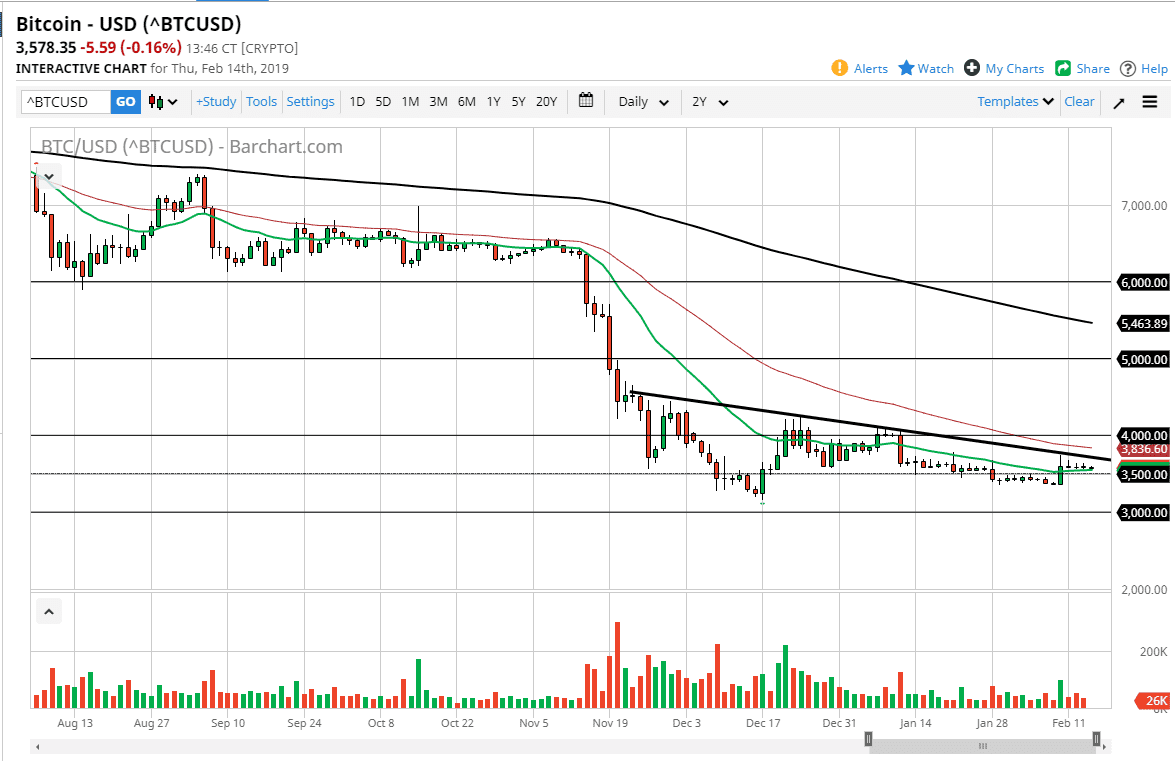

BTC/USD

Bitcoin markets did very little during the trading session on Thursday, as we continue to go sideways as the 20 day EMA level. This is a very important moving average for this chart, as it has been very predictive of where the market is heading. Currently, the 20 day EMA is sitting right at the 3500 level, an area that of course will attract certain amount of attention. The EMA is flat now, so that tells me that this market is going back to sleep.

If you look back at the last six weeks or so, this market has all but died. The volume has dried up, and we just continue to go sideways. Ironically, this might be a really good sign for the buyers longer term. That doesn’t mean that were going to go higher from here, but really at this point what the market needs is to get rid of most of the “hot money”, which I think it already has for the most part, but now it needs to keep people bored enough to get them looking in the other direction. This is a classic example of money chasing the trade in the past. Do you remember at the end of 2017 when Bitcoin was going to make everybody billionaires? It seems like a decade ago, doesn’t it?

The real money during that move was made at extraordinarily low levels. The smart money got out towards the top. That being said, I think Bitcoin is going to be very difficult to trade for quite some time, because although I would sell rallies at this point, I eventually the tide will turn. Once it does, we are probably looking at a multiyear process. However, that would leave the diehards in the market, which is exactly what it needs at this point. In the short term, sell rallies as it continues to work with the downtrend line just above, and of course the 50 day EMA as well as the $4000 handle. $3000 below should be supported.