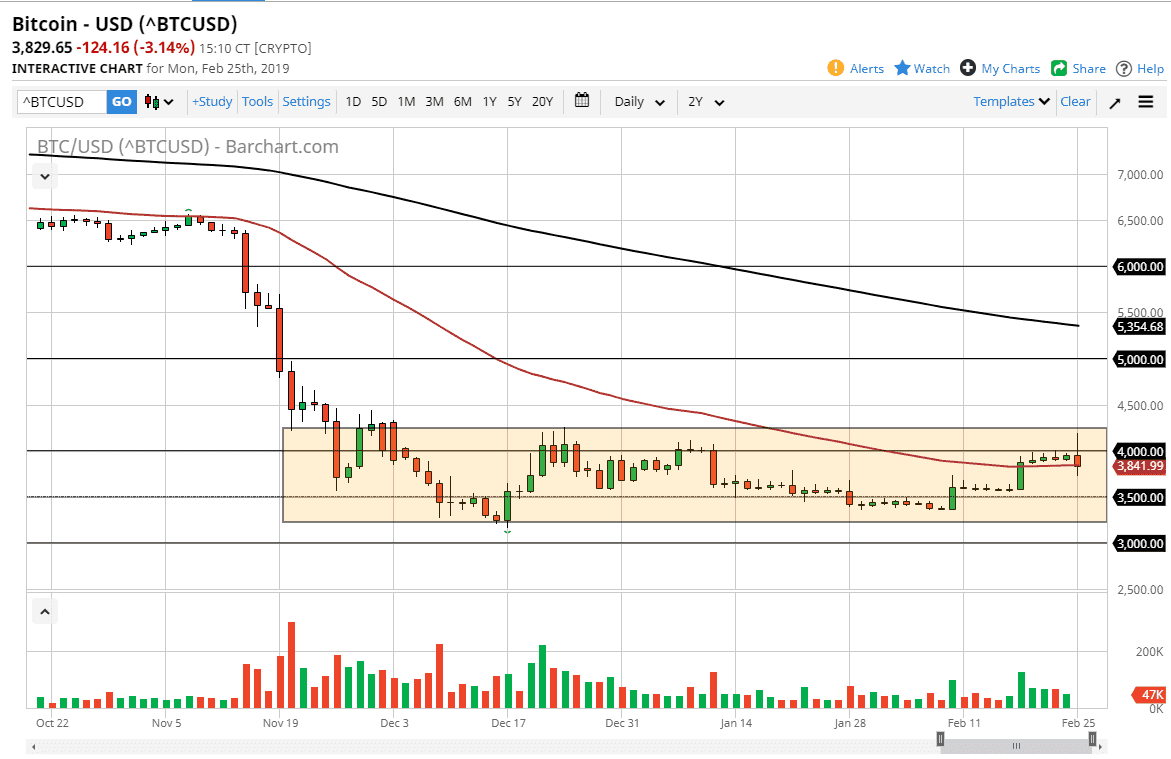

Bitcoin initially tried to rally during trading on Monday as people return to their desks from the weekend, but as you can see we have rolled over and struggled at the $4200 level. That’s an area that has been resistance previously, and at this point it looks as if it’s going to hold considering that we rolled back underneath that level and closed below the $4000 handle.

At this point, we are forming a shooting star like candle, which of course leaves a lot to be desired if you are a bullish trader. The 50 day EMA is just below, which of course is somewhat supportive, but at this point it would not surprise me at all to see this market continues to go lower. If we break down below the bottom of the candle stick for the trading session, it’s very likely that bitcoin will go looking towards the $3600 level again.

The alternate scenario of course is that we break above the $4200 level, smashing through the top of the shooting star. If that happens, that would be a very bullish sign and could send this market towards the $4500 level, and then towards the $5000 level after that. That of course is an area that’s going to be very difficult to break above, because it is a large, round, psychologically significant figure and an area that we have seen a lot of action at previously. Beyond that, the 200 day EMA sits just above that level, perhaps offering a longer-term sell signal as well. Ultimately, this is a market that continues to give us plenty of opportunities to short this market as there seems to be no practical use for Bitcoin at the moment, but more importantly there is almost no demand.