BTC/USD

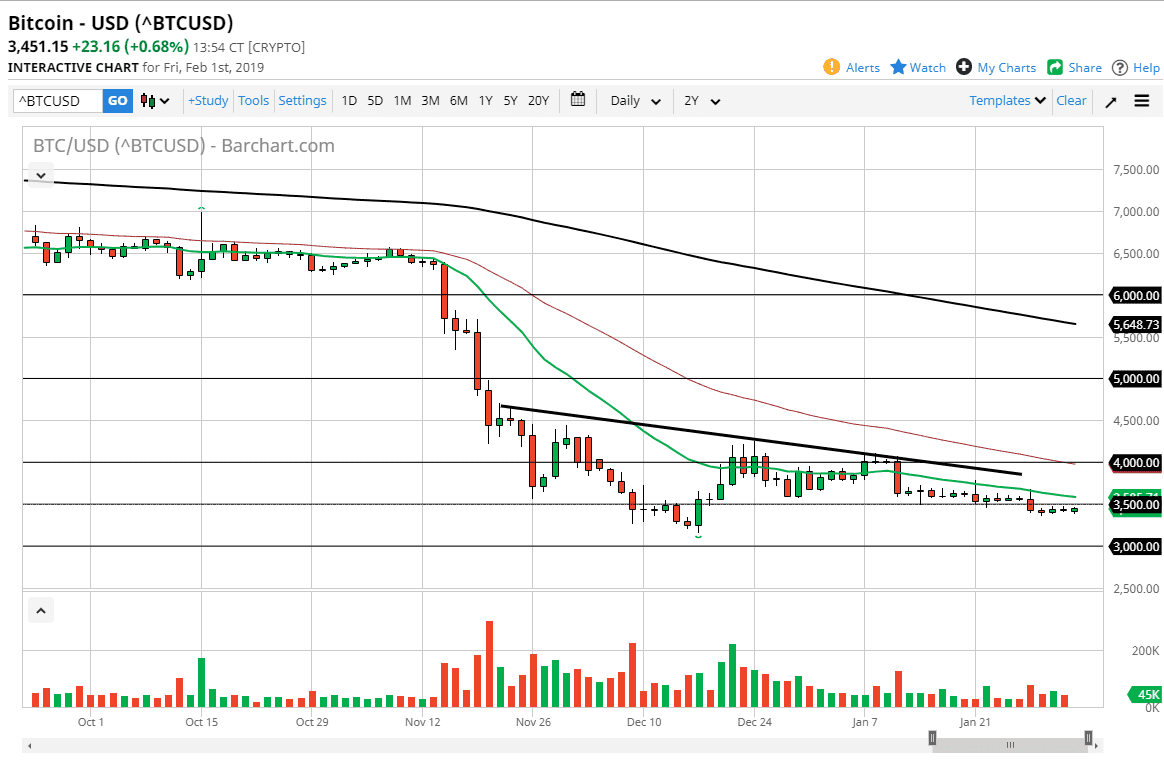

Bitcoin continues to struggle overall, but we did see a bit of positivity during the day on Friday. The market continues to look at the $3500 level as potential resistance that it can’t seem to break above. The 20 day moving average is just above that and pointing lower, so that of course is a very negative sign. If we can break above the 20 day EMA, that would obviously be a very bullish sign but we also have a downtrend line just above there that will cause significant resistance. In other words, there is a lot of work against the value of bitcoin presently from a technical analysis standpoint. However, the market is in a fairly calm attitude, so it makes sense that traders are simply being put to sleep right now. That being the case, I think that the market is one that you can take your time with.

From everything that I see, I believe that the market probably continues to go lower, perhaps reaching down towards the $3000 level. That’s an area that will attract a lot of attention due to the large, round, psychologically significant manner of the level, and of course the fact that we have bounced from just above their previously. With that in mind, I am interested in trying to short this market at the first signs of volatility but I think it’s easier to simply fade rallies that show signs of exhaustion. After all, you can get the momentum of the market working with you much better if you have a little bit more room to run.

From the bullish perspective, if we managed to break above the $4000 level, I could be convinced to start thinking about going long. If the attitude of the bitcoin faithful remains, a move above the $4000 level should signal that longer-term buyers are starting to step in. At this point though, I don’t have a lot of faith in that.