that we will see a lot of back-and-forth but ultimately I do think that the buyers will take out the highs. The market could be forming a bit of an inverse head and shoulders, which could lead this market as high as $67.50 based upon the measurement. Once we get a daily close above the $55 level, I think it will bring in a lot of fresh money.

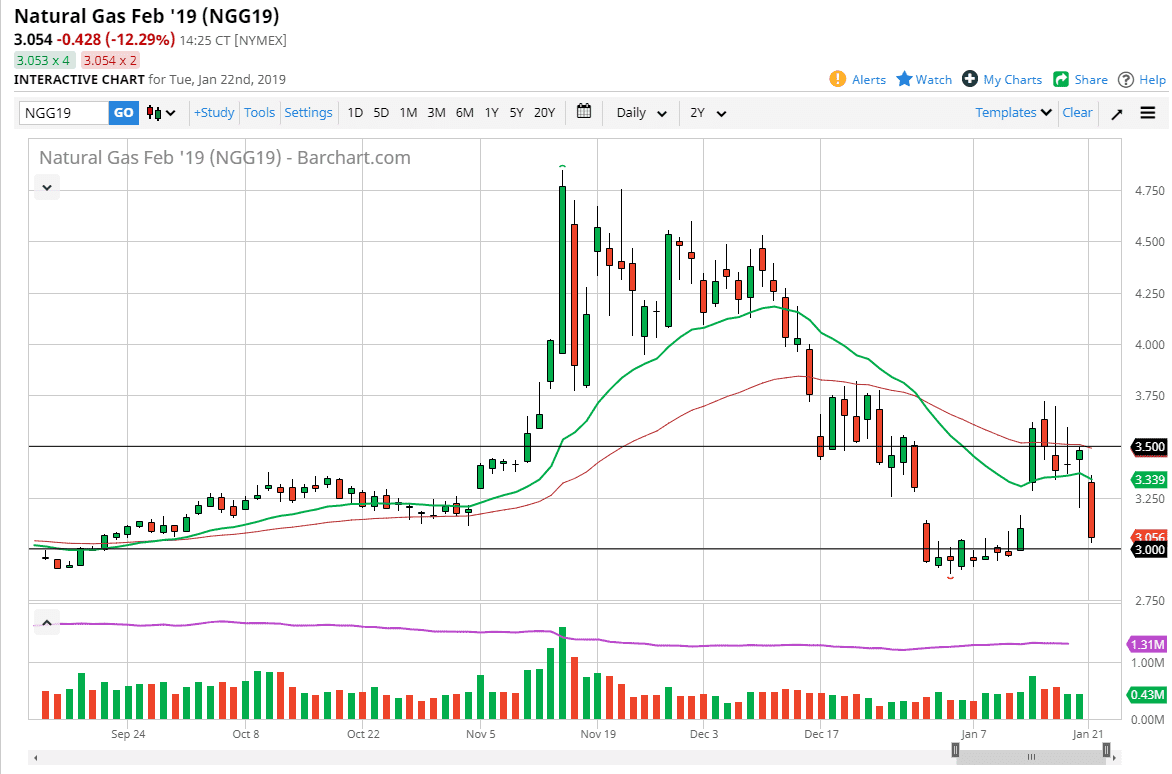

Natural Gas

Natural gas markets gapped lower to kick off the Tuesday session and then collapsed. As we reached towards the $3.00 level, we started to see a bit of support. That being the case, I think it’s likely that we will continue to see a lot of support in this area so I would not be surprised at all to see a bit of a bounce. I think there is a lot of support down to the $2.80 level, so ultimately we should see buyers coming back in to pick this market back up and reach towards the $3.35 level above, the top of the gap. I think anytime we see rallies in this market which be looking for an opportunity to start shorting again. Signs of exhaustion near the $3.50 level would be an excellent place to start selling.