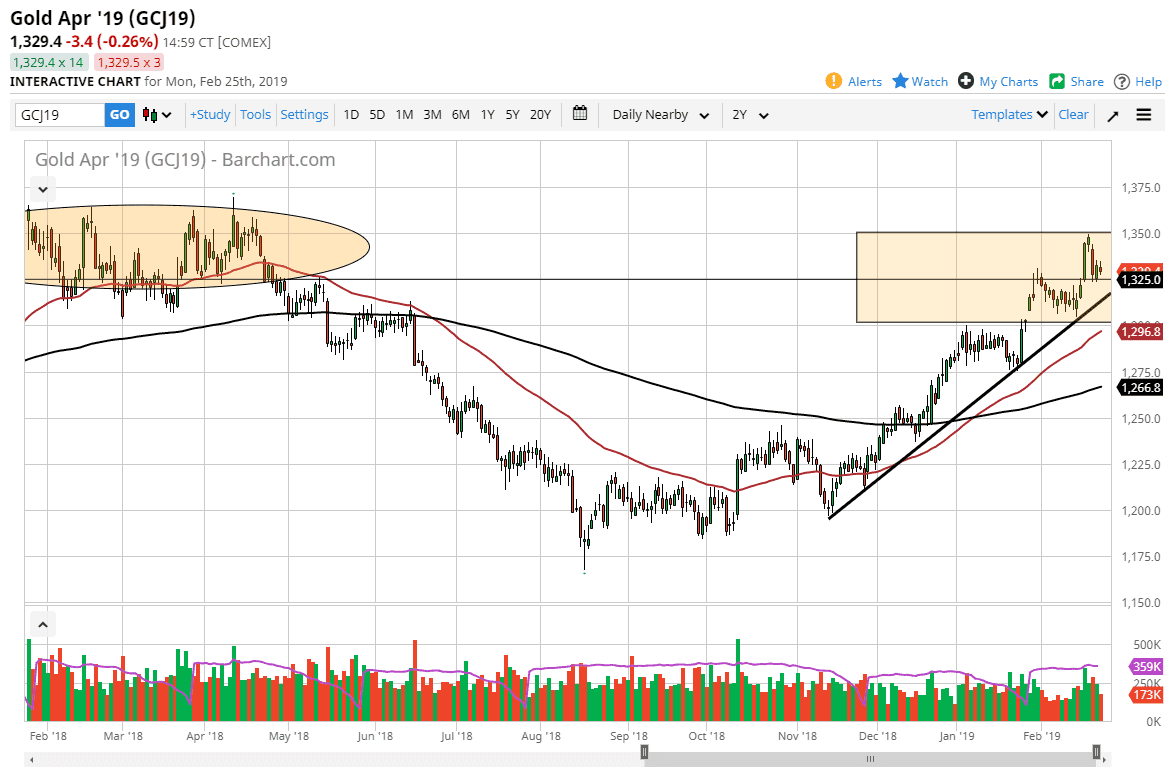

Gold markets pulled back a little bit to kick off the week on Monday, testing support at the $1325 region. We could not continue to go higher after initially trying to rally, so it suggests that perhaps we need to pullback just a bit. This makes sense, we are in the middle of major resistance that extends to the $1350 level.

The uptrend line underneath should continue to offer support though, so I would be a bit surprised if we made all the way to the $1300 level. That being said, the 50 day EMA is just below there, so even if we do break down through the trendline, it’s very likely that we will find buyers. We are a bit extended at this point, so I’m looking at picking up this market at lower levels.

If we break above the highs from both the Monday and Friday session, then we could rally towards the $1350 level, but you should keep in mind that last week’s candle was essentially a shooting star. That being the case, I think it’s very likely that this pullback is necessary. If we were to break down below the $1300 level, then we could unwind rather drastically, but it would coincide with a stronger US dollar would be my guess.

That seems to be very unlikely to happen this week, because Jerome Powell is testifying in front of Congress, which will probably only reiterate his dovish stance, and therefore should work against the value of the dollar. We may get a little bit of softness between now and then, but it should end up being a buying opportunity if he sticks to what he has recently said when it comes to monetary policy. I also recognize that the $1350 level above is massive resistance, so we could clear that then the market will probably go another $25 higher.