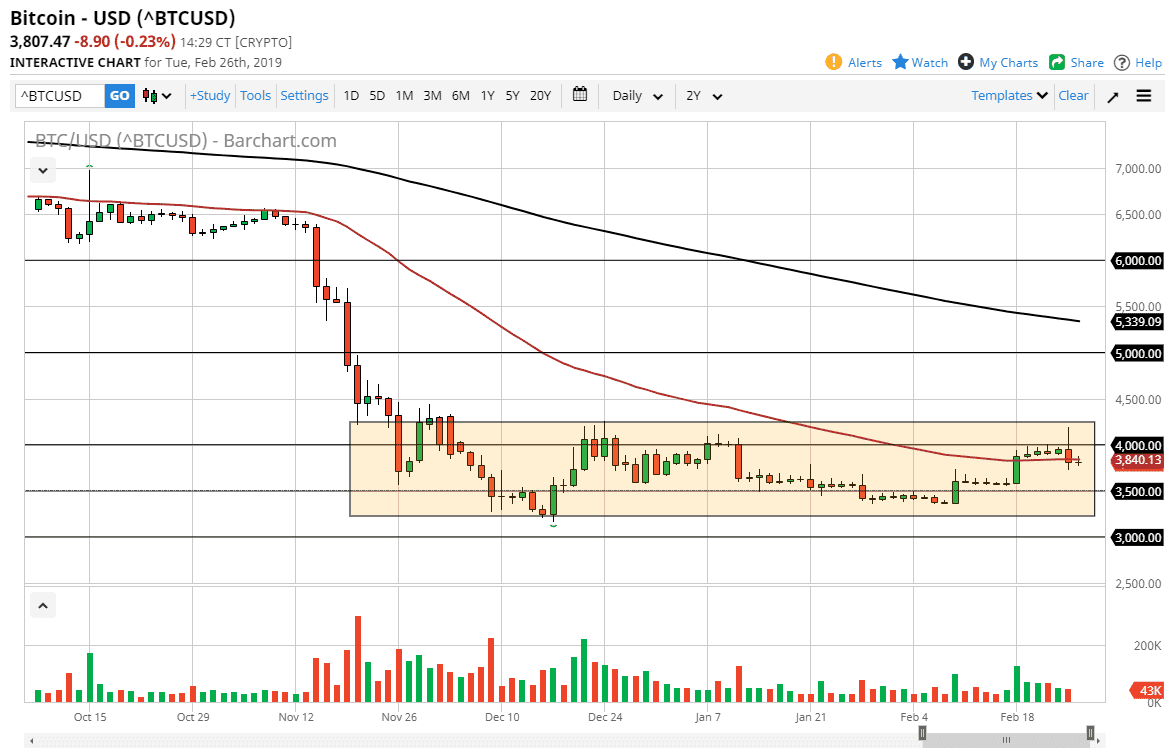

The bitcoin markets rallied a bit initially during the day but then rolled over slightly to essentially do nothing overall. What’s more important to pay attention to is the fact that we had a massively negative candle during the previous session, which quite frankly has not changed anything. Overall, this is a market that I think continues to see a lot of negativity, as we continue to see plenty of selling pressure near the $4000 handle. In fact, it’s really not until we break above the $4250 level that the buyers will start to take over with any type of significance.

Looking at the charts, to the downside I believe that we will probably go looking towards the $3600 level again, which has been a significant support level recently, and of course will attract a lot of attention. The market participants seem to be willing to punish Bitcoin any time it tries to rally, and even though we have some US dollar weakness simultaneously, we simply cannot see cryptocurrencies rally for any length of time. That tells me that there is no real underlying demand for them.

The great thing about paying attention to the Bitcoin market is that it’s the big dog. If Bitcoin cannot rally, you can be assured that most other coins won’t be able to either. That being the case, I have no interest in buying any cryptocurrency right now and believe that every time we rally it will be sold off yet again. It doesn’t matter if it’s Ethereum, Litecoin, Ripple, or anything else. It’s obvious that until Bitcoin can take off to the upside, the rest of the overall dead money as well. Selling rallies has worked for roughly $17,000 and looks likely to continue to do so.