BTC/USD

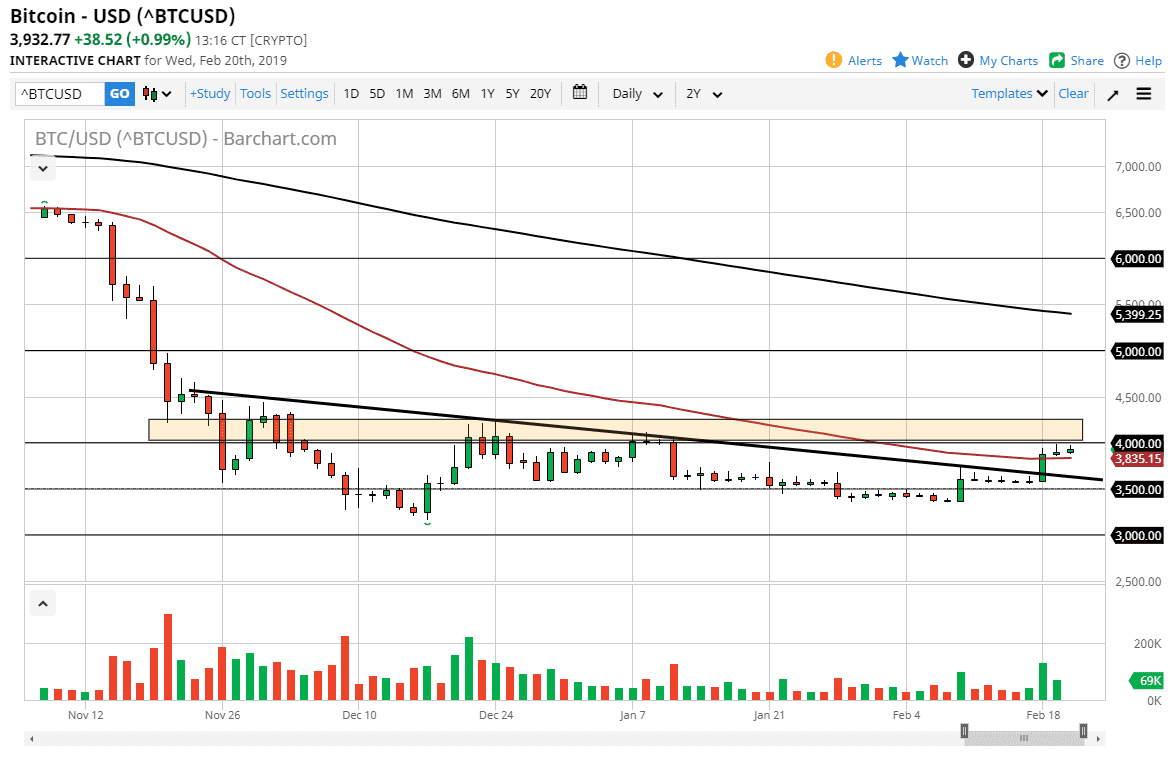

Bitcoin rallied a bit during the trading session on Wednesday, as the US dollar got hit. However, we gained just enough to test major resistance and have pulled back from that same place again on Wednesday that had because so many problems on Tuesday. With this in mind, the analysis will be very similar, but it looks as if there is a lot to think about in this area, as I will layout the case for both directions.

Looking at the $4000 handle, you can see that it is important overall, as it has caused a significant amount of selling pressure on Tuesday. It was also the scene of the latest large red candle, so it makes sense that there is probably a bit of selling pressure there. Overall, it’s also a large, round, psychologically significant figure, so it makes sense that there will be sellers there waiting to push this market lower, which of course makes even more sense considering that it is in a longer-term downtrend over the last 15 months or so.

On the positive side, the 50 day EMA is starting to turn higher, and the last couple of candles that have had decent volume have both been positive. It will be interesting to see how this plays out from here, as I think we have a lot of competing pressures, and therefore I think the one thing that you can probably count on is that we are going to see a lot of choppiness.

Looking at this chart, if we can break above the $4200 level I believe that Bitcoin can continue to go higher, perhaps reaching towards the $5000 level after that. In general, I am negative on Bitcoin, but the technical analysis has changed a bit over the last couple of sessions. We are at a very interesting area to say the least.