EUR/USD

The Euro has gone back and forth during trading on Friday, as we continue to show a lot of choppiness. This makes sense, because we have the Federal Reserve on one side of the Atlantic Ocean being ultra-easy with its monetary policy, and of course that drives down the value of the US dollar. At the other side of the ocean, we have the ECB which has to deal with a soft economy, and poor economic numbers coming out of places like Germany which is indeed alarming. Looking at this chart, it makes sense that we will continue to bounce around, as the overall consolidation has held. The 1.1250 level underneath is supportive, just as the 61.8% Fibonacci retracement level is just below there. Above, we have massive resistance in the form of the 1.15 level.

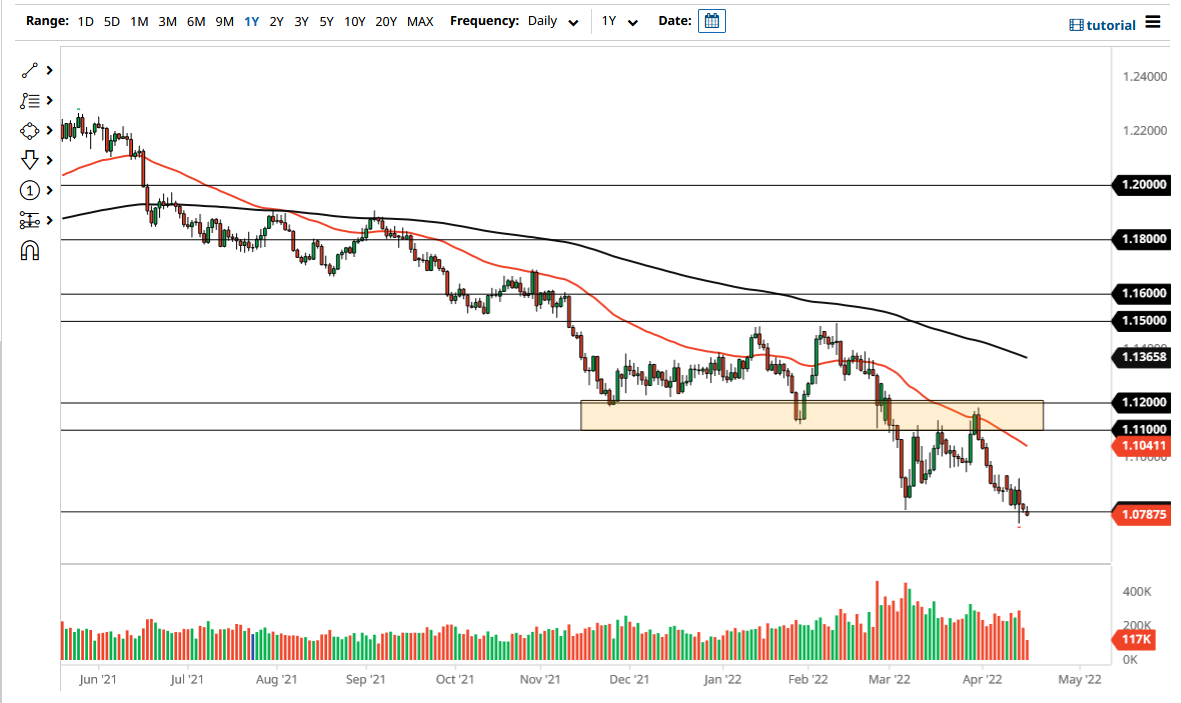

GBP/USD

The British pound fell rather hard during the trading session on Friday but bounced rather impressively to show signs of life again. It looks as if the market continues to pick up and try to find value, and at this point it looks likely that the market is continuing to find buying opportunities at lower levels. The fact that we have found support at the 50% Fibonacci retracement level and the previous downtrend line, that gives me more confidence in the idea of this market changing the overall attitude and trend. I like buying dips, as the Federal Reserve is super soft and easy, just while the British pound has been historically cheap as of late and value hunters are getting involved. As long as we don’t get a “no deal Brexit”, the British pound should have bottomed a while ago.