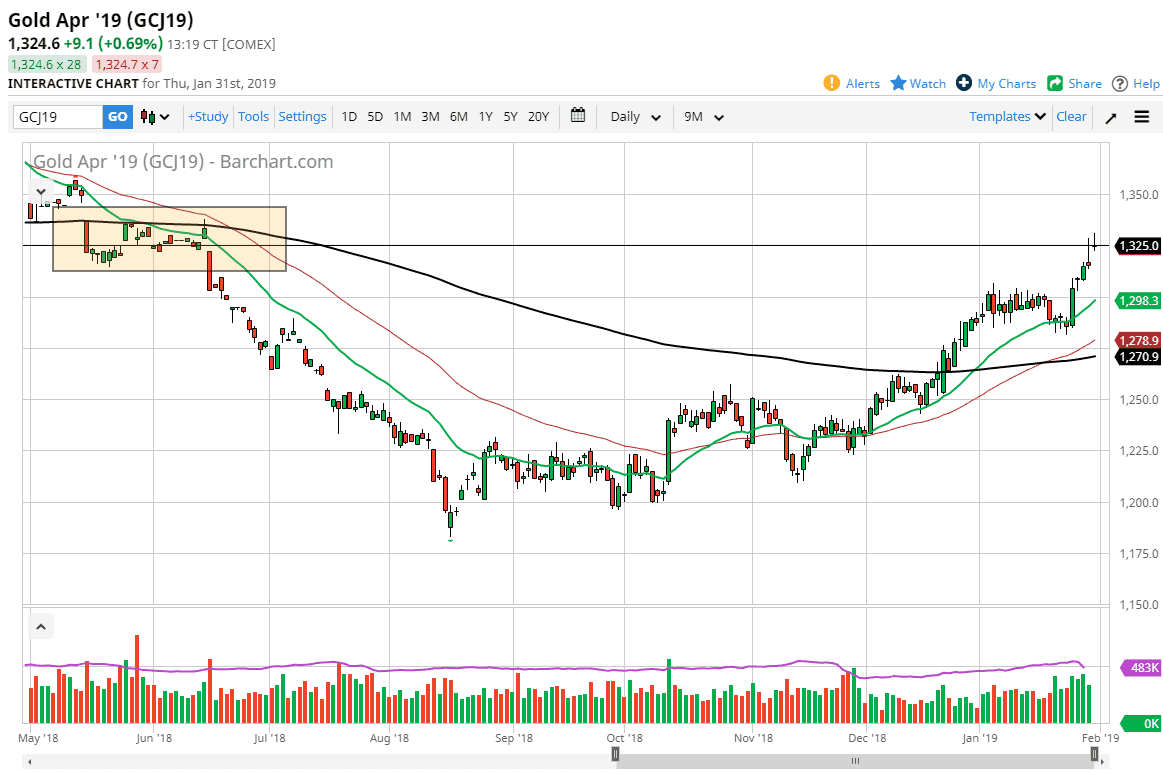

Gold markets have had a significant couple of days, breaking well above the resistance barrier to go higher and clear the $1300 level. At this point, that’s a very bullish sign and the fact that we shot straight towards the $1325 level suggests that we will continue to see a lot of volatility but I think that the shooting star like candle at the $1325 level on Thursday suggest that although we are still very bullish, I think at this point we need to be looking towards value at lower levels. Perhaps we need to retest the $1300 region, an area that I think would have a lot of support. Ultimately, I think that looking for value is going to be the best way to trade the gold market, and certainly this pullback should attract a lot of attention. Keep in mind that we had gotten far ahead of ourselves after the Federal Reserve suggested that they were “listening to the market”, and this could keep the market somewhat afloat as the Federal Reserve looks less likely to hike rates.

Beyond that, they have suggested that perhaps the balance sheet runoff may slow down if necessary, so this should all be negative for the US dollar. If the US dollar falls, typically the Gold markets will rally. I think that the market certainly has made a major move recently, and I think that it is one that should have some type of follow-through. I would be rather shocked if we broke down below the $1280 level, and with the jobs number coming out during the day on Friday I think that what we will see is a binary situation as to where gold goes due to the US dollar. Keep in mind that around 8:30 AM New York time, things will get rather choppy. Obviously though, this is still a very bullish market.