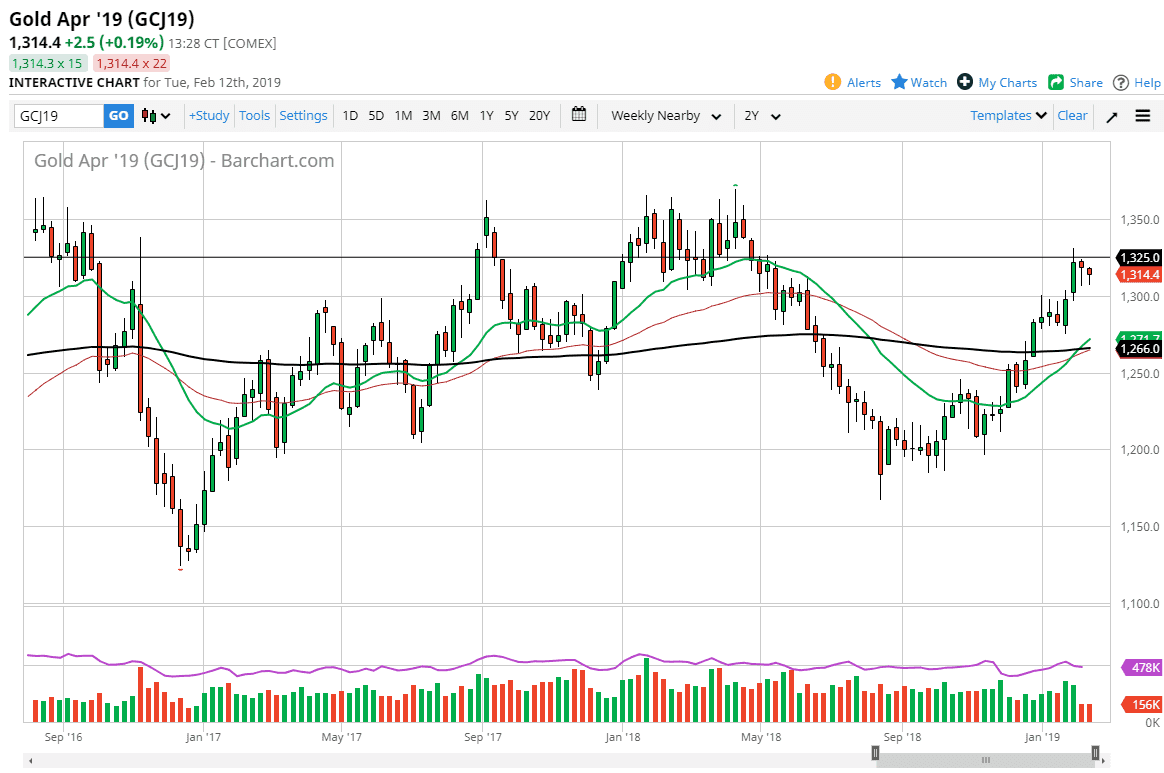

Gold markets fell slightly during the trading session on Tuesday to kick off trading, reaching down towards the $1307 level. However, we have found plenty of buyers in that general vicinity to turn around of form a bit of a hammer. We previously formed a hammer during the day on Monday, as we are pressing the $1325 level. That is an area that is massive resistance, but I think it extends to the $1350 level. I think at this point it’s likely that we will need to see the occasional pullback in order to build up enough momentum to break that region.

In the short term, the $1300 level looks very likely to offer support, as we have seen such a massive breakout from that level, and of course we have a massive impulsive candle stick from Friday at that level. Below there, I see that there is plenty of support extending down to the $1275 level, which is an area where we had seen a lot of support.

Looking at the moving averages, the 20 day moving average has crossed above the 200 day moving average, just as the 50 day moving average is doing the same thing. That is a very bullish sign, and therefore I do think that pullbacks will be thought of as buying opportunities and a bit of value in a market that should continue to strengthen due to geopolitical concerns, and of course the Federal Reserve being on the soft side of things as of late. If that continues to be the case, the greenback will eventually sell off, and that should send Gold much higher. If we can break above the $1350 level above, then the market will more than likely target $1400 level after that.