BTC/USD

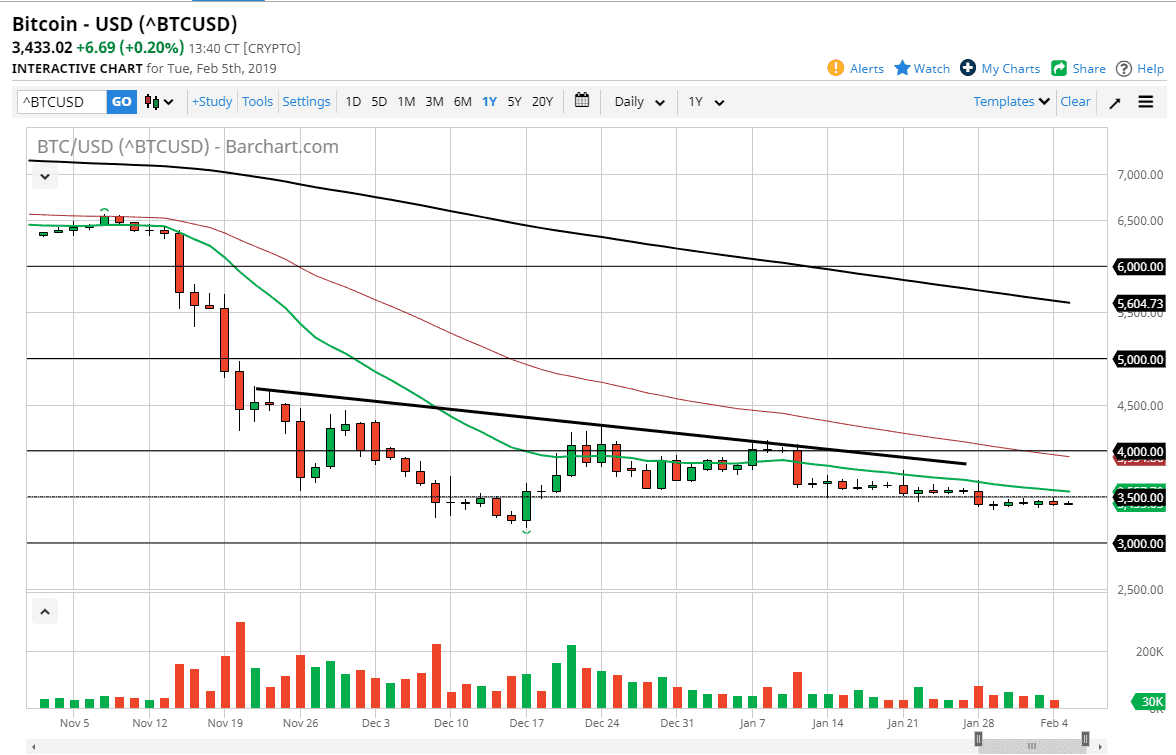

Bitcoin did very little during the trading session again on Tuesday, as we continue to hover underneath the $3500 level. That’s a level that of course has attracted a lot of attention in the past, being massive support over the course of several weeks, and now it looks as if it is attracting a lot of attention again as resistance. At this point, the market looks as if it is essentially flat, and the volume has dried up yet again. In that sense, this is a market that is all but untradeable. However, many people believe that this market is waiting for some type of catalyst, and at this point we simply don’t have it. Looking at this chart, there is nothing that makes me think that we are going to rally, because we have multiple reasons to see selling above.

Looking at the chart, the $3500 level courses psychological resistance, as well as structural. Beyond that, the 20 day EMA has rolled over and it is sloping downward, offering resistance. Beyond that, the downtrend line will also offer plenty of resistance. After that we also have to worry about the 50 day EMA and of course the $4000 level. That being the case, the market is likely to offer plenty of selling opportunities above, and the first signs of exhaustion will be sold. At this point, I believe that the market is likely to go down to the $3000 level given enough time as the market will retest the low yet again.

I see no reason to think that bitcoin is going to suddenly change its attitude, and therefore I believe that the grind lower continues. About a year ago, I noticed that there was a descending triangle that suggested a move down to zero dollars. I would be ready to call that as a target, but I have to admit the chart’s keep dropping even lower than I thought likely.