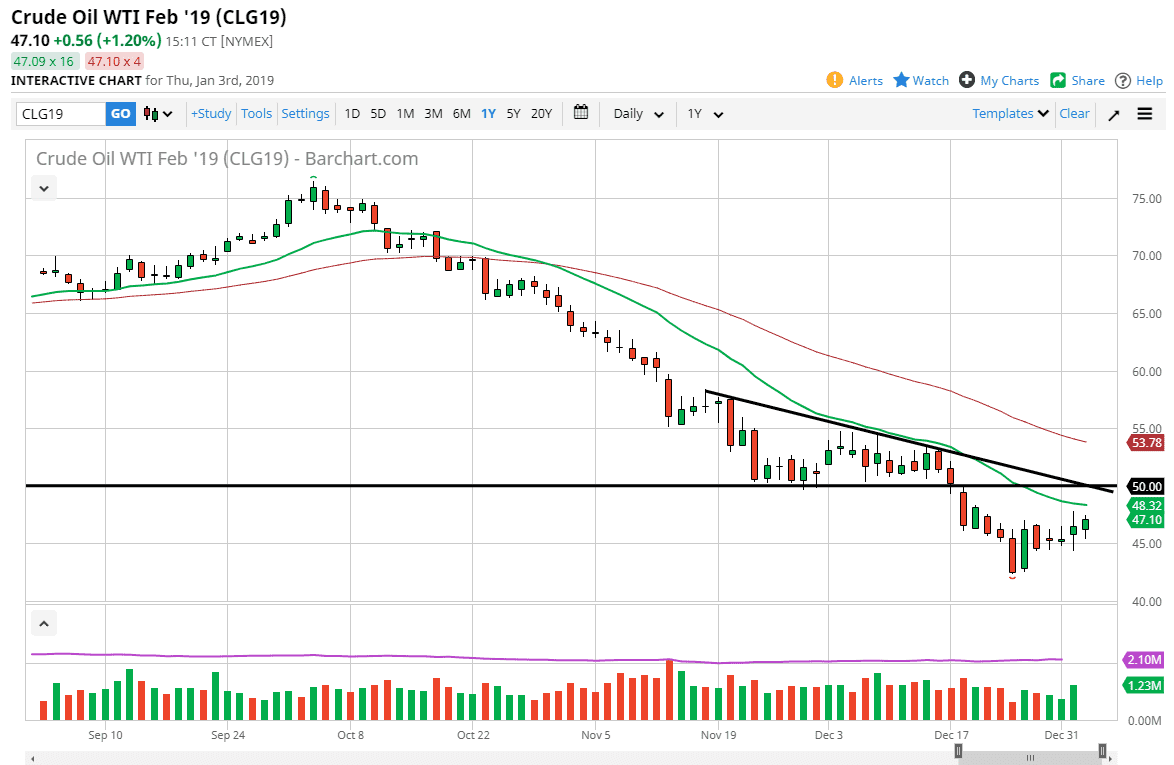

WTI Crude Oil

The WTI Crude Oil market initially pulled back a bit during the trading session on Thursday but did show some signs of life. The 20 day EMA fell significantly over the last several days, and we are now approaching it, so we should see a bit of resistance. The downtrend line of course should also offer resistance, as will the $50 level offer resistance. Because of this, I believe that this market will show a nice selling opportunity given enough time, so look for signs of exhaustion that you can fade. If we do break above the $50 level, then we may be on to something to the upside. However, I believe that the bearish pressure isn’t quite ready to give up yet, so I think that concerns about global growth will continue to weigh upon this market.

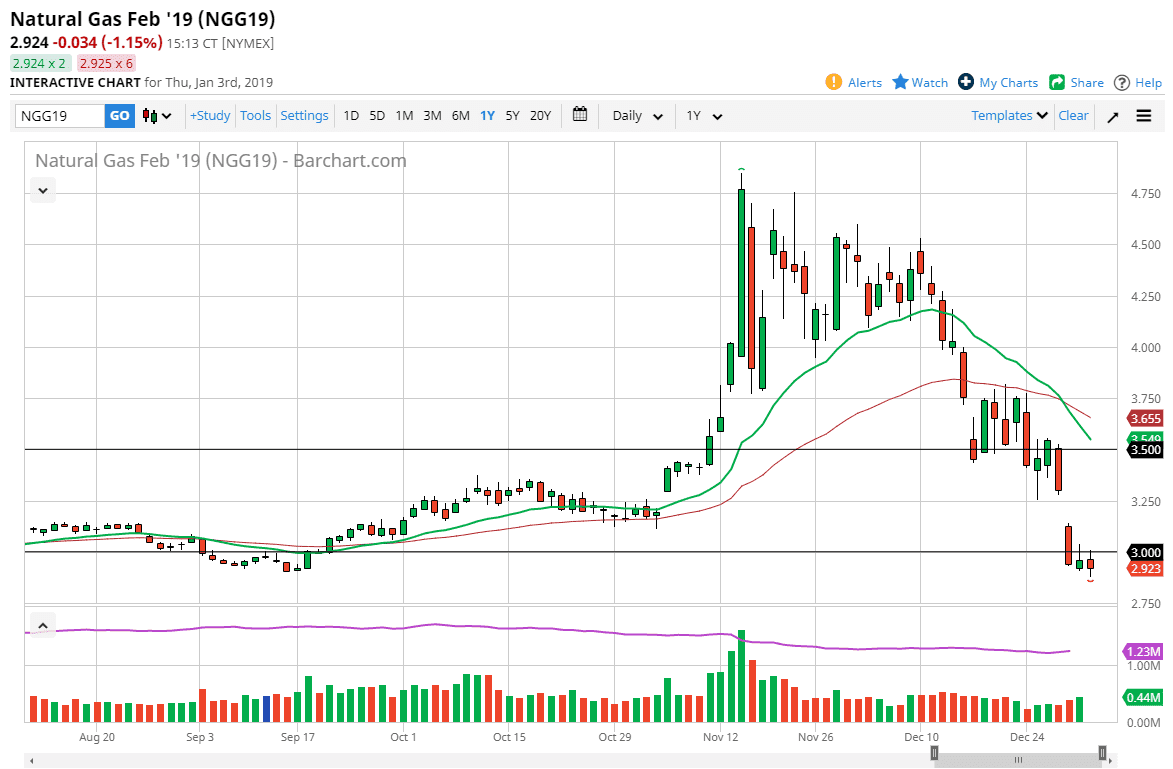

Natural Gas

Natural gas markets went back and forth during the trading session on Thursday, just below the $3.00 level. The market is a bit overdone at this point though, so I think that if we can break above the candle stick from the Wednesday session, we may go looking to fill the gap above, which sends this market towards the $3.27 level. I’m looking for some type of exhaustion in that area to start selling though, as the natural gas market is so very negative. I got no interest in buying this market, the fundamentals are not good for this commodity, and of course if the global economic situation is starting to slow down as well, that is pretty negative for demand. There is more than enough supply out there to keep this market down, so quite frankly I think it’s only a matter of time before the sellers come back.