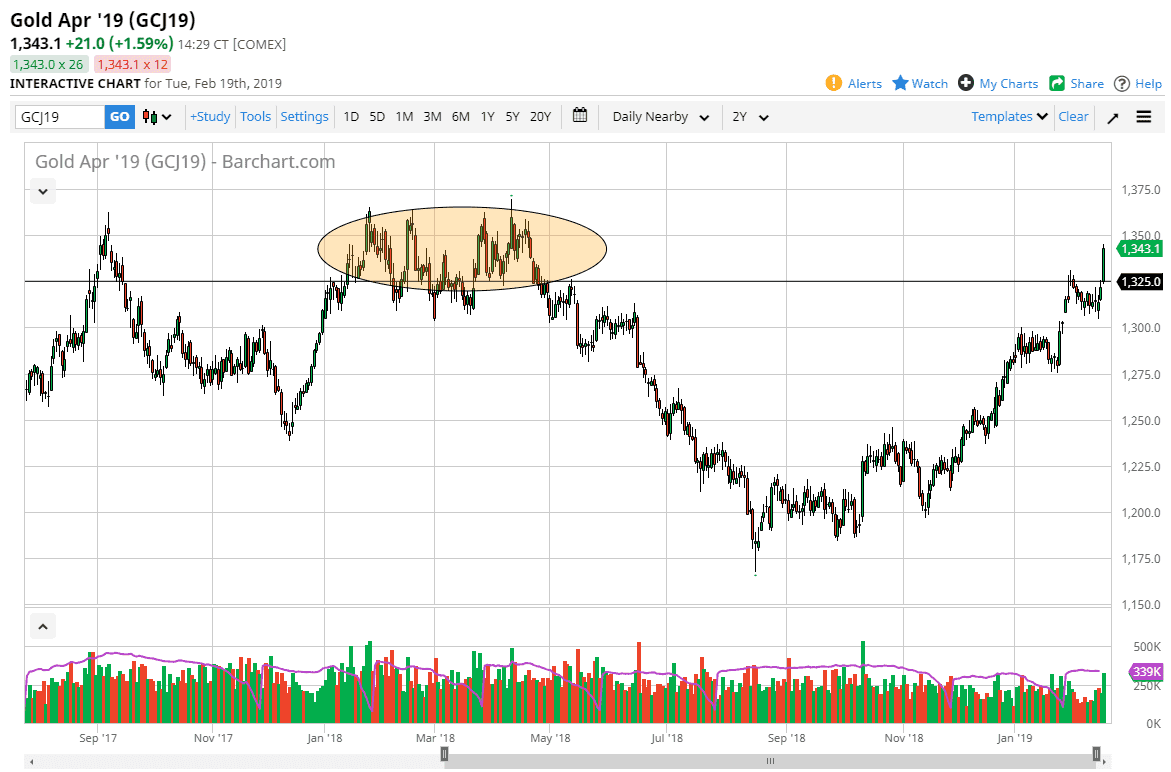

Gold markets rallied significantly during the trading session on Tuesday as Americans came back to work. The greenback got hammered again several different currencies during the day, which of course is always a sign that we are trading on the US dollar more than anything else. If the US dollar continues to fall, and it certainly shows itself likely to do so, the Gold markets will quite often rally by proxy. Keep in mind that this market has a significant amount of resistance above, as we are towards the top of the overall consolidated range.

If we can break above the $1350 level, the crack in the ice will become the dam opening up, and the gold market should very quickly go heading towards the $1400 level. At this point, I like the idea of buying pullbacks in gold, because the strong uptrend certainly looks likely to continue. Looking at this chart, you can say that we just broke out above a bullish flag, and of course have cleared a significant resistance. Those are a couple of really good reasons to think that we should continue to see strength, so look for value and you should be rewarded.

I believe that the $1300 level underneath is a massive floor in the market, and that it will be difficult for this market to break down through there. If we do, then the $1275 level should offer support, so I think there’s a couple of different places where the buyers will return. You will probably need to look at short-term charts, but you should get the opportunity to pick up gold “on the cheap” rather soon. I believe that we have rallied a bit too much to buy at this level, and that since we are in such a major area of congestion previously, it would make sense that the pullback happens.