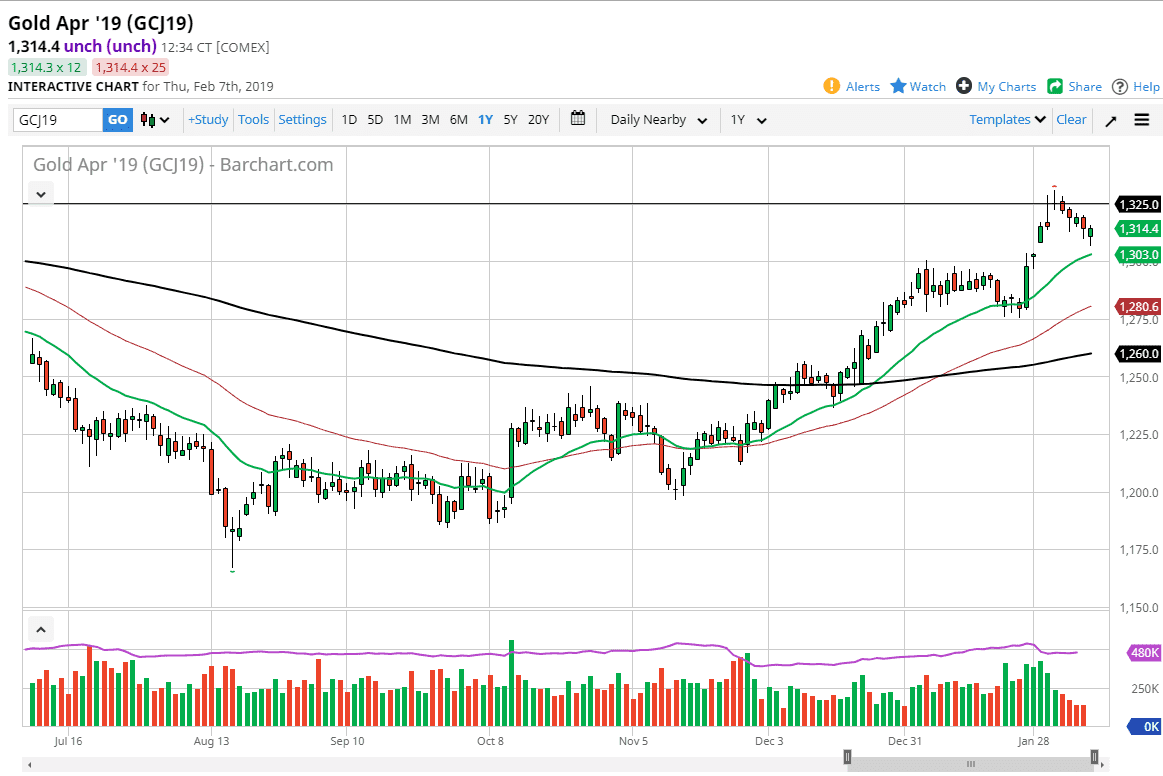

Gold markets fell initially during the trading session on Thursday, as a lot of risk assets got absolutely hammered. That being the case, of course Gold gave up some of its gains as the US dollar strengthened. However, we have turned around since then to form a relatively bullish looking candle. The 20 day EMA underneath continues to be supportive, so it’s very likely that we will make another move towards the $1325 level given enough time.

I do like buying the dips, and we just had a nice one. I believe that the $1300 level underneath offers plenty of support, and it’s very likely that level would attract a lot of attention. I think that we are trying to build up enough momentum to finally break out above the $1325 level, and a daily close above that level is exactly what we are expecting to happen given enough time. Once that happens, I believe that the market then will probably go to the $1350 level.

The alternate scenario of course is that we break down below the $1300 level, which would be a very negative sign and could turn the market back down to the $1280 level which has been massive support in the past. I do think that this market eventually find plenty of buyers on dips, and I have been adding as we go along. It looks as if the risk appetite has come back to the markets, at least in the later part of the day so it looks like gold still has a chance. Beyond that, we have geopolitical concerns that could push gold higher as well, so I have no interest in shorting as long as we are above the $1280 level. Given enough time, this is a market that continues to grind higher.