BTC/USD

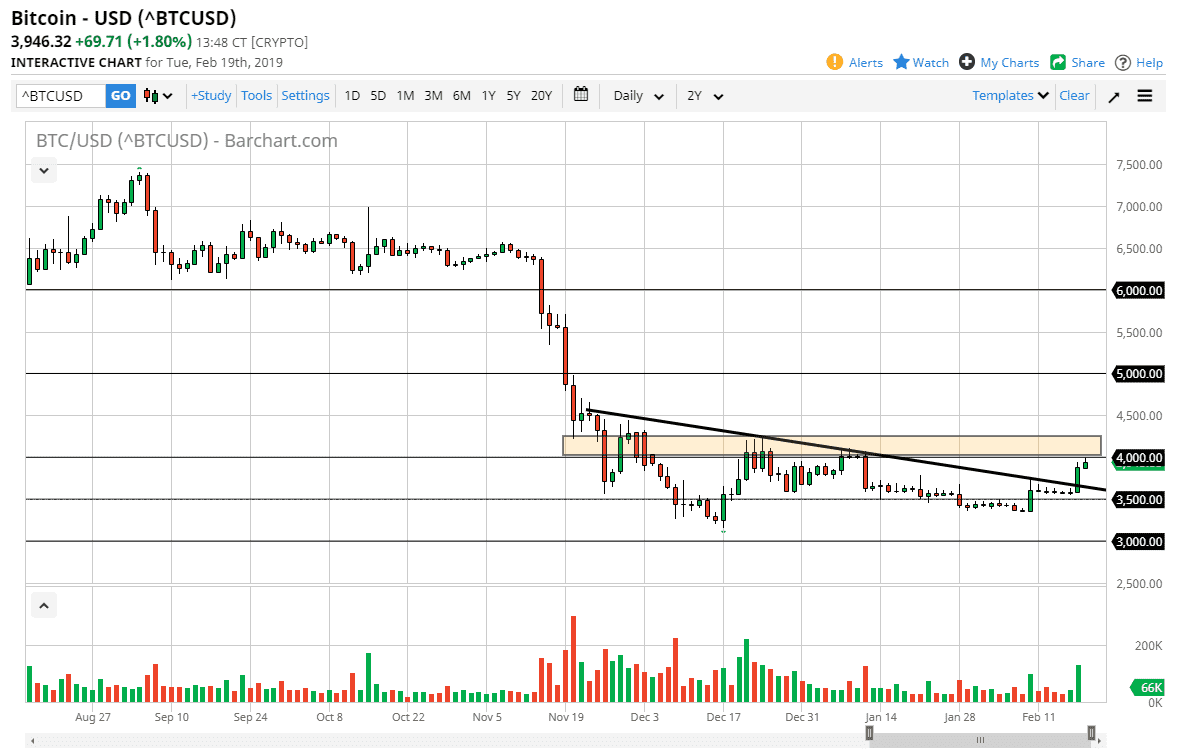

The bitcoin market rallied a bit during the trading session on Tuesday, matching the attitude of the Monday session as well. We find ourselves near the $4000 level, which of course is a good sign in and of itself, but this is an area where I would expect to see a lot of selling pressure. Although we have broken above a downtrend line, which is a good sign, we also have to worry about the psychologically important $4000 handle, which of course is also an area where we’ve seen selling in the past.

With that being the case, I think signs of exhaustion would probably be selling opportunities, and I think it’s not until we break above the triple top at the $4250 level that formed along the downtrend line that I think we have the momentum to go a little bit higher. I believe that one of the main drivers of this market to the upside probably is the weakness in the US dollar itself. However, that doesn’t necessarily translate into higher crypto currency pricing, so overall I’m looking for exhaustion before getting involved.

As for the bullish case, if we can break above the $4250 level, then I think we could go a bit higher. At this point though, we are starting to pull back a bit from the $4000 level, so overall I think that there are still plenty of sellers out there to jump in and punish this market. Underneath, there is obviously a bit of a supportive area around the $3500 level as we had seen a bit of a shell form. I don’t know if we break down below there easily, but we have seen this market rally previously, only to turn right back around. Obviously, the volume would be a bit of a concern at this point as well.