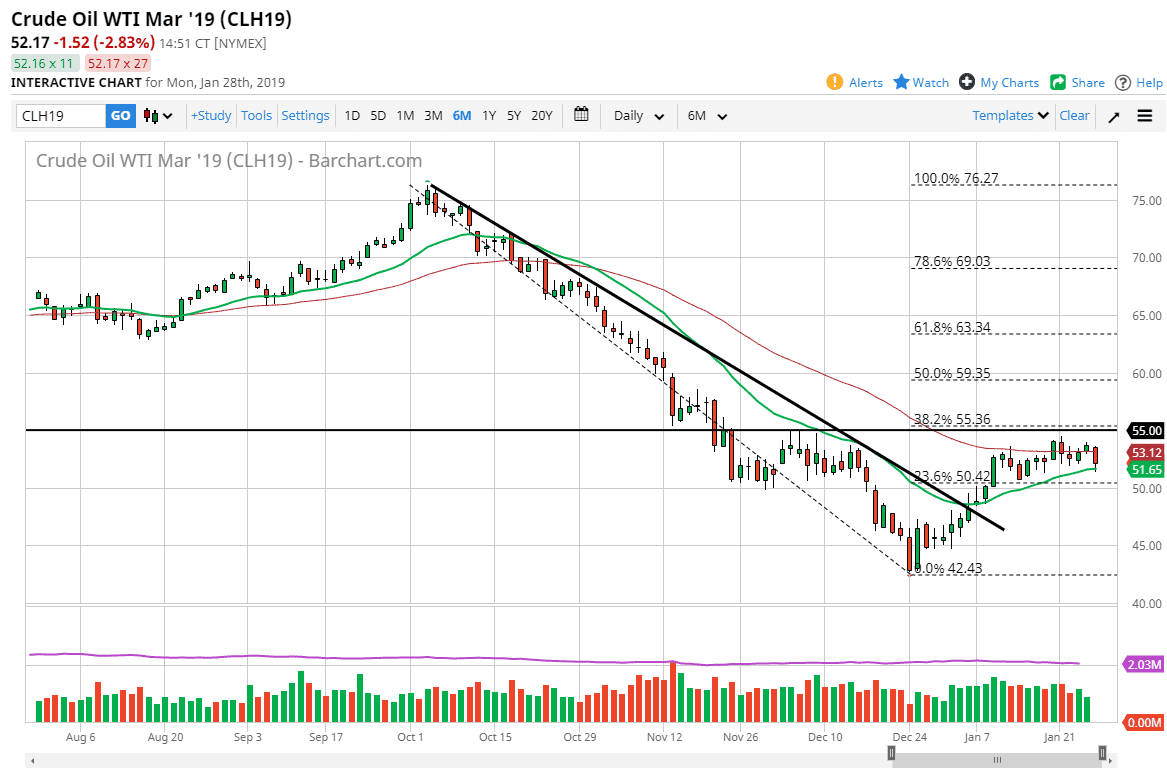

WTI Crude Oil

The WTI Crude Oil market fell during most of the trading session on Monday as we continue to see a lot of volatility in the petroleum markets. However, we did see a significant support towards the end of the day near the 20 day EMA. The 50 day EMA is slicing right through the middle of the candle stick, and right now it looks as if we are continuing to see a bit of consolidation, so the question is whether or not we can build up momentum to the upside? If we can clear the $55 level, then the market is free to go much higher. However, I do not expect to see that happen between now and the jobs number on Friday. I think that we will get a lot of noise between now and then based upon various announcements, but I do think there is a proclivity to go to the upside given enough time. We are simply momentum building in the short term.

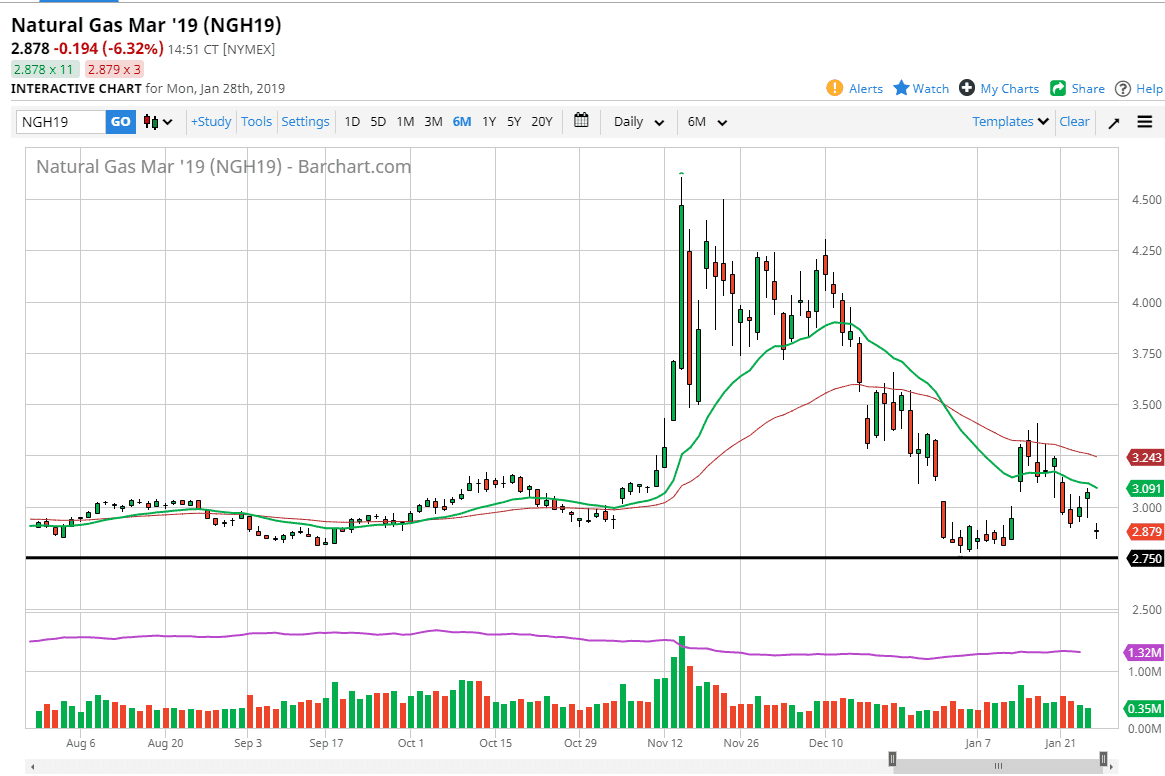

Natural Gas

Natural gas markets gapped lower during the open on Monday, then essentially went nowhere. I think the gap will get filled, so I suspect that the short term movement is probably to the upside. However, I still believe that the easiest trade in this market is to simply sell on signs of exhaustion above. I think at this point, selling is all but impossible, and I would be surprised to see this market break down below the $2.75 level in the short term. I think that is massive support, but I do believe in the downtrend overall as we have plenty of reason to think that the natural gas markets will continue to be plagued by oversupply.