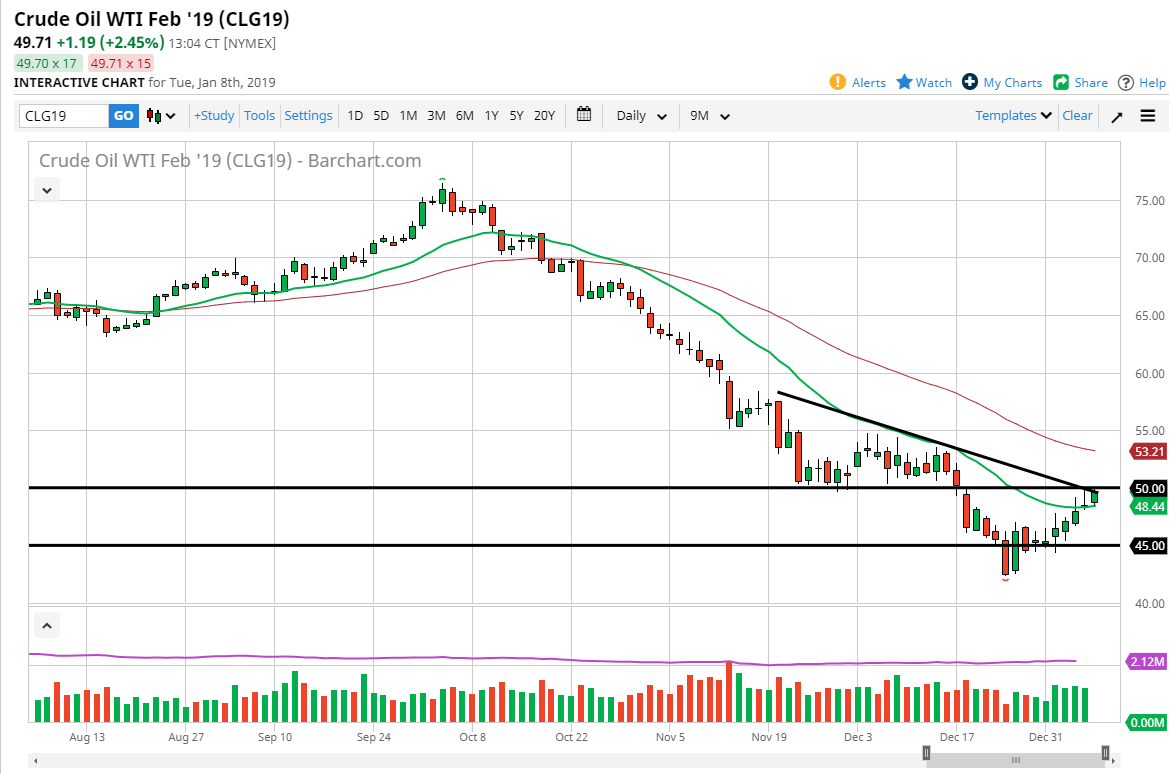

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Tuesday, slamming into the $50 level. That’s an area that should be interesting, as we not only have a large round number two pay attention to, but we also have the downtrend line that is very much intact. I think the next 24 hours a going to be crucial for the WTI Crude Oil market, so if we get a daily close above the $50 handle, I think that would be a very bullish sign. I expect the next day or so to be very difficult, so by all means make sure that you get a daily close to take a position on, as things will probably only continue to be very noisy in the process. The US dollar falling could help as well, so will have to wait and see if that happens.

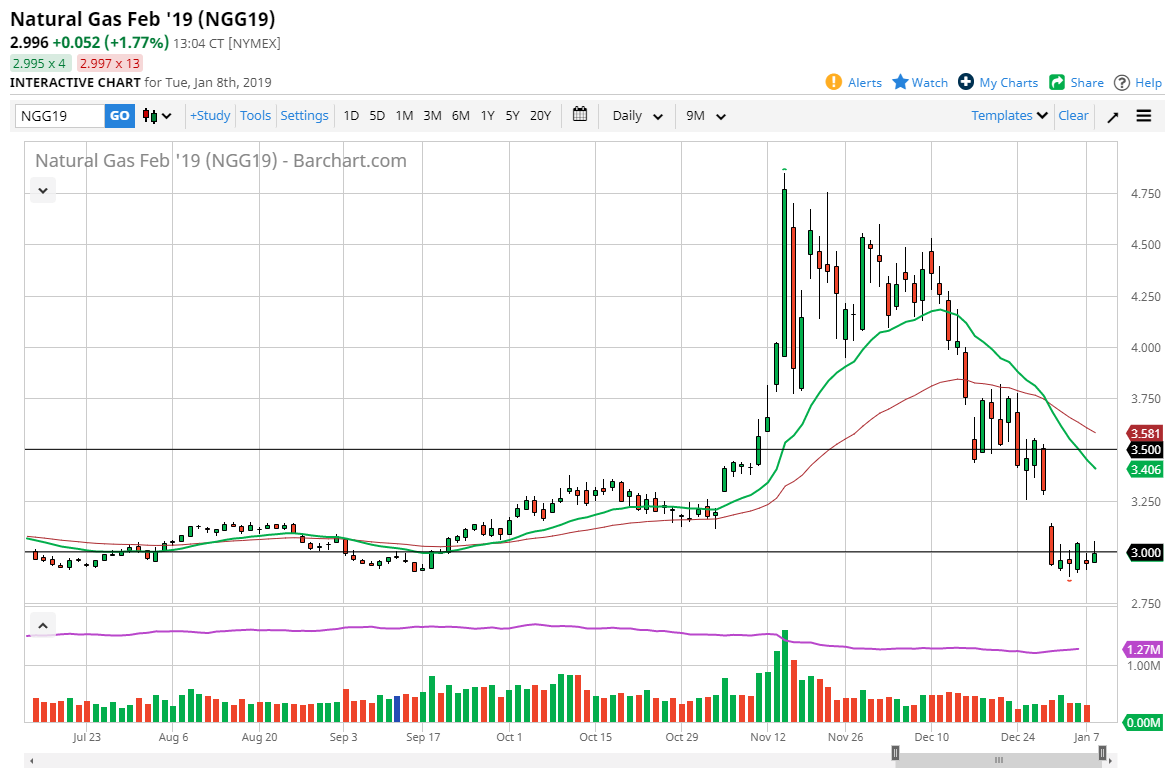

Natural Gas

Natural gas markets tried to rally during the day on Tuesday but continue to find resistance above the $3.00 level. By finding that resistance, we turned around of form an exhaustive looking candle but I still think that we need to rally from here and fill the gap above before we can start shorting. True, we could continue to go lower and perhaps even as low as the $2.50 level but I think at this point in time the risk/reward ratio just isn’t there. On a rally towards the $3.30 level and on signs of exhaustion, I would be more than willing to short this market. I like the idea of fading rallies that show signs of exhaustion, and I do believe that the oversupply of natural gas will continue to be a major issue long term.