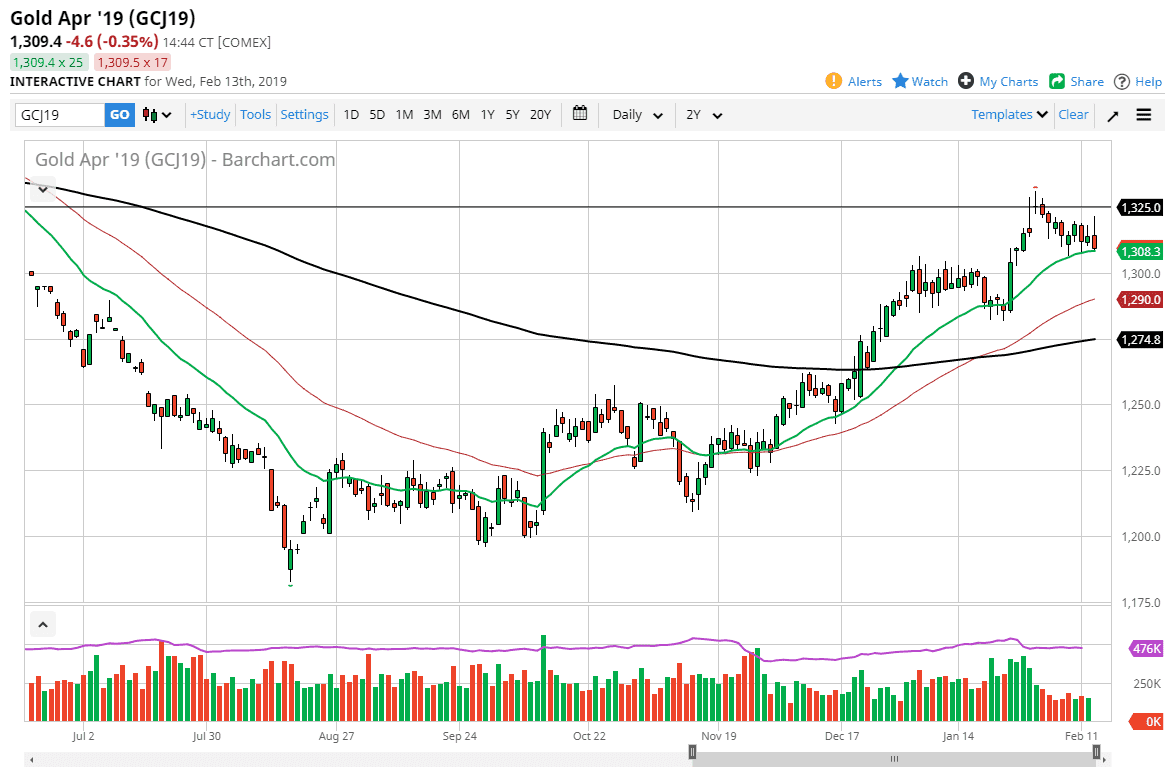

Gold markets struggled a bit during the trading session on Wednesday as we continue to see selling pressure above and near the $1325 level. This is an area that has been rather negative for gold, and it does bring in a significant amount of selling pressure. We are currently dancing around the 20 day EMA and I do think that there are buyers below. However, gold is starting to show signs of weakness, or at least being overbought and that the buyers may need to find lower pricing to get above the massive resistance that sits overhead.

The $1325 level leads to a large cluster of selling pressure and resistance all the way to the $1350 level. Although I am bullish of gold longer-term, it is obvious that it isn’t going to be easier to get to the upside ultimately, I think this comes down to the US dollar and whatever happens with the Federal Reserve. We do have bullish pressure for gold when it comes to geopolitical concerns, so keep that in mind as well.

The $1300 level should be rather supportive, just as I believe the $1275 level will be. If we were to break down below that level, then I think the market unwinds completely, and that the uptrend is done. I think that is probably the least likely of outcomes, but I do recognize that we obviously need to build up momentum. With this, I expect to see a couple of days’ worth of selling ahead, and that rallies will continue to be sold into in the short term.

Pay attention to the 50 day EMA, pictured in red. I believe that is probably going to be a very important level longer-term. Ultimately, this is a market that will move counter to the US dollar or is a reaction to people trying to protect wealth in an uncertain environment.