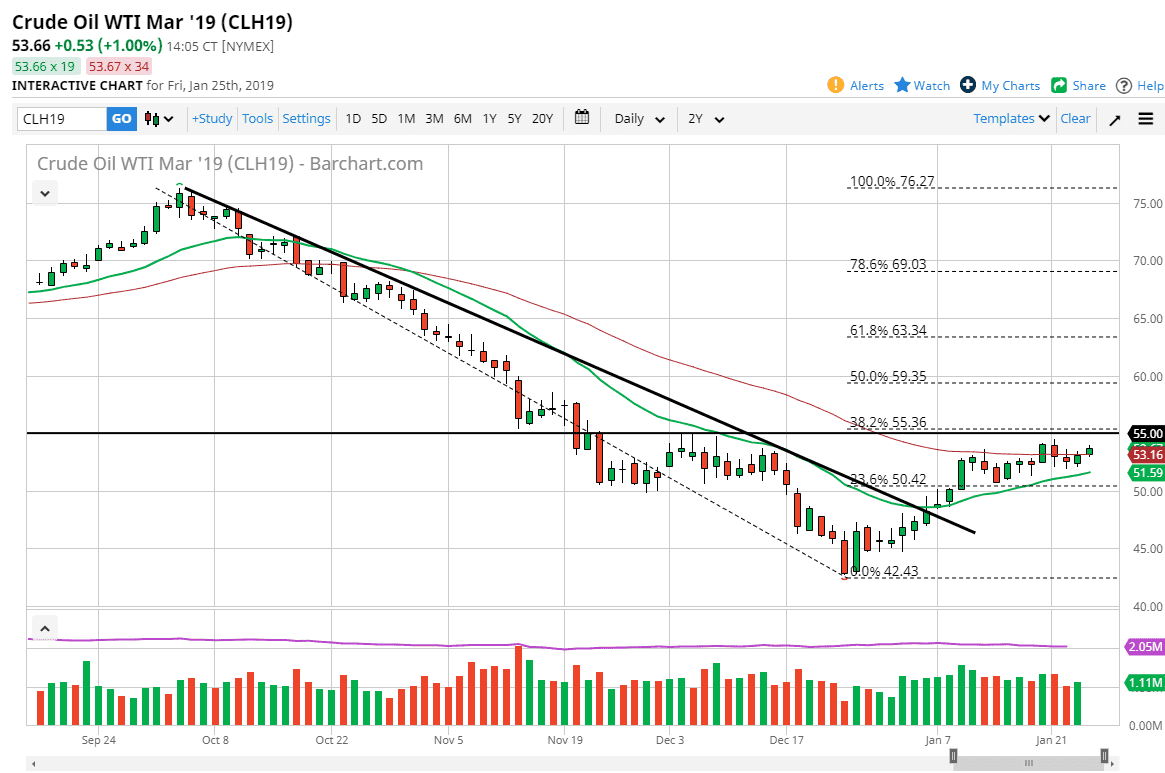

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday, but we are still below major resistance. At this point, the market is still going sideways, as the $55 level above continues to offer major resistance. If we can break above that, it would be an inverse head and shoulders kicking off, and then we could go higher. The $57.50 level above is the initial target, but I believe that we go much higher than that. The $50 level underneath is massive support, so I think that pullbacks will continue to be bought. Once we break out though, I think that we would see this market take off to the upside rather quickly. This is a market that seems as if it is trying to build up enough momentum to finally go higher, so when we do finally get the push to the upside it will be obvious. I have no interest in shorting this market.

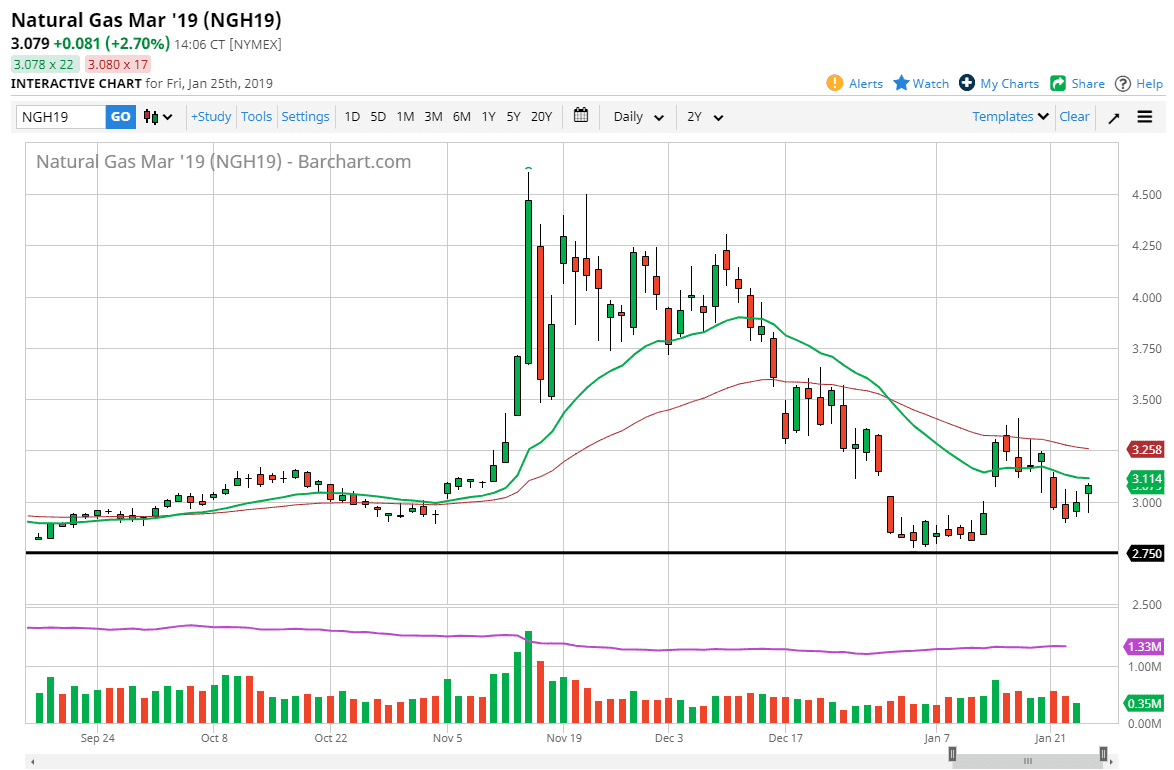

Natural Gas

Natural gas markets gapped higher during the open on Friday, pulled back to test support, and then turned around of form a hammer. This is a bullish sign obviously, but at this point I think there is plenty of resistance above to keep this market down. The 50 day EMA above, pictured in red, I think is a selling opportunity. The $3.25 level is significant resistance, but even if we broke above there I think the $3.50 level is difficult as well. If you go to the upside now, we should see an exhaustive candle that you can take advantage of and start shorting due to the oversupply that we have in this market. The $2.75 level underneath continues offer massive support though. Short-term rallies will offer short-term selling opportunities.