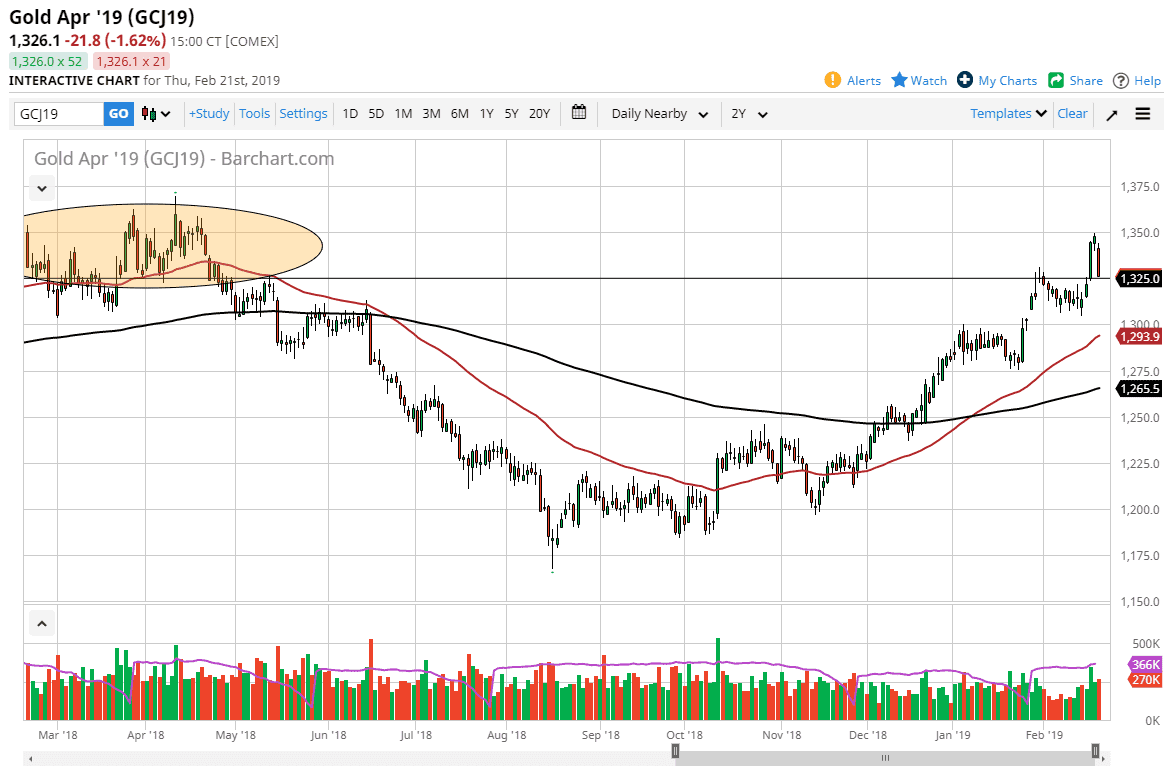

Gold markets got hammered on Thursday as the US dollar strengthened a bit, and of course we had hit major resistance. However, by the end of the day we are parked at a significant level that should offer a bit of support. The 1325 level was major resistance, and now we have come complete round turn from the rally. I believe that it’s only a matter time before the buyers come back in and try to pick this market up, but the close was a bit to be concerned about.

Gold markets have extended to the downside rather drastically, showing signs of panic selling, but I would be the first to point out that we are still in an uptrend, and the consolidation between $1325 and the $1350 level above should continue to be a major force to deal with. Nonetheless, this is a market that is extraordinarily bullish with the central banks around the world continue to jump in and pick up gold, and I think that will continue to be a major driver.

Soft central banks around the world should continue to make precious metals attractive, not to mention the fact that the Federal Reserve is suddenly a lot more dovish and it should continue to put bearish pressure on the US dollar longer-term. If that’s going to be the case, then gold hymns a bit of a tailwind going forward. I do recognize that the $1350 level is major resistance, but we will probably break through there given enough time. Once we do, this market will go looking towards the $1400 level in my estimation.

We could fall from here, but that only sets up for a nice buying opportunity down at the $1300 level. Honestly though, I would be a bit surprised if we made it down that far.