BTC/USD

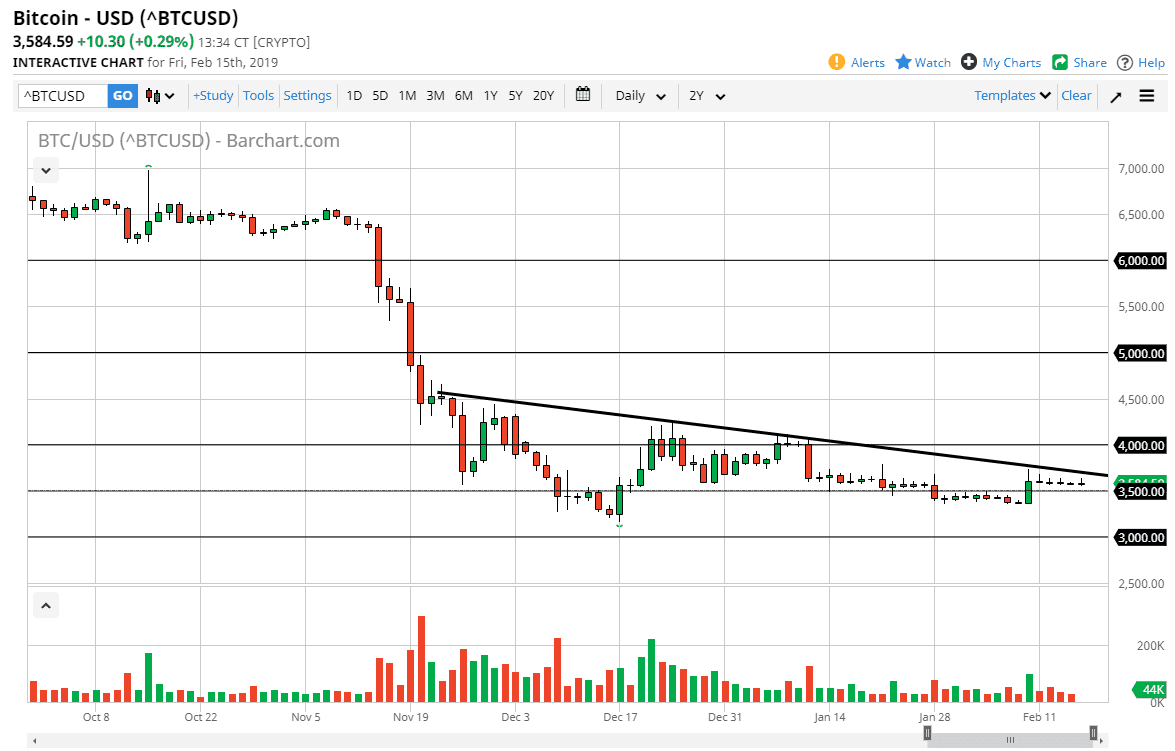

Bitcoin markets rallied initially during the trading session on Friday but gave back the gains yet again. As you can see, the market is essentially going nowhere and the volume is drying up. This is not good sign for a rally, as we have a downtrend line just above that should continue to put bearish pressure on the crypto currency. There’s nothing to suggest that we are about to see an explosive move to the upside so I think anytime you get the outlying candle like we had a few days ago, it should be thought of as a selling opportunity and what has been extraordinarily reliable downtrend.

I believe that the market will probably continue to have short-term rallies but offer selling opportunities. Unfortunately, most retail brokerages won’t offer the ability to trade this type of action because of the spread, which of course is going to be very large. However, if you have the ability to trade in a relatively tight CFD market, then you could possibly trade this market, otherwise you are waiting for some type of rally that you can fade or some type of move that shows extreme negativity, perhaps if they can break down below the $3500 level. If that’s the case, the market could probably drop down to the $3100 level, which was where the most recent rally came from. However, if we break above the downtrend line we could go as high as the $4000 level, which I would be more than willing to sell from at the first signs of exhaustion.

Overall, I don’t have a plan to buy Bitcoin anytime soon, because I think that the market has shown us that we either are going lower or going to go sideways. There’s no proclivity to go higher for any length of time.