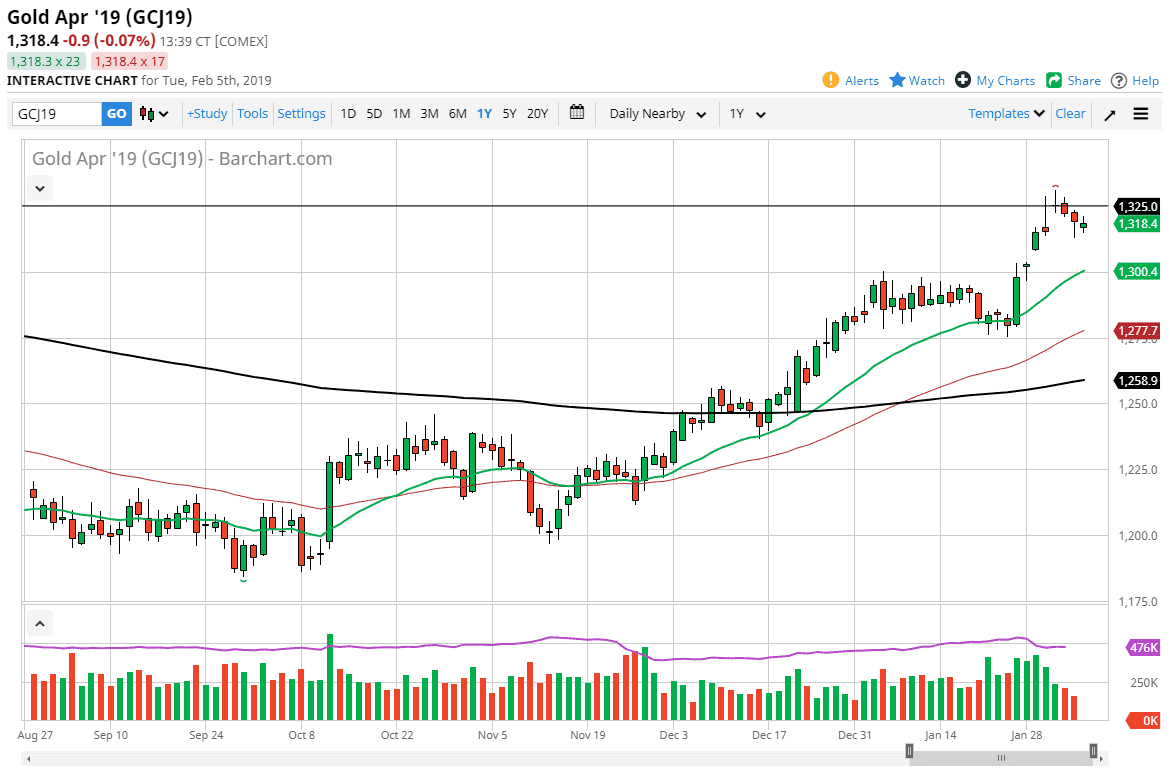

Gold markets gapped a little bit lower to kick off the trading session on Tuesday, but then gained some of those losses back. This stabilization was rather healthy, considering that the markets had filled a gap the previous session. We have been testing major resistance just above in the form of the $1325 level, so it wouldn’t surprise me at all that we need to pullback to build a bit of momentum. There are a couple of shooting stars that we need to overcome to get above there, so if we do that it’s obviously a very bullish sign. That would show the market breaking higher in reaching towards the top of the longer-term consolidation area which could have this market go as high as $1400.

However, I wouldn’t anticipate that this market would go straight up. I believe that every $25 or so you will see a reaction in the market. The 20 day EMA underneath is offering support near the $1300 level, which of course has a lot of significant importance attached to it as well, being a large, round, psychologically significant figure. Beyond that, the 50 day EMA is below and the spread between the two moving averages is rather wide, so that shows a bullish sign in general.

Overall, I believe that the market will continue to be a “buy on the dips” scenario, as the greenback has been softening due to the Federal Reserve stepping away from its hawkish stance. That doesn’t mean that it’s going to go straight up, but clearly Gold should be on a path higher due to greenback weakness. Beyond that, we also have plenty of geopolitical concerns that can come into play.