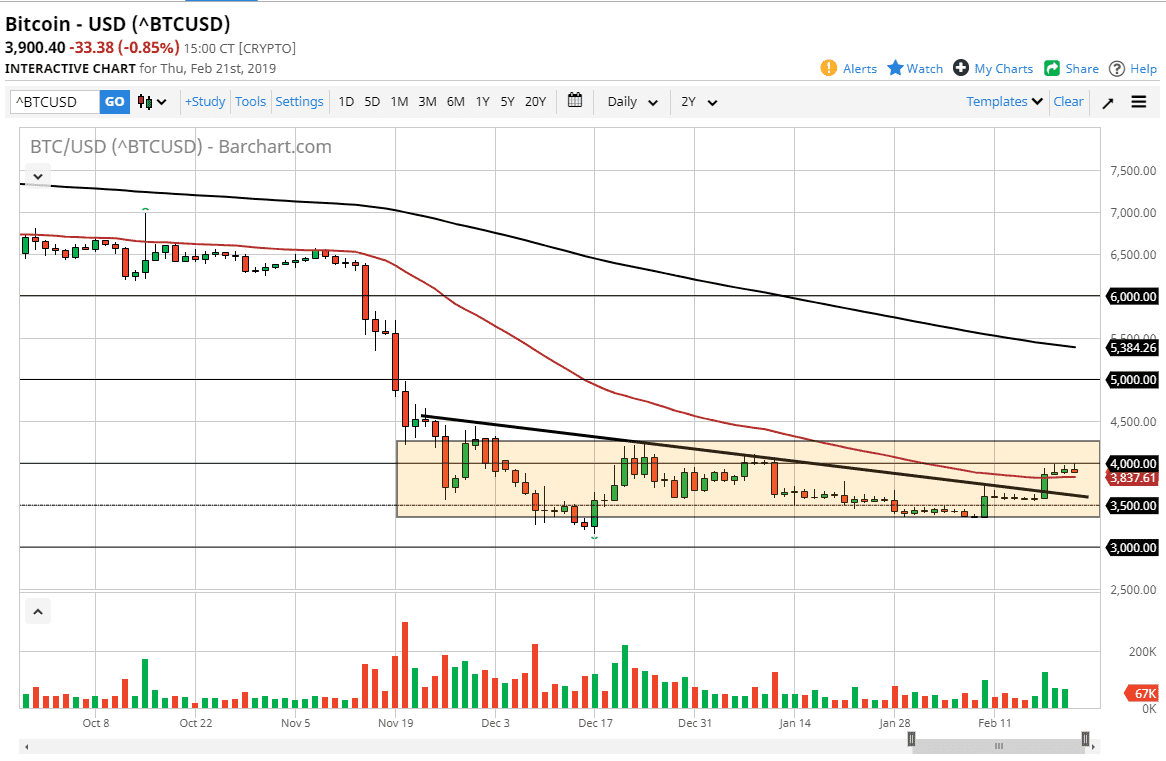

Bitcoin rallied initially during the trading session on Thursday but found resistance again at the $4000 level. At this point, it looks very unlikely to break above there anytime soon and considering we had formed a bit of a “triple shooting star pattern”, something that is very uncommon, and it’s even more uncommon to break above. The $4000 level looks to be massive resistance based upon psychological and structural trading.

With this in mind, I think we will probably pull back towards the bottom of the big green candle from earlier in the week, because quite frankly there’s no reason for bitcoin to go higher. Low liquidity has given the ability for larger players to move the market suddenly, but there’s no follow-through and that something that simply does not look good. Even if we break higher, it’s not until we clear the $4200 region that I think you can start to make an argument for a breakout.

The previous downtrend line was broken, but now it looks as if we are respecting the potential rectangle pattern, so at this point although things have gotten better, there still not that great. Beyond that, the US dollar has started to strengthen a little bit so that works as resistance also. That being said, if we do break above the $4250 level, it’s very likely that we could go to the $4500 level, and possibly even the $5000 level above that. Ultimately, this is a market that seems to have a lot of support underneath, but it has just as much resistance above. Bitcoin has all but put people to sleep lately, and I think at this point although we have seen is the market simply goes sideways over the longer-term standpoint. That being said, if you are a long-term believer, that’s not a bad sign at all.