BTC/USD

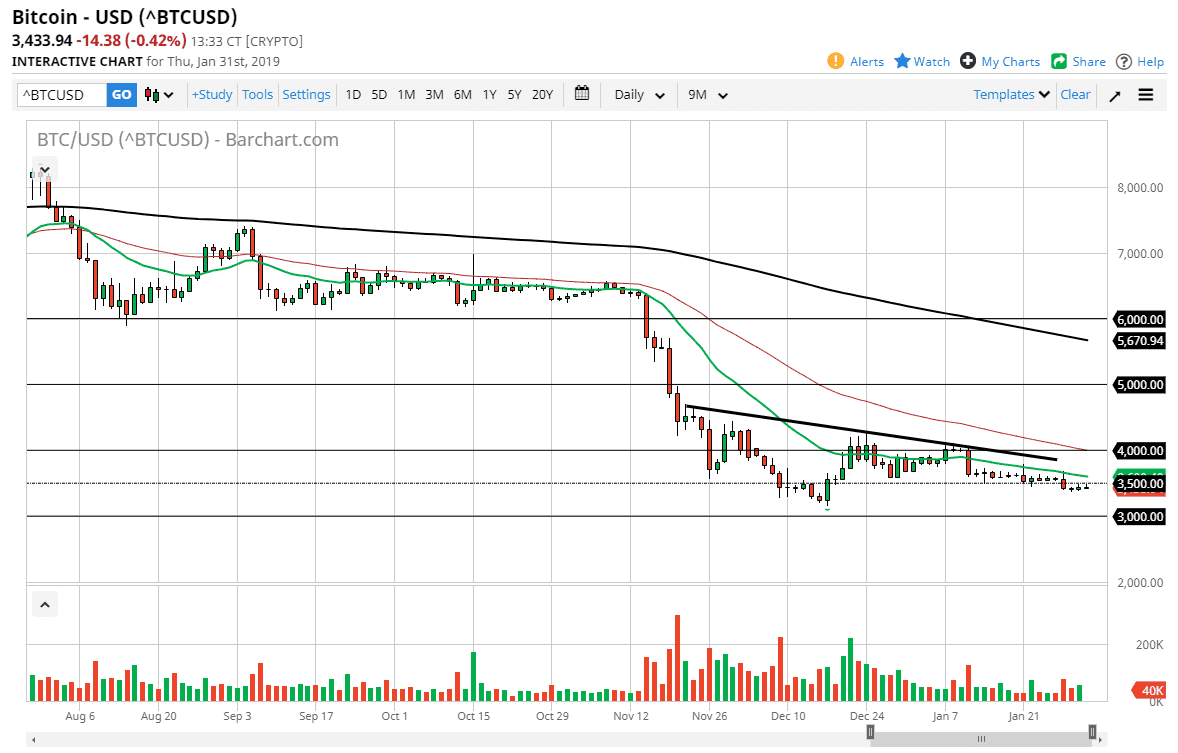

Bitcoin initially tried to rally during the trading session on Thursday again, but as we have seen several times now, sellers come in to squash these rallies. The 20 day EMA, pictured in green on the chart is slanted lower now, so I do think that we continue to grind lower. I’m not looking for some type of major break down, I think it simply suggests that the market will continue to fade rallies. If we can break above the 20 day EMA, then the market will test the downtrend line above. Beyond that, we have the $4000 level and the 50 day EMA to keep the market down. Ultimately, this is a market that did not get a lift from the US dollar falling drastically during the trading session on Wednesday, so it’s no surprise that we simply cannot hang onto gains at all.

Looking at the chart, I can make an argument for $3500 being resistance now, so as we continue to fall every time we reach towards that area, I suggest that we are probably going to go looking towards the three $100 level initially, followed by the $3000 level which of course will cause a lot of support based upon psychological importance. A breakdown below that level should send this market much lower. If that happens, I would anticipate a move to the $2500 level, which is important based upon longer-term charts.

Ultimately, I don’t see a scenario in which it’s worth risking buying Bitcoin right now, because just can’t hold its own. If what most people say about Bitcoin from the bullish side comes true, then waiting for a move above the $4000 level isn’t giving that much back, and therefore isn’t that much to ask. Being patient about going long of this market is crucial. In the meantime, phage short-term rallies.