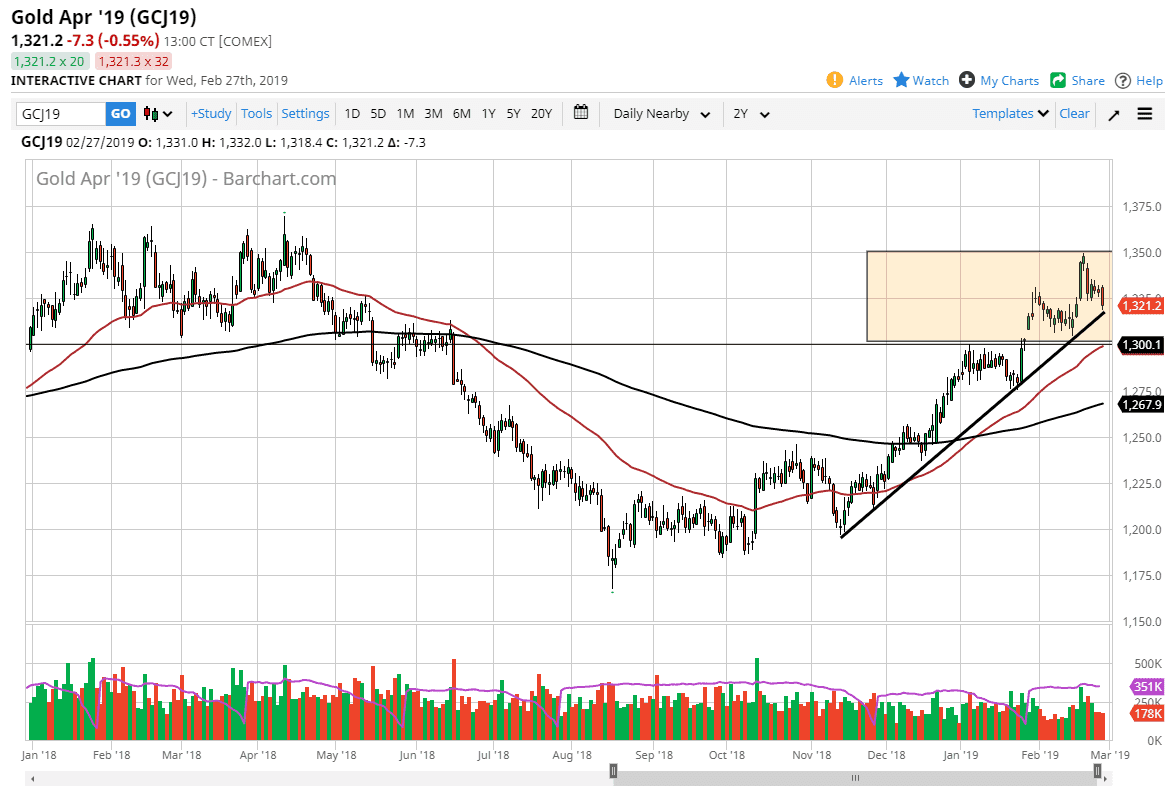

Gold markets fell during trading on Wednesday as Jerome Powell spoke in front of Congress. The US dollar strengthened a bit, so that of course makes a huge difference when it comes to the way the US dollar behaves. With that, we did see Gold pull back. However, we have been in an uptrend for some time and the uptrend line did hold at the end of the day.

Even if we break through this uptrend line that I have drawn on the chart, I suspect that we will have buying pressure underneath that as well. The 50 day EMA is hovering around the $1300 level, and that’s the area I am considering to be a bit of a “floor” at the moment. I like buying gold on pullbacks as the Federal Reserve has suggested that they are happy to let inflation run a little hotter than usual. That should be good for Gold longer-term, so I don’t have any interest in shorting it for a significant move.

I do recognize that the $1350 level above is significant resistance, and therefore it will be difficult to break above there. If we do, there is a band of a resistance barrier that extends to the $1360 level. It’s breaking above there that will free the market to go to the $1400 level which is my longer-term target. That being said, we should always look at the opposite scenario.

On a break below the $1300 level, and I mean closing below there on the daily candle stick, then the gold market could go drifting towards the $1275 level, or perhaps even lower. We would need to see significant US dollar strength to have that happen though, so therefore you should be paying attention to that. Without US dollar strength, I suspect the buyers will take over rather quickly.