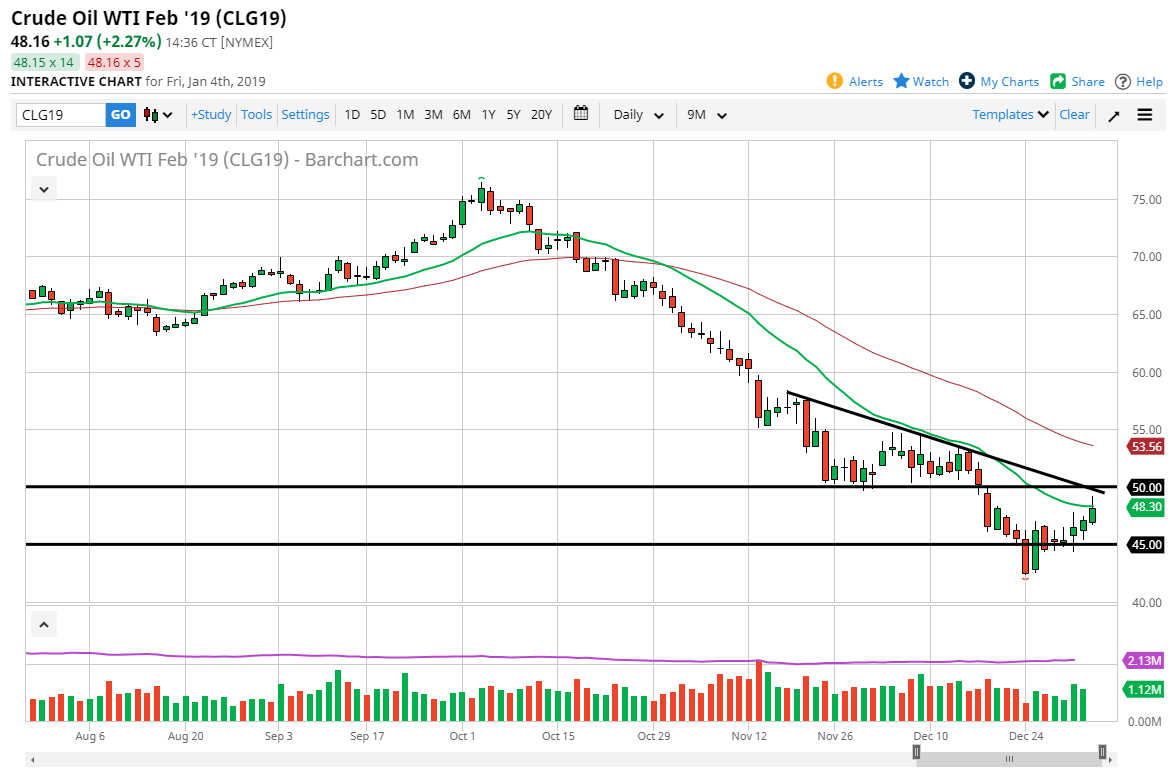

WTI Crude Oil

The WTI Crude Oil market has rallied significantly during trading on Friday after a stronger than anticipated jobs number out of the United States. This signifies that perhaps there could be more demand, and then the fact that Jerome Powell suggested that the Federal Reserve was in fact watching market suggests to traders that there may be a bit of a “Fed put” built into the stock markets, which had everybody buying risk assets. However, when you look at this chart you can see that there is clearly a downtrend line near the $50 level, so I think that any rally at this point is probably going to struggle in that area and I think that sellers will come back in and jump in that market. If we do break the $50 level, then we could go as high as the 50 day EMA, currently at $53.57 above.

Natural Gas

Natural gas rallied during the day as well, showing signs of life just below the three dollars level. Because of this, the market looks as if it is trying to form a bit of a base, and I think we could rally from here, perhaps reaching to fill the gap above, near the $3.30 level. I suspect that it is only a matter of time before it happens, so I’m looking to sell this market on that rally that certainly seems to be needed. After all, we are oversold and I think that punishing rallies will probably be the way this market behaves, especially considering that the winter has been much warmer than anticipated in the United States. With crude oil being cheap, that means there is an alternative source of energy that corporation can use as well.