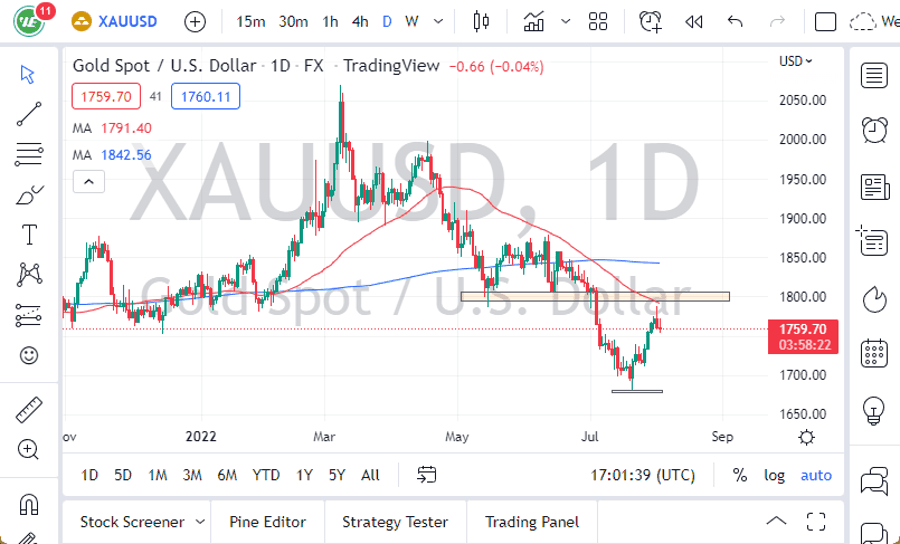

Gold markets pulled back slightly to kick off the trading session on Monday, as traders came back from the weekend. While we are overextended at this point, we have a significant amount of support underneath that we will eventually try to come back into this market plays and break above the brick wall we have run into.

Gold

Looking at the gold market, it’s very easy to say that we have stalled. However, I believe that the $1350 level above is massive resistance that will take a significant amount of momentum to finally break through there. Pulling back from here should see plenty of support at the $1300 level underneath, and that is an area that has not only been supported in the past, but also resistance. There is a lot of interest at that level, and I think that the buyers will continue to go back in that general vicinity. Beyond that, I think that the 20 day EMA turning higher and breaking above the 200 day EMA, while the 50 day EMA is doing much the same suggests that we will eventually find more of a buy-and-hold attitude.

In the short term, look for value as this market will continue to get knocked around by geopolitical concerns and of course the value of the greenback. The greenback is softer due to the softening Federal Reserve and that should continue to be the case. Ultimately, I think that we will not only break above the $1350 level, we probably then go to the $1400 level. As far as the other side is concerned, if we break down below the 200 day EMA, pictured in black on the chart, then we could roll over rather significantly, reaching down to the $1200 level.