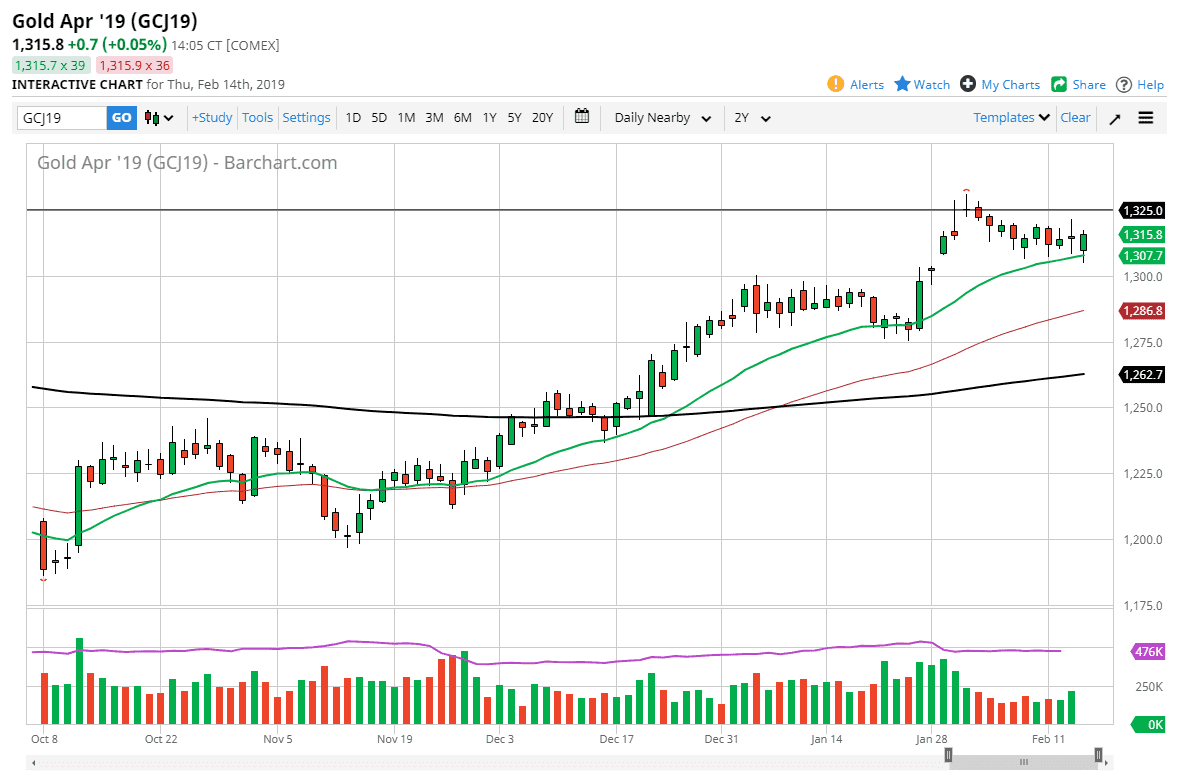

Looking at the gold market, you can see that there is plenty of support just below. If we initially pulled back a bit and found support underneath the 20 day EMA. By doing so, the market turned around to reach towards the highs of the day again. The $1300 level underneath is massive support, not only from a psychological but also from a structural standpoint. Because of this, I think that gold traders will continue to look to short term charts to pick up value, as this market has more than enough interest in it.

You should keep in mind that the Federal Reserve has softened a bit recently, and that of course continues to put a bit of a boost into the gold market. Beyond that, we also have a lot of geopolitical issues out there that could continue to propel gold as well, as the market will sometimes start buying gold to protect wealth, and that looks like what we are seeing right now.

The 20 day EMA has offered support more than once, so it’s not a surprise to see that has happened yet again. I look at the $1325 level above as massive resistance that extends to the $1350 level, so it’s difficult to imagine that is going to shoot straight up in the air, but I think that these sudden short pullbacks will build up a bit of momentum in order to try to take this level out. If we fall from here, I anticipate that the 50 day EMA will cause a bit of support underneath as well, so at this point I think that you can only be a buyer of this market, and if it does drop you should be looking for value down there as well.