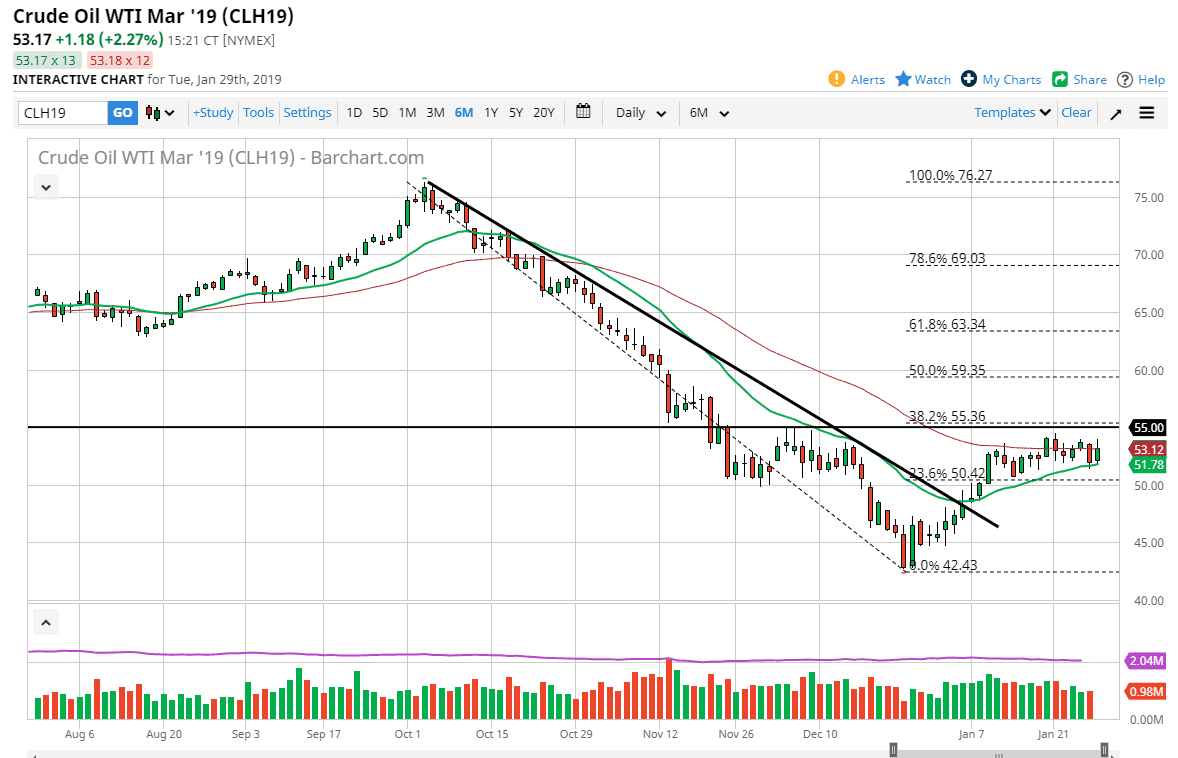

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Tuesday as we continue to grind sideways overall. With the next three days being so important, I don’t think that were going to see much in the way of conviction directly. We have the FOMC Meeting and press conference on Wednesday, then we have the usual inventories report on Thursday, followed by the jobs number on Friday. I think the market is trying to digest a lot of information at once, and therefore it makes sense that we will continue to be very volatile. Short-term range bound trading strategies have worked quite well, but I would be the first to say that it seems as if the bias is most certainly starting to drift to the upside. If we can clear the $55 level that kicks off an inverse head and shoulders that should have this market looking for a couple of dollars right away.

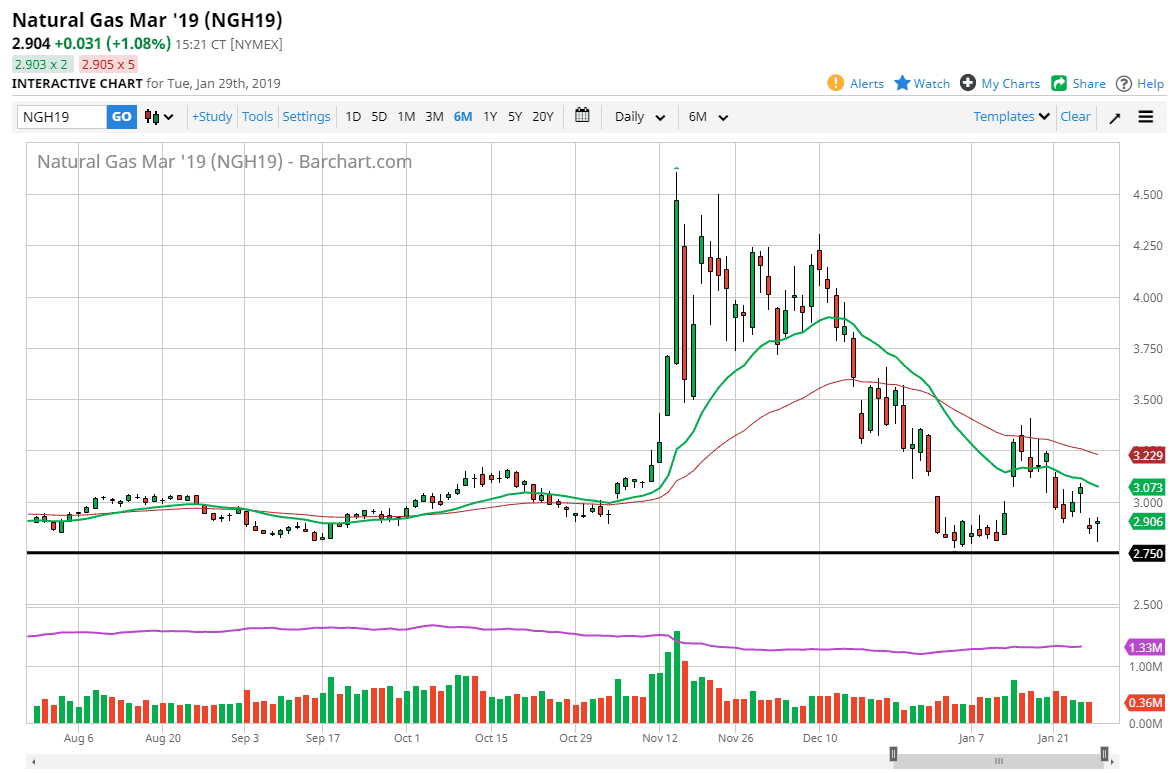

Natural Gas

Natural gas had an interesting day, falling significantly only to turn around and form a hammer. This makes a lot of sense considering that there is massive support at the $2.75 level, which is an area that has been tested several times. Ultimately, I think that the market is using the $2.75 level as a bit of a “floor”, and it will be difficult to break down through there. The hammer that we formed for the day certainly seems to solidify that thought process. I believe that waiting for rallies that show signs of exhaustion will be the best way to trade this market, as it is most certainly bearish but we are at such a major support level’s going to be difficult to break through it. If we did, the market is going to scream down to the $2.50 level.